Channel Management in the Chemical Industry – Selecting the Right Option

Abstract

Channel management was not until recently the chemical manufacturers’ main concern. Their main priorities were to manufacture and innovate. It was only in the nineties that the marketing imperative prevailed and that cost efficient channel management processes were put in place. Producers facing a tougher competitive environment became aware of the importance to serve well their customers through direct and indirect channels. These channels adapted themselves to the growing needs of demanding customers who are seeking high quality and competitive products and services. In this article, we will highlight the relationship between producers’ channel management and marketing strategy, selecting and managing the right market channel and finally the main challenges facing European chemical distributors.

Channel management is linked to corporate strategy

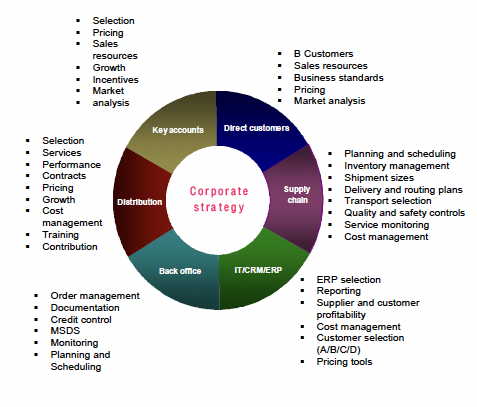

The importance of channel management is shown in figure 1. Marketing strategy covers the areas of market positioning, sales and order management as well as channel management processes which can be properly implemented when the supplier has already segmented its customer mix by size and needs, defined its supply chain processes, its IT programs and its order management processes. On this basis, the management of key accounts or A customers, medium size or important B accounts and C customers to be transferred and managed by distributors become transparent in the chemical, like in other industries.

Figure 1: Channel management is linked to corporate strategy (source: DistriConsult)

The management of small and medium size customers is justified by these customers needs as they require more technical and commercial assistance, a wide choice of chemicals in small lots as well as specific services related to bulk chemicals, such as blends and formulations, packaging and drumming, returnable containers, recycling and disposal of used chemicals. The range of products and services required by these customers generally exceeds most manufacturers’ capabilities and justifies the important role of chemical distributors.

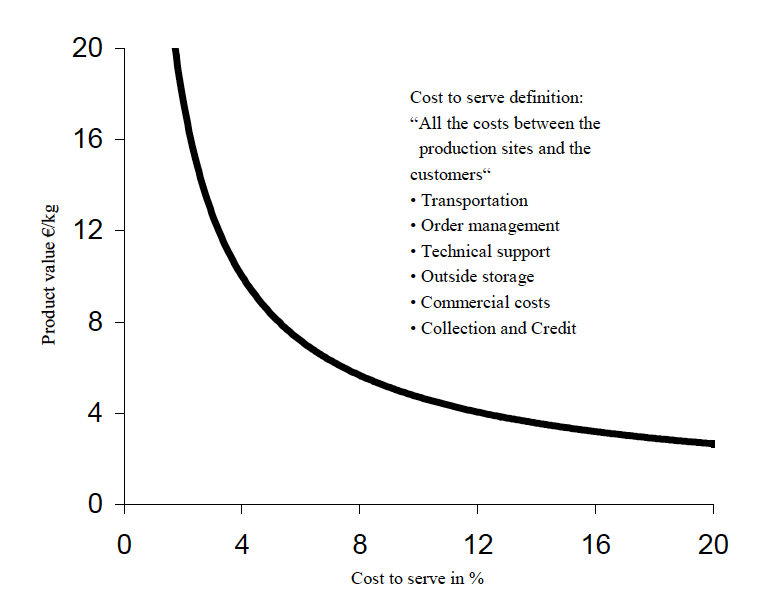

In addition, in a tougher competitive environment, chemical manufacturers became aware the cost to serve importance. The cost to serve is the sum of all external costs which exist between the producers’ sites and the final customers. As is shown in figure 2, the higher the value of the chemical sold, the lower in % is the importance of the cost to serve. By contrast, the lower the value of the chemicals, the higher is the relative importance in % of the cost to serve.

Figure 2: Producers’ cost to serve assessment (source: DistriConsult)

Consequently, chemical distributors have a relatively high market share of the lower value inorganic and organic liquid chemicals and a smaller share of the higher value fine and specialty chemicals which many producers prefer marketing themselves. Some European specialty and fine chemicals producers wish to retain the value of branded differentiated chemicals which they fear could become commoditized when sold through indirect channels. Some domestic producers use indirect channels for their products on overseas markets and sell directly or through controlled or fully owned distributors in Europe. An interesting example in that respect is BASF who markets their specialty chemicals through their in house BTC distribution company.

In the past years, distributors owned by chemical producers were sold to specialized distributors and mostly disappeared in Europe, as such distributors are often dominated by their owners’ commercial priorities. They prefer selling their own in house products in priority to selling third party chemicals. An interesting example in this respect exists in polymer distribution where distributors which are owned by compounds and master batches producers are somehow outperformed by specialized polymer distributors. The expanding importance and contribution of chemical distributors in Europe and overseas is explained by the producers’ necessity to reduce the cost to serve, to serve well the smaller customer segments and to grow sales.

Choosing and managing the right channels

Once a producer is convinced that managing themselves small and medium size customers is a costly and inefficient proposal, he faces the daunting task of having to choose and select the right channels.

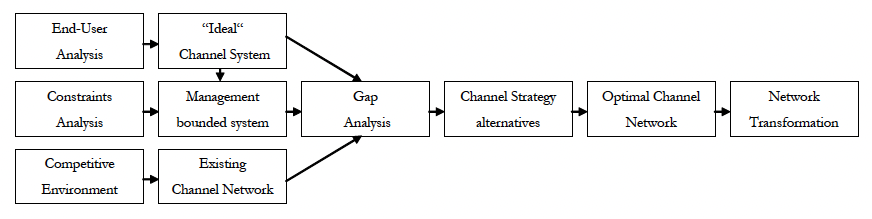

These are important decisions which are on a short term basis almost irreversible. Therefore the channel selection process is a strategic process which requires an objective and professional approach. It must be implemented keeping in mind the overall corporate and marketing strategies as well as the customers’ needs. Too often, those important channel decisions are taken with limited market knowledge and are wrongly based on internal requirements. The approach defined in 1993 by Northwestern University Professor Louis Stern is still up to date.

The recommended approach focuses initially on a clear understanding of end user needs, the supplier positioning and offering and competitors channel strategies. The existing channel network is compared with the ideal network. Once the channel options are defined, the optimal or achievable network is put in place.

Most producers are more or less following a similar approach based on their own selection criteria which are specific to bulk, specialty and fine chemicals. The indirect channel selection criteria tend to generically cover the following aspects, namely environmental compliance based on REACH and Responsible Care, market or industry coverage, financial stability, resources available for growth, product portfolio, specific services and expertise available, ERP/CRM systems and quality management processes in place. According to the market to be served, it is wise to rank each channel option according to an objective rating process which measures the target distributor performance in relation to the defined selection criteria.

Once, a professional and objective selection process is put in place, the quality of the channel network tends to match the supplier’s expectations for market growth and cost efficiency. Afterwards, it is common practice to put in place a defined and transparent channel performance monitoring process to reach jointly defined goals and objectives.

Figure 3: Channel Network Restructuring Professor Louis Stern’s recommended approach (source: Louis Stern’s analytical approach European Management Journal 1993)

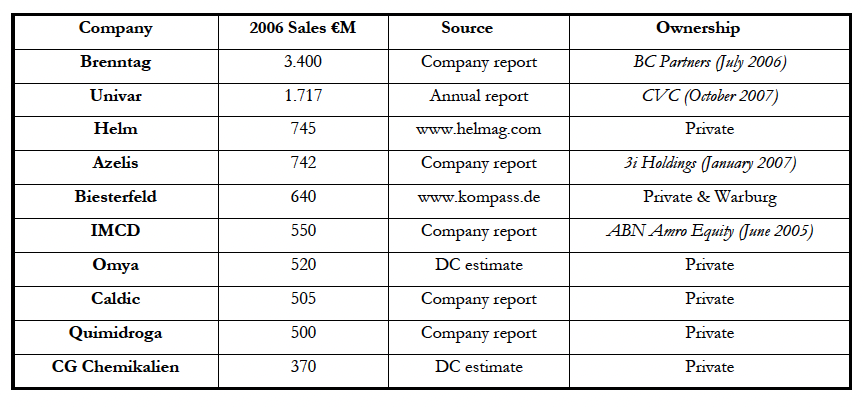

Table 1: 2006 European Distributor ranking

Channel challenges in the chemical industry

We identify four major challenges facing the European distributor industry namely REACH implementation, the growing role of private equity investors, the differentiated market structure for bulk and specialty chemical distributors and new rules on information exchange between suppliers and distributors. These four challenges are impacting significantly the European distributor scene.

- REACH compliance and implementation is one of the major challenges facing chemical distributors. They will gradually need to register themselves, their imported chemicals, as well as their “in house” blends and formulations. For some specialty distributors, this may represent a significant share of their sales and an additional cost to bear, which in some instances may not be in relation with the volumes transacted. Blends and formulations, particularly in the fine chemicals and life science areas are an additional sensitive area which will increase the operating costs of the distributors involved in those sectors.

- Among the top six European distributors, four are already owned by private equity investors who are attracted to this sector by high cash flows, limited financial risks and so far profitable exit prospects. Private equity owners are primarily focusing on cash flow generation and tend to favour the reduction of working capital, namely inventory, customer credit and staff costs. For this purpose, they tend to factor or sell the customer invoices, reduce credit and monitor closely inventory levels. Distributors who have more flexibility are often in a position to gain market share at the expense of financially rigid distributors. Privately owned private equity investors are keen buyers of distribution companies to reduce competition and to increase the value of the companies they own. Their preferred targets are high cash flow generating and asset rich distributors who offer good synergies with their existing assets. For such companies, they are ready to pay top multipliers in excess of 9 to 10, as the recent battle for the control of CHEMCENTRAL between Univar and Brenntag illustrates it well.

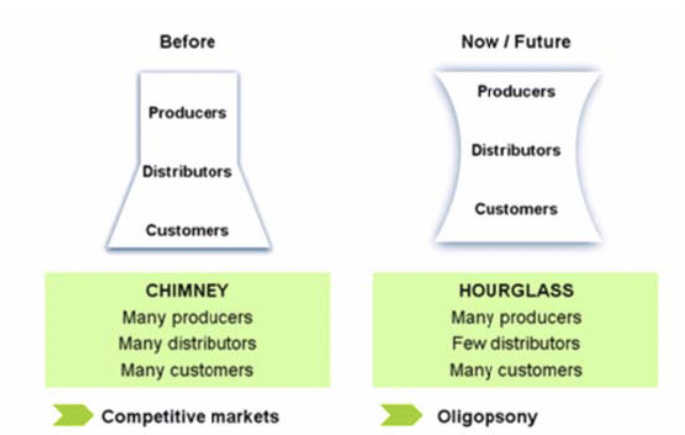

- As a result of the ongoing market consolidation through M&A, the number of bulk chemical distributors is reduced and the available channel options for bulk chemical producers is limited in each European country to a maximum of five or six distributors who together hold more than eighty percent of the relevant bulk chemical markets. For specialty chemicals, the options are wider and the existence of “oligopsony” or reduced market options may only occur on some niche industry segments where the number of specialist distributors is limited like in metal treatment, cosmetology or oil and gas. Figure 4 illustrates well the market structure of bulk chemical distribution.

- The EU competition rules introduced in 2001 are now being fully implemented. From a legal standpoint, distributors operate and compete on the same markets than their suppliers. Consequently, producers are not allowed to exchange pricing and customer information with their distributors. They need to operate commercially independently from one another. Suppliers are not allowed to restrict sale territories or to impose supply exclusivity. In the near future, it is expected that an additional set of rules will be introduced in order to prevent vertical and horizontal competitive restraints. This will make chemical markets more open and more competitive for the benefits of both suppliers and customers. In addition, all distributors will have to implement stricter governance guidelines to ensure full legal compliance within their organizations.

Figure 4: Bulk chemicals distribution (source: DistriConsult)

Conclusion

In conclusion, chemical distribution which followed until recently a reasonably simple model based on marketing domestically produced chemicals and margin monitoring is changing its model to become even more efficient and more professional in managing complex environmental and legal rules. It is also becoming more global in its search for new markets and supply sources. The growth and profit opportunities for distributors are immense; however fewer chemical distributors will reap the benefits of this market expansion, due to the need to comply with ever increasing legal, environmental and supply complexities.