Collaboration in the context of industry convergence – an overview

Abstract

Recent literature on organizational features and activities along the phases of convergent value chains is gathered in a classification framework. It is emphasized that within convergent value chains organizations lack certain competences and hence need to collaborate in order to close their competence gaps. These collaborations are also discussed in regard to the intensity of resource and competence integration, ranging from licensing agreements to mergers and acquisitions. Strategic alliances, joint ventures as well as mergers and acquisitions in the biotechnology sector undergoing convergent processes are analyzed over the 20-year period, 1997-2016. Subsequently, the biopharmaceutical sector is chosen as a convergent industry case example and its value chain analyzed using the classification framework developed. The position of the incumbent firms is shown to shift from spanning the entire value chain in a fully-integrated business model, to being pushed towards the market end of the value chain by the industry new entrants, to finally trying to regain a stronger position by adapting a coordinating hub business model.

1 Introduction

In recent years more and more often we observe industries overlapping and merging. This convergence process has been witnessed in a range of high technology environments, initially in computing and telecommunication systems, and more recently also in the field of natural sciences. With a growing number of inter-industry fields, the relevance of cross-industry innovation and collaboration has increased. There is growing literature detailing the stages of the industry convergence. What is currently missing however is a framework for classification of organizational features and activities along the stages of the value chain. Having such a framework will allow the positioning of organizations along the value chain and subsequently the examination of the changing structure of the value chain during its disintegration process. Furthermore, the framework will allow the investigation of changes in business models of the organizations involved. Hence it will provide a tool to track industry development not only on the level of technology, but also on the level of business model innovation. This framework will be of high strategic value, enabling firms to analyze convergent processes in greater depth and hence to adapt earlier to changes in technologies, markets, customers and competitors.

In this work a cross-section is cut through the life cycle curve of a convergent R&D-intense industry and the types of collaborations formed by different institutions along the value chain are analyzed. The work focuses on biotechnologies, which are defined as “new technologies of genetic, protein, cell and tissue engineering that enable significant advancements in human and veterinary health, agriculture, industrial processing and other application areas” (OECD, 2006). Such technologies include genomics, pharmacogenomics, genetic engineering, gene editing, protein engineering, cell/tissue/embryo culture and manipulation, bioinformatics and bioleaching. The biotechnology industry shows tendencies to converge with adjacent industry and market segments both on technology and market levels (Aaldering et al., 2018).

2 Theoretical background

2.1 Industry convergence

Industry convergence is recognized as the blurring of boundaries between formerly distinct industries and can be described as a sequential process starting with converging scientific fields followed by a convergence of formerly distinct technologies and markets, finally leading to converging industries (Curran and Leker, 2011). Industry convergence can either be driven by developments on a technological level (technology-driven input-side convergence) or market level (market-driven output-side convergence) (Bröring, 2010). In most cases technology convergence, reinforced by market convergence, triggers industry convergence. Industry convergence can be either substitutive or complementary: technology substitution tends to be driven by radical innovation, whereas technology integration by more incremental innovation (Rikkiev and Mäkinen, 2013). Converging technologies and markets lead the firms involved to identify competence gaps which they close through collaborations with firms of complementary competence.

The convergence process follows a life cycle pattern where science convergence is superseded by technology convergence and then by market convergence over time, as the new industry goes through introduction, growth and maturity phases (Bornkessel et al., 2016). The types of collaborations formed will differ depending on the stage of the life cycle the industry is currently at (Marks et al., 1999). Furthermore, the innovativeness of the entrepreneurial activities will also differ based on the stage of the industry life cycle. High technological opportunities stimulate entry early in the industry life cycle. As the industry matures, entry barriers rise, entry falls off, concentration increases and innovation becomes more incremental.

Industry convergence is distinguished from fusion (Curran and Leker, 2011). While in convergence the converging area is formed between the two converging sectors, in fusion the resulting segment is formed at the spot where one of the two former sectors was located. The resulting sector therefore does not create any new application domain. One or both of the old sectors may either remain as independent technology segments, giving birth to new fusion in the future, or they may disappear as a result of the fusion of its applications.

2.2 Types of collaborations formed with respect to the intensity of resource and competence integration

Within convergent fields, owing to their interdisciplinary nature institutions collaborate with each other in order to gain critical resources and competences and to share costs and risks (Parmigiani and Rivera-Santos, 2011). Resources can be classified into financial resources and intellectual resources. Intellectual resources include technology knowledge and market knowledge, which are otherwise called technology and market competences. Types of collaborations range from forms such as licensing agreements, strategic alliances and joint ventures to mergers and acquisitions (M&A). Each of these collaboration types integrates the resources and competences of another institution to a different degree. A licensing agreement is an agreement between two companies to use resources and competences of the other firm for a payment of a licensing fee (Gallini et al., 1985), which demonstrates the lowest level of resource and competence integration. A strategic alliance is a contract between two partners, which exists for a set time and task (Parmigiani and Rivera-Santos, 2011) and which shows a slightly higher level of resource and competence integration. A joint venture is a jointly-owned entity created by two companies that stay separate, resulting in risks and rewards for each company (Parmigiani and Rivera-Santos, 2011), where resources and competences of the involved institutions merge due to the establishment of a new entity (i.e. a further increase in resource and competence integration). Lastly, M&A result in a fusion of companies (Hennart and Reddy, 1997), where resource and competences of the involved institutions merge completely resulting in the highest level of resource and competence integration.

The early stage of complementary industry convergence is characterized by more flexible collaboration forms such as strategic alliances or joint ventures owing to the high level of uncertainty caused by the dynamic and fast changing technological environment (Sick et al., 2018). These are collaborations on the technology level formed in order to close technology competence gaps. In the substitutive convergence more technology-based M&A collaborations are observed even in highly uncertain environments as the company´s core business is threatened. The medium stage of the complementary industry convergence is characterized by market-oriented strategic alliances and joint ventures to close the market competence gaps during the period of slower technological change and emerging industry standards. In the substitutive case, market-oriented M&A collaborations are formed. As the industry proceeds into the late stage, uncertainty decreases even further as more regulations and standards are becoming established. In the case of complementary convergence the companies will now engage in M&A, whereas in substitutive convergence the companies reshape their business units and respective business areas.

2.3. Framework for classification of collaborations based on closing resource and competence gaps

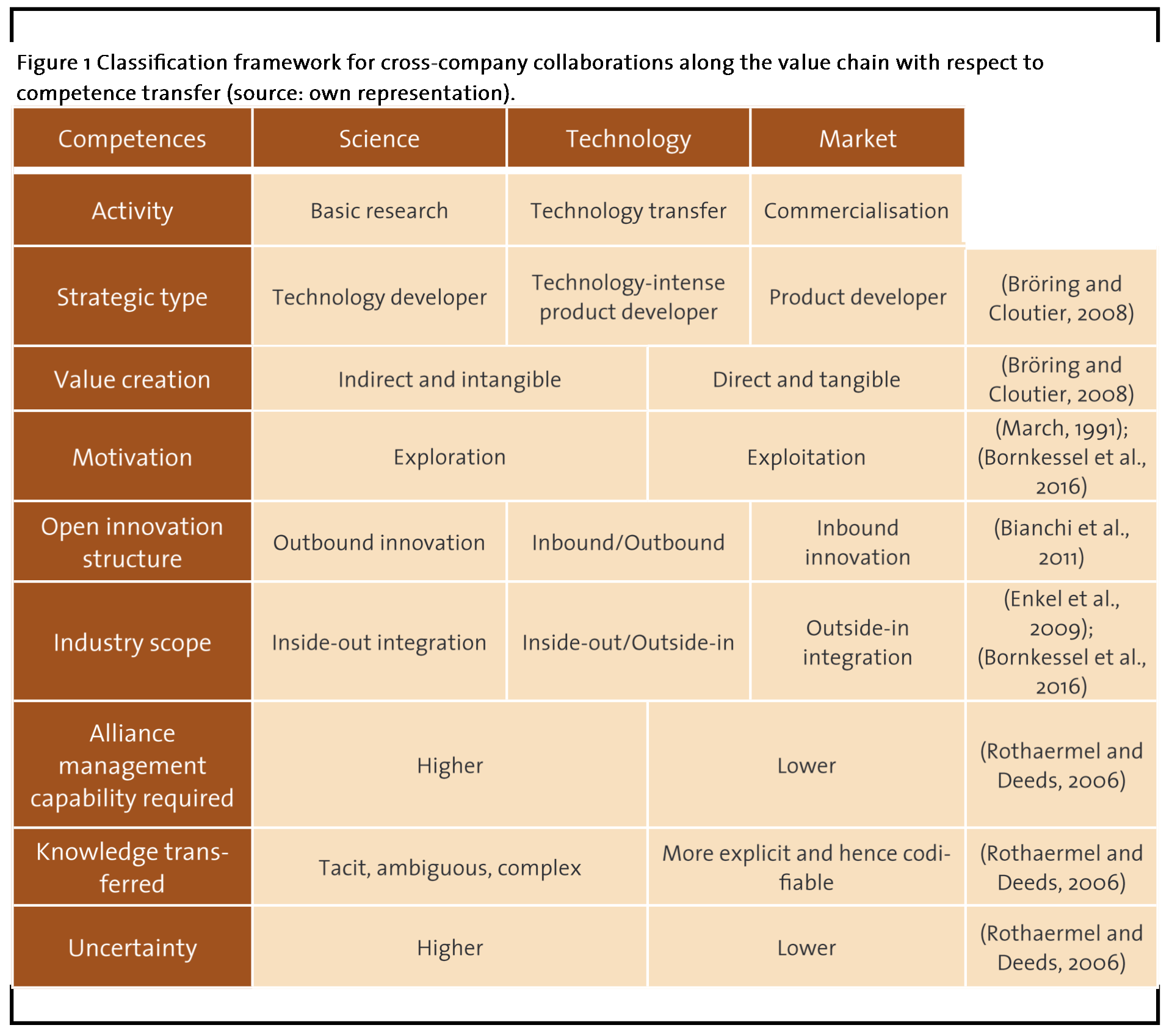

Apart from classifying the types of collaborations with respect to the intensity of resource and competence integration, a further classification is proposed based on the types of competences transferred.

Collaborations are based on different factors, which are needed for competence transfer. One such factor is the strategic type of the partner. Strategic types include technology developers, technology-intense product developers and product developers using existing technologies (Bröring and Cloutier, 2008). It can be seen that the technology developers will collaborate to gain market competences and the product developers to gain technology competences, with the technology-intense product developers lying in between. Therefore, collaborations can also be distinguished as technology- or market- based: technological agreements include joint development agreements, research joint ventures, technology transfer and technology sharing, whereas commercial agreements include licenses, joint distribution agreements or customer-supplier relationships (Colombo et al., 2006).

Similarly, collaborations are based on value creation, which again is associated with competence transfer. Value can be either indirect and intangible, or direct and tangible (Bröring and Cloutier, 2008). The indirect, intangible value is associated with the earlier stages of ideation, technology development through to product development, whereas direct, tangible value is obtained going from the product development to commercialization and sale.

The nature of the motivation for collaboration is also influenced by the competences that each partner can offer. The motivation for collaborations include explorative and exploitative types (March, 1991). Exploration aims to investigate new opportunities and focuses on long-term competitive advantage, while exploitation aims to execute existing knowledge and focuses on short-term commercialization. The intensity of collaboration differs between the two types (Parmigiani and Rivera-Santos, 2011). Exploration shows reciprocal interdependence between the two institutions, where they have a joint development using resources and competences from both partners. Exploitation shows discrete interdependence, where decisions are made independently by the two partners. Building on the distinction between the exploration and exploitation, alliances can also be distinguished between ones which acquire knowledge and ones which access knowledge (Grant and Baden-Fuller, 2004). In a knowledge acquiring alliance each firm transfers and absorbs the partner´s knowledge base. On the other hand, in knowledge accessing alliances each firm accesses its partner´s knowledge in order to exploit complementarities but maintains its own specialized knowledge.

The way competences are transferred between companies can be viewed in terms of organization modes in open innovation (Bianchi et al., 2011). Through inbound open innovation companies can be brought into the collaboration with others through in-licensing, acquisitions, joint ventures, R&D contracts and research funding, or purchase of technical and scientific services. Looking from the perspective of outbound open innovation, the possibilities include licensing out, spinning out of new ventures, sale of innovation projects, joint venture for technology commercialization and supply of technical and scientific services.

The competence transfer may also vary based on the industry sector the company is a part of (Enkel et al., 2009). The outside-in collaboration describes the integration of resources and competences from other industry sectors. The inside-out collaboration describes the externalization of assets towards other industry sectors. The coupled process describes a simultaneous internationalization of external assets and externalization of internal assets.

Furthermore, the alliance management capability, defined as “a firm´s ability to effectively manage multiple alliances” will differ for different firms and in different collaborations (Rothaermel and Deeds, 2006). The alliance management capability is dependent on the type of knowledge transferred in a collaboration, where greater alliance management capability is needed when more tacit, ambiguous and complex knowledge is concerned. This more tacit, ambiguous and complex knowledge is also associated with a higher degree of uncertainty in the alliance.

The classification of collaborations in terms of the transfer of the science, the technology and the market competences, along the value chain starting with basic research, through technology transfer up to commercialization is summarized (Figure 1).

Knowledge-based collaborations benefit from the economies of scope (Grant and Baden-Fuller, 2004). Economies of scope are prevalent in sectors where knowledge requirements are broad and where a lot of knowledge is not product-specific, such as in medicines and pharmaceuticals. This trend is further emphasized during convergence, where knowledge requirements are broadened and the importance of knowledge not specific to particular products and sectors increases e.g. incorporating digital technologies or management sciences into other sectors.

Collaborations can also provide early-mover advantage during convergence. While knowledge is rapidly advancing during the convergence process, appropriating its returns often depends on achieving early-mover advantage. Collaborations allow firms to quickly identify, access and integrate across new knowledge combinations to recombine knowledge into innovative products, and hence greatly increase the speed with which a company can bring new products to the market.

Opposing the many benefits, forming a collaboration also incurs transaction and management costs (Colombo et al., 2006). Transaction costs include the costs of the search for suitable partners, the costs of partner assessment and selection, negotiation and other contractual costs, and the appropriability hazards endangered by the alliance, while management costs are the opportunity costs of time and effort devoted to the alliance management over other activities.

3 Data collection and analysis

3.1 Data Collection

In order to perform an analysis of strategic alliances, joint venture, mergers and acquisitions in convergent biotechnology industry, data on collaboration of biotechnology sector firms were compiled. The data differentiates between collaborations of firms within the biotechnology sector and with firms from other sectors. The number of strategic alliance and joint venture formations between the years 1997 –2016 was assessed through the Thomson Reuters database, whereas the number of M&A between the years 1997 – 2016 was assessed through the Securities Data Corporation (SDC) Platinum database. Since there is not one Standard Industrial Classification (SIC) code for the biotechnology sector in the SDC Platinum database, five SIC codes for either the acquirer or the target were searched for to represent the biotechnology sector as closely as possible (Aaldering et al., 2018). These were: 2834, 2835, 2836, 8731, 8734, which stand for Pharmaceutical Preparations, In Vitro and In Vivo Diagnostic Substances, Biological Products except Diagnostic Substances, Commercial Physical and Biological Research, and Testing Laboratories respectively. Acquisitions deals were defined as these where the acquirer previously owned <50% of the target´s voting shares and increased the ownership to at least 50% as a result of the takeover.

3.2. Analysis

3.2.1 Strategic alliances and joint ventures

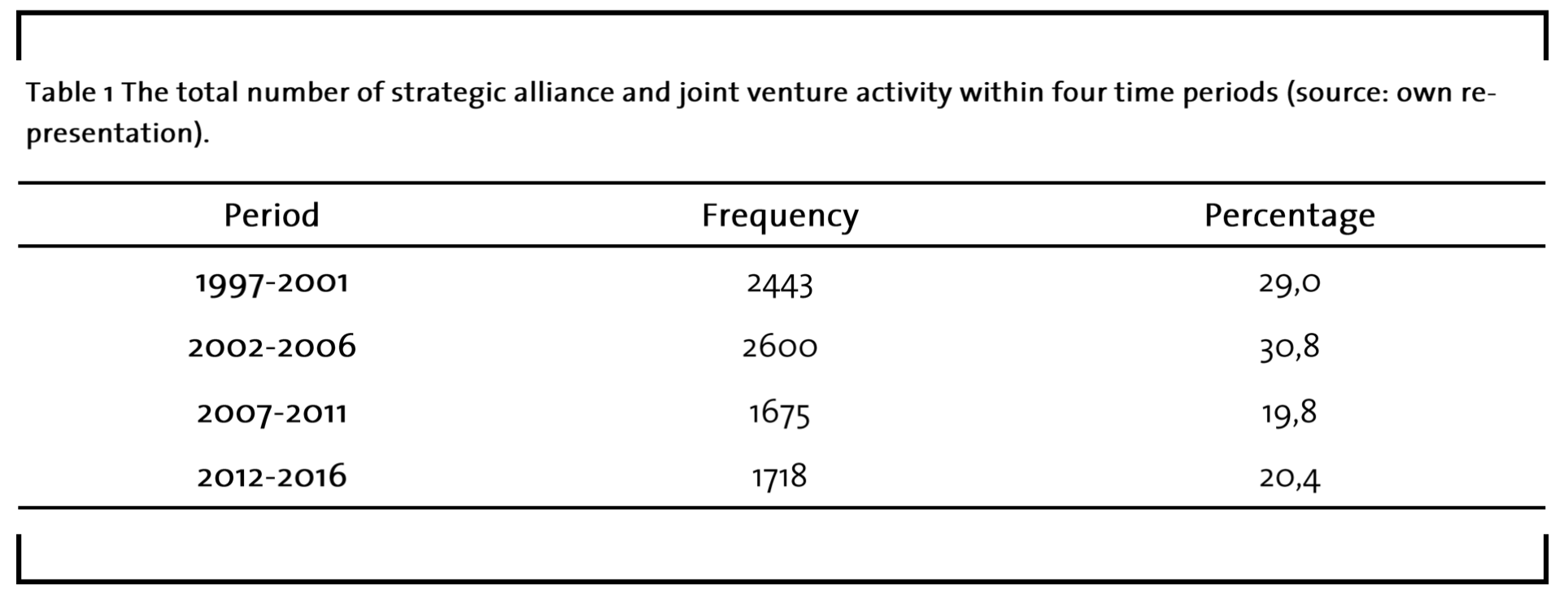

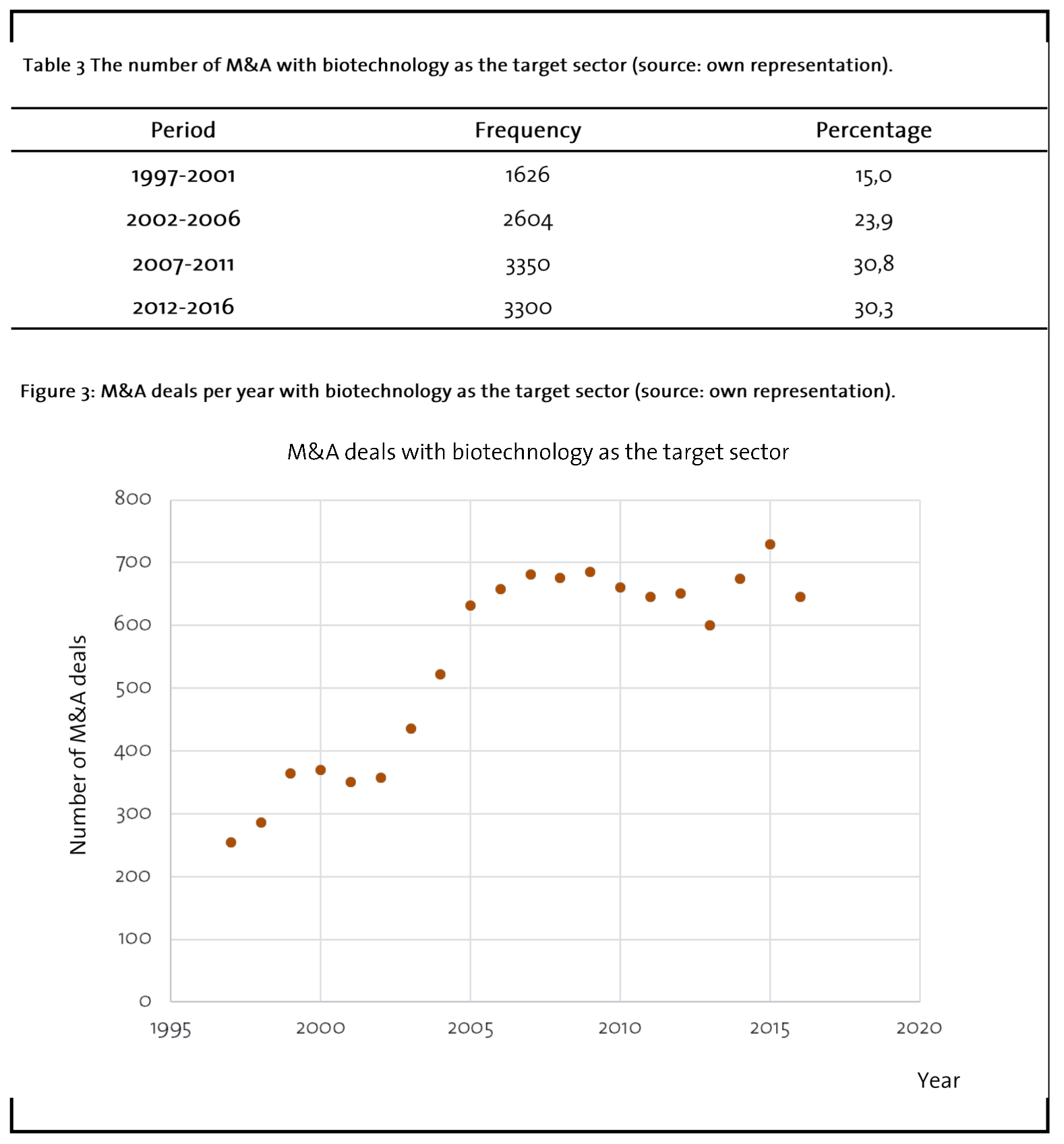

The twenty-year period was divided into five-year segments to investigate how the sectors interacting with the biotechnology sector changed over time. For strategic alliances and joint ventures the sectors of joint activity were investigated. 8436 strategic alliances and joint ventures were identified over the specified time period (Table 1). The most prominent sectors over the twenty-year period were shown to be: exclusive licensing services, health and medical services, licensing services, manufacturing services, marketing services, research and development services, retail and wholesale services, and supply services (Table 2, Figure 2).

3.2.2. Mergers and acquisitions

The development in mergers and acquisitions was investigated over the 20-year period, 1997-2016. The analysis was done on five dimensions. Firstly, the study looked at the biotechnology sector as the target for M&A of firms from all sectors. Secondly, it examined the biotechnology sector as the acquirer in M&A of firms from all sectors. Subsequently, the biotechnology-biotechnology transactions were removed to get a more in-depth picture of transactions only between the biotechnology sector and other sectors. Lastly, only transactions within the biotechnology sector were shown for completeness.

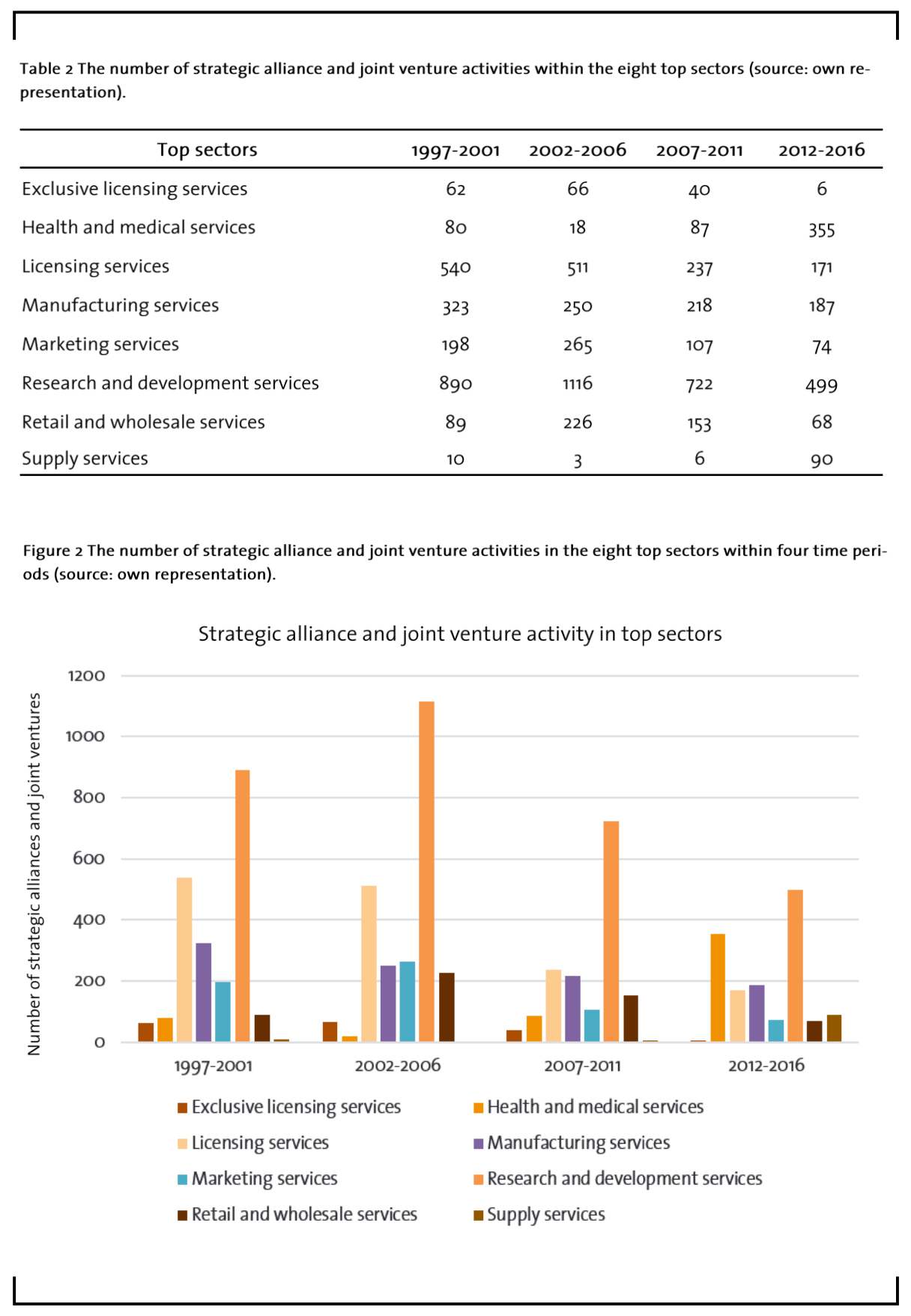

The number of M&A with biotechnology as the target sector over the 20 years was investigated (Table 3, Figure 3). 10880 M&A transactions were found. This data includes transactions between biotechnology firms.

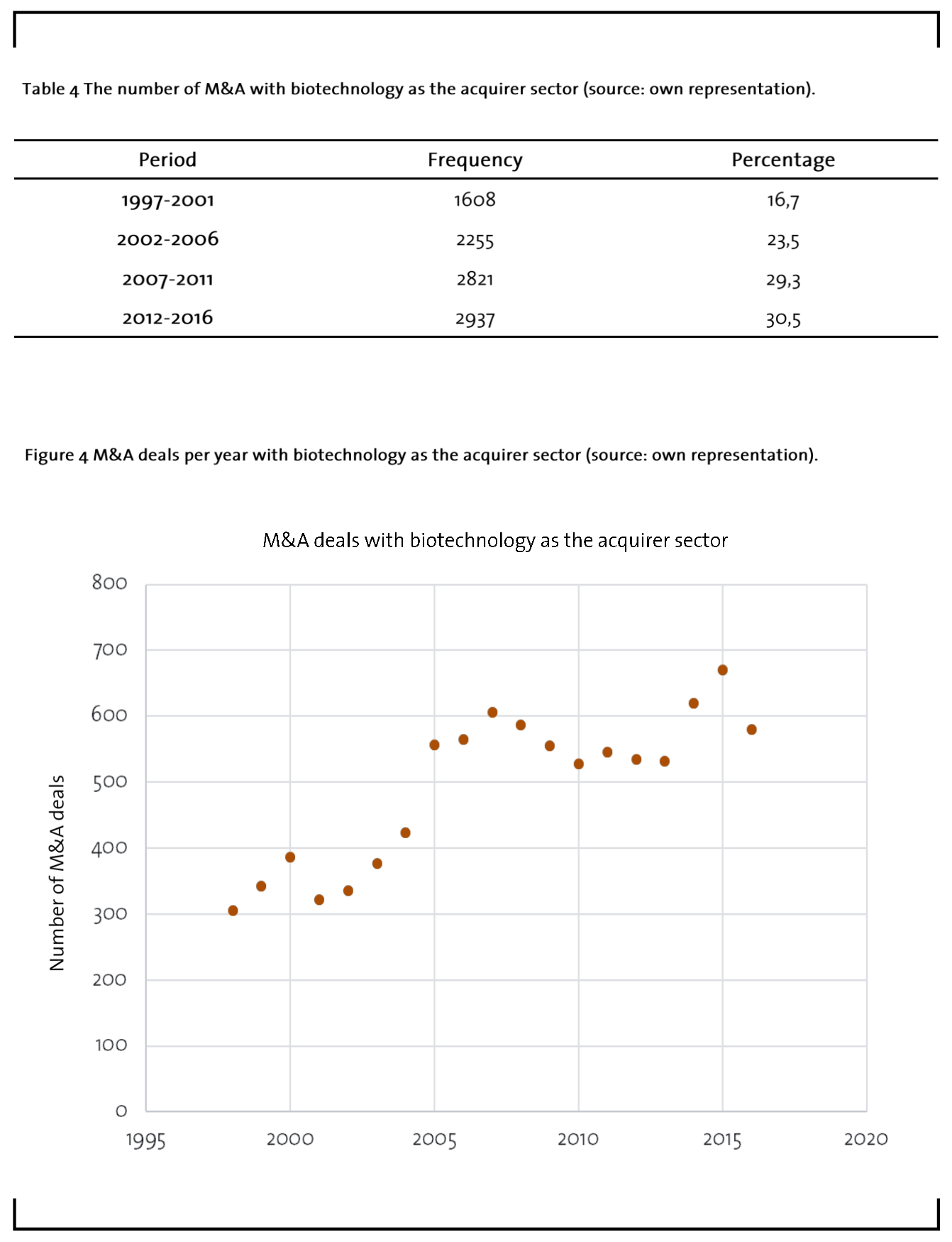

Furthermore, the number of M&A with biotechnology as the acquirer sector over the 20 years was investigated (Table 4, Figure 4). 9621 transactions were found. This data includes transactions between biotechnology firms.

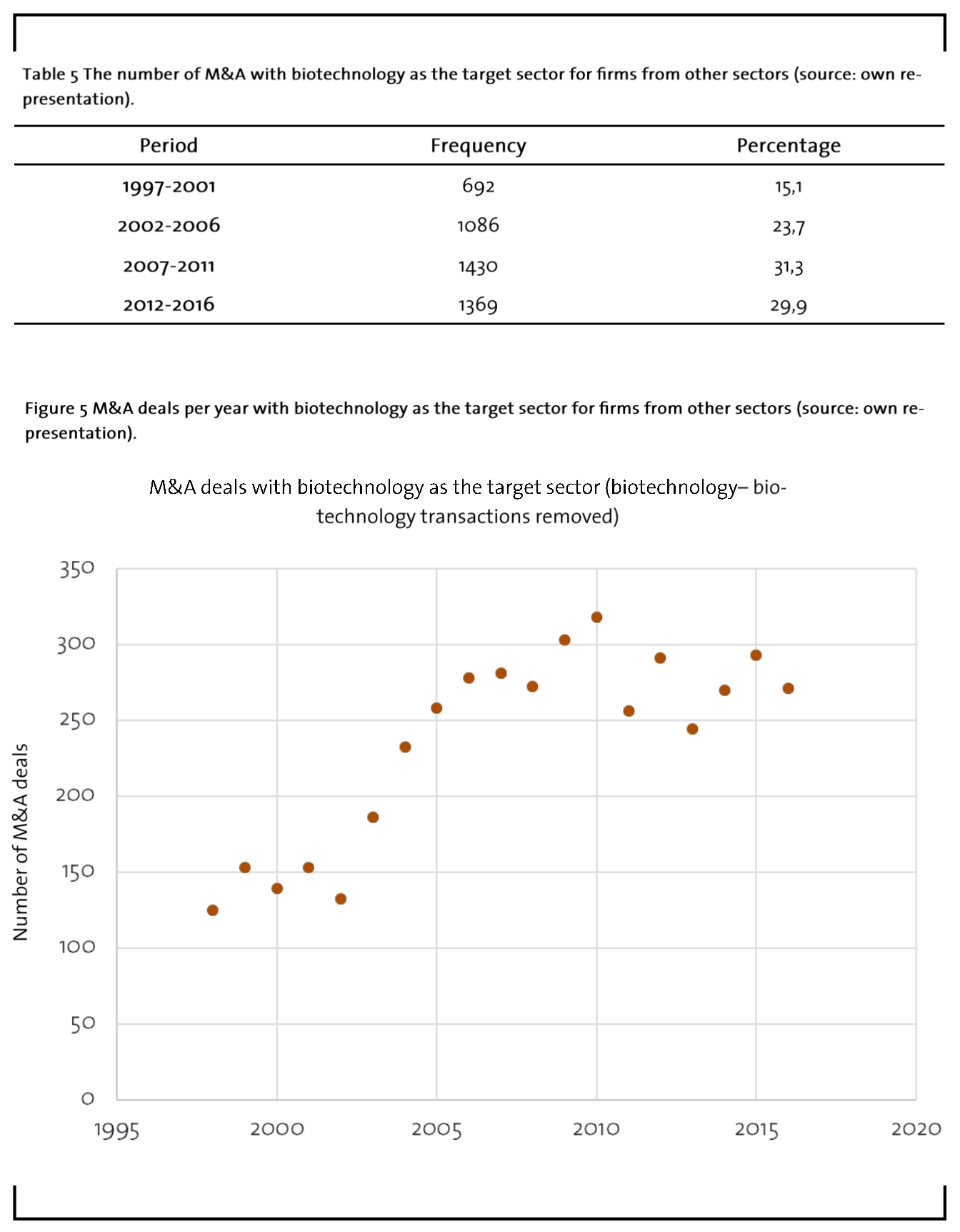

Subsequently, the number of M&A with biotechnology as the target sector was investigated, where biotechnology firms were the target for firms from other sectors (i.e. biotechnology to biotechnology transactions were removed) (Table 5, Figure 5). 4577 transactions were identified.

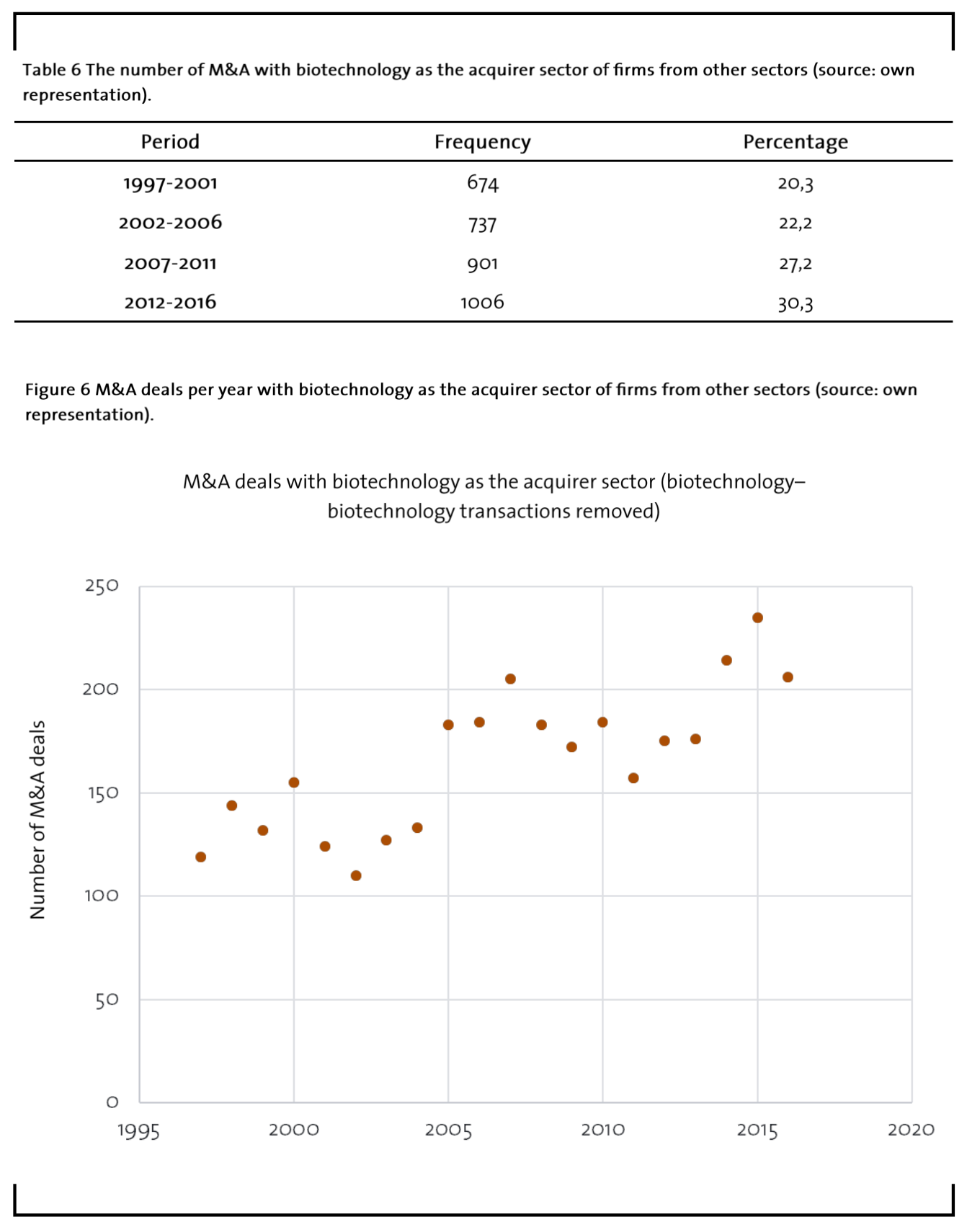

Moreover, the number of M&A with biotechnology as the acquirer sector was investigated, where biotechnology firms were the acquirer of firms from other sectors (i.e. biotechnology to biotechnology transactions are removed) (Table 6, Figure 6). 3318 such transactions were identified.

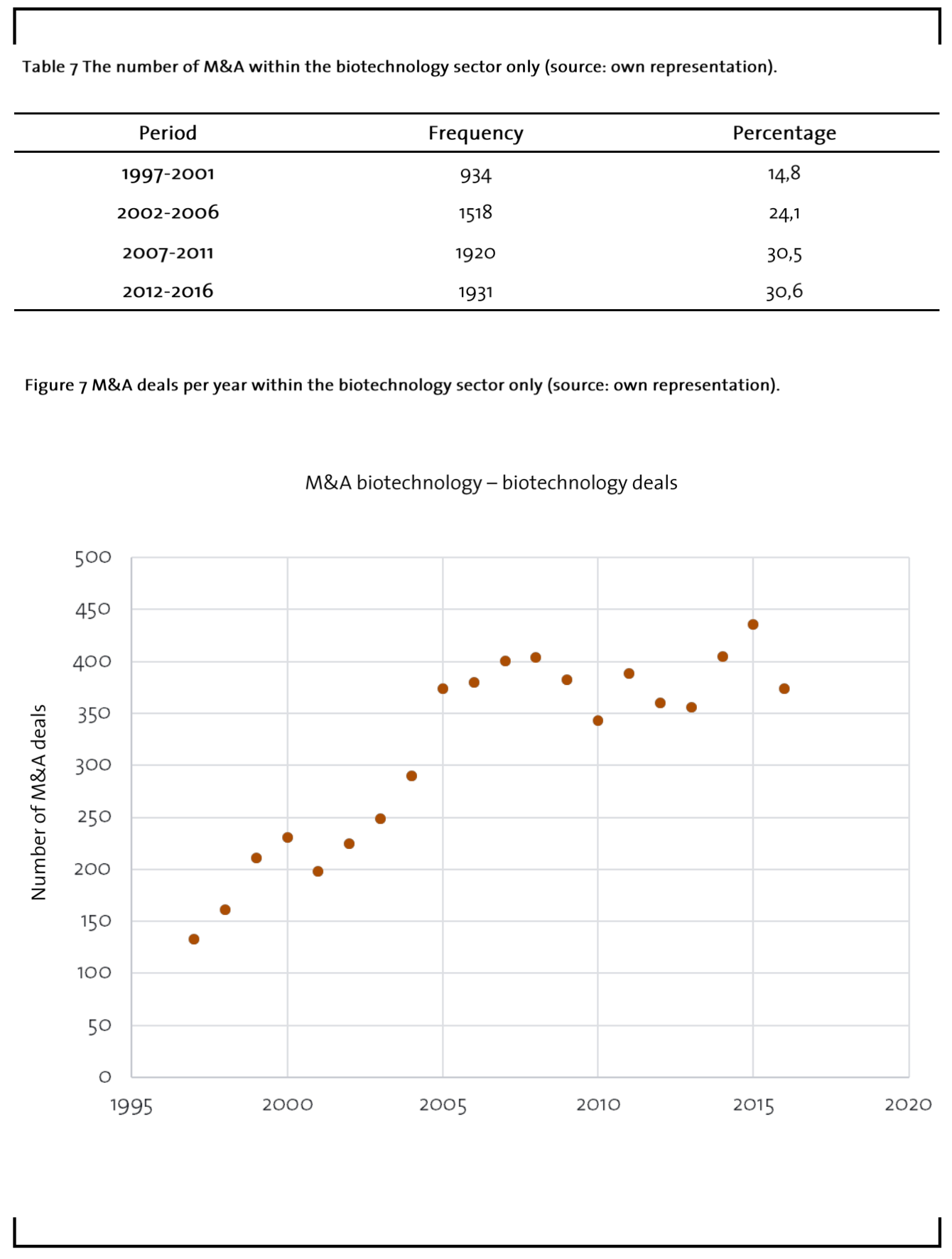

Finally, M&A transactions within the biotechnology sector were investigated (Table 7, Figure 7). 6303 such transactions were found.

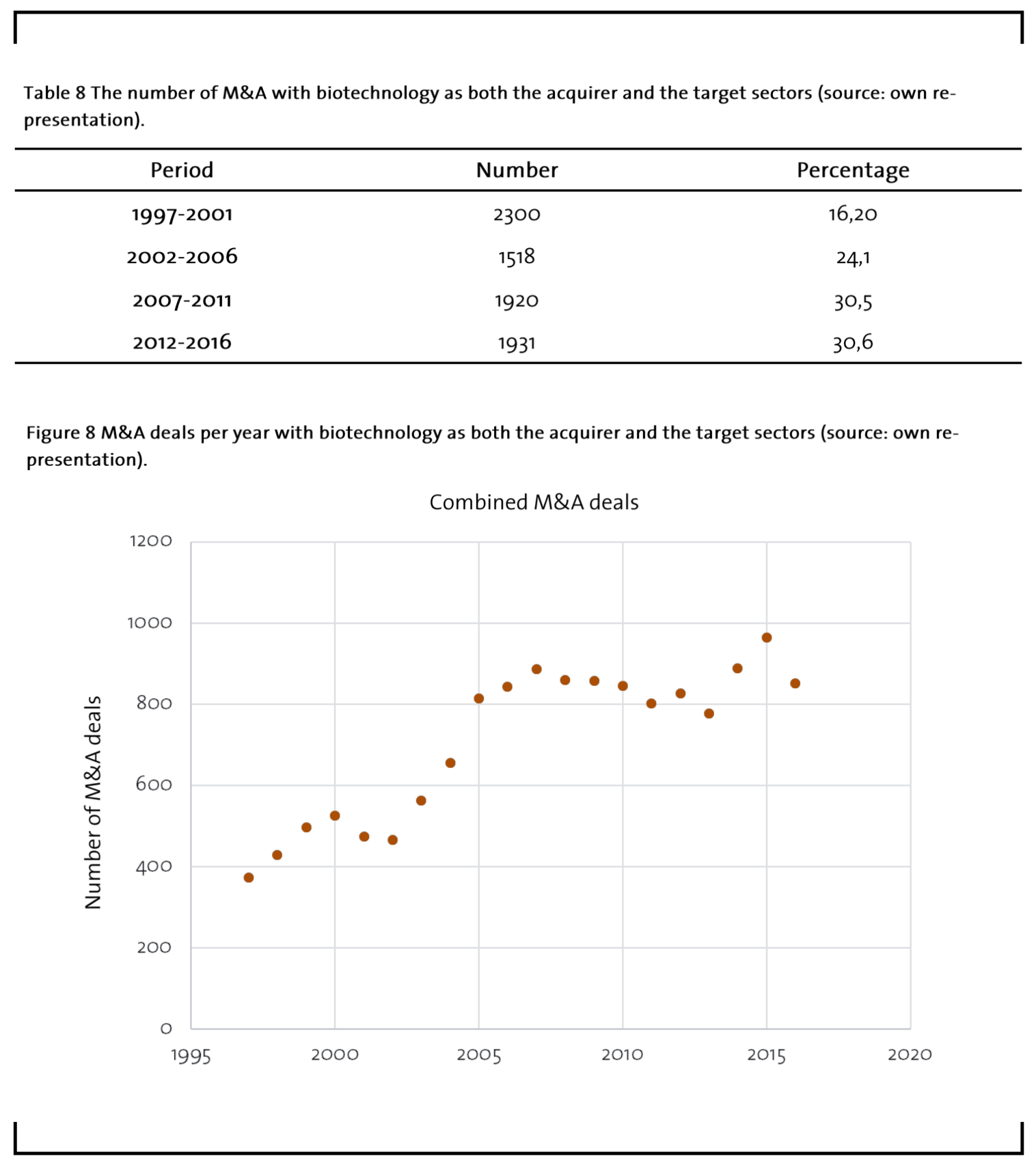

Aaldering et al., 2018 report a dataset, which includes biotechnology sector as the acquirer of firms from other sectors, other sectors as the acquirer of biotechnology firms, as well as biotechnology firms acquiring within its own sector. 14198 transactions were found. This data is shown in the table and graph below for completeness (Table 8, Figure 8).

An increase in the number of M&A is observed over the 20-year period. It is interesting to compare the trends in the number of M&A deals against strategic alliances and joint ventures during the years post 2008 Global Financial Crisis. The Financial Crisis affected both pharmaceutical and biotechnology industries. Small biotechnology companies were weakened by investment shortages during the time of the crisis, which caused them to scale down their activities. At the same time many major pharmaceutical companies strengthened their capabilities and focused on improving efficiency, cost-effectiveness and productivity; many companies significantly restructured. The number of mergers between large companies and acquisitions of smaller companies by larger ones stayed high during the financial crisis. The high number of acquisitions of drug candidates from biotech companies took place because the large companies retained significant cash reserves, whereas smaller biotech companies became financially unstable and lost their bargaining power. Similarly, a high number of mergers could be explained by the fact that mergers allow for greater control over the partner at a time where trust between partners is uncertain. On the other hand, a decrease in the number of acquisitions by biotechnology companies of firms from other sectors was observed, which can be explained by the weaker position of the biotechnology companies, which are heavily reliant on capital investments. Moreover, a steep decrease was observed in the number of strategic alliances and joint ventures, in part since companies were focused on merger and acquisition activities and because such forms of collaboration provide the acquirer with less control over the partner, which might be considered to be more risky in uncertain times of the financial crisis.

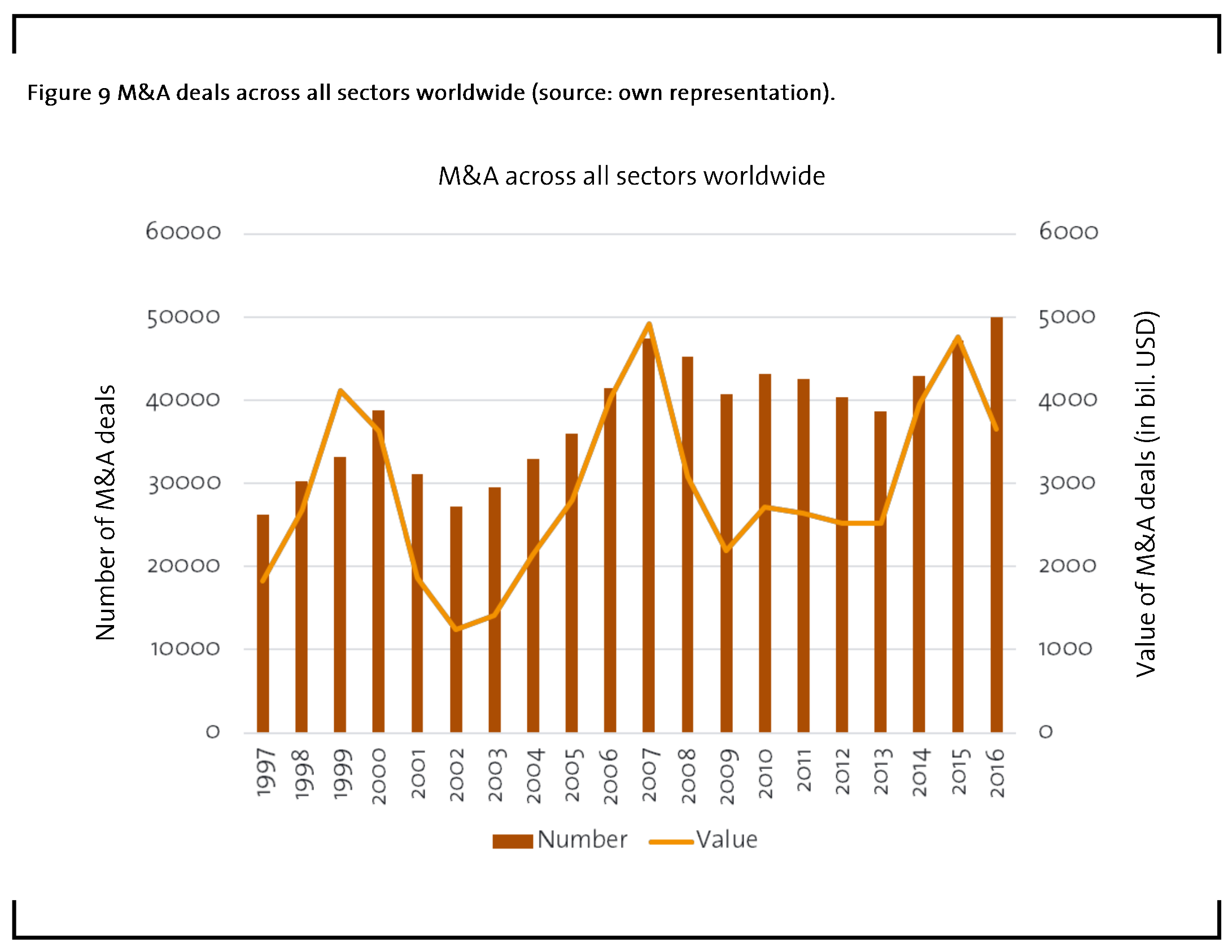

To further demonstrate how the biotechnology sector fits within the global, cross-industry M&A trends around the time of the financial crisis, a graph by the Institute for Mergers, Acquisitions and Alliances (IMAA) is included below (Figure 9) (based on: https://imaa-institute.org/mergers-and-acquisitions-statistics/, accessed 21.12.2018). A drop by 6745 transactions (14.2%) is observed in the years 2007 – 2009, a 2728.5 billion USD (55.5%) drop in cash terms. It is interesting to observe that biotechnology industries do not adhere to this generally observed pattern.

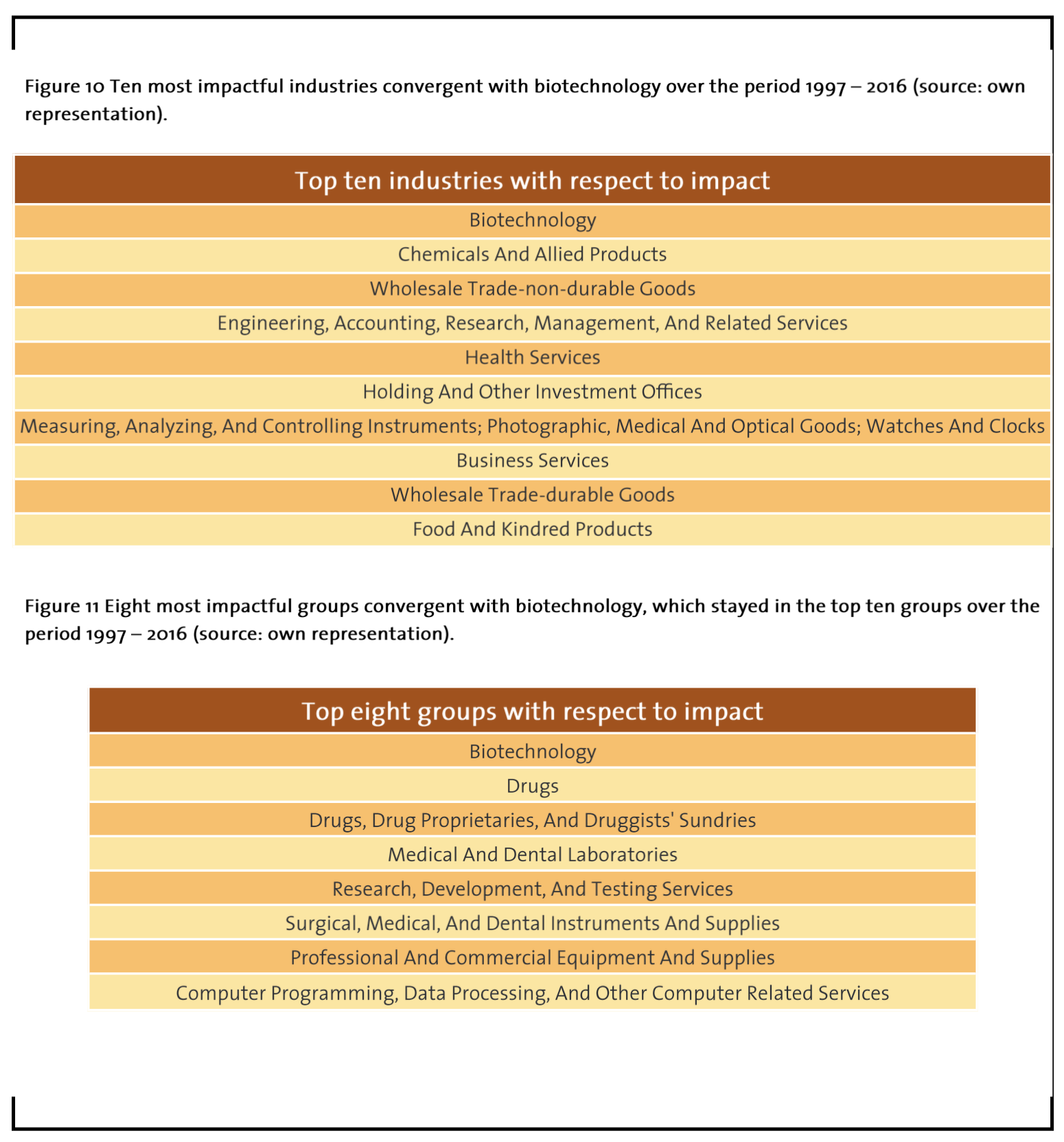

3.2.3 M&A – convergence triggering and receiving sectors

Apart from the changing trends in the number of M&A transactions over the years, it is important to show which sectors converge with biotechnology. Aaldering et al., 2018 report the impact that different sectors have on convergence with biotechnology and whether they act as a trigger or a receiver in the convergence process. Their data was divided over four time periods: 1997-2001, 2002-2006, 2007-2011 and 2012-2016. The data included industries converging with the biotechnology sector (72, 78, 78 and 80 industries respectively over the four intervals) as well as more specific converging groups (249, 280, 298 and 304 groups respectively over the four time intervals). They showed that in the industry category all ten industry sectors stayed within the same given top ten bracket throughout all four time periods (Figure 10). There were more convergence triggering industries than convergence receiving industries in the top ten. For convergence receiving industries, seven out of ten kept their top positions throughout the entire time period. Two convergence triggering industries that only appeared in the top ten in the final interval were “Security and commodity brokers, dealers, exchanges and services” as well as “Real estate”. Regarding convergence receiving industries only two, namely “Biotechnology” itself and “Health services” were present consistently over all time intervals. “Stone, clay, glass and concrete products” as well as “Rubber and miscellaneous plastics products” were two industries which entered the top ten convergence receiving industries category in the final interval. In the group category, eight group sectors stayed within the top ten bracket throughout all four periods (Figure 11).

4 Convergent biotechnology industry case example: biopharmaceuticals

As shown in the analysis of the strategic alliances and the M&A, one of the major sectors of convergence with the biotechnology industry is the pharmaceutical sector. Therefore, in this section the convergence between biotechnology, pharmaceuticals and information technology is analyzed, and the change in the biopharmaceutical business models over time is illustrated. Lastly, the position of the incumbent firms in the collaboration framework along the value chain is shown to change over time.

4.1 The changing scene of the biopharmaceutical industry

In the recent years technology firms, wellness companies and other non-traditional players have started to enter the traditional biopharmaceutical space (Campbell, 2017). These competitors face new regulatory hurdles, timelines and risks of therapeutic R&D, but they show advantage in their in-depth expertise in understanding customer behavior, brand building, big data analysis, IT and short-cycle innovation – areas which form the healthcare scene of today and where many biopharma companies have limited skills. The dominant industry logic is challenged not only by technological discontinuities but also by disruptive business models that the new entrants employ (Sabatier et al., 2012).

In future digital tools might help improve patient outcomes as well as traditional drug therapies (Campbell, 2017). This could pose a large threat to current biopharma business models, especially if the service is offered at a much lower price and without concerns regarding unwanted side effects or drug-drug interactions.

Biopharma is already starting to incorporate digitalization, driven by cost pressures and the urgent need for product differentiation. Currently the research focuses on incorporation of digital technologies into clinical trials and the gathering of real world evidence. Further work is being done on consumer-facing digital technologies to augment drug value. This product-focused side of digital technologies is still in early stage. Some biopharmaceutical companies, however, try to see digital tools as a way to increase profits, while these may in fact cause exactly the opposite effect.

The new sources of competition can also provide a new source of partnerships and external innovation for the incumbents. Over time digital health and technology companies have evolved to work closer with regulators in the pharmaceutical sector, which is necessary in a highly regulated health system. The narrowing cultural divide with biopharma is making collaborations between the sectors easier. Currently biopharmaceutical companies do not have the data infrastructure to properly exploit digital tools, hence they rely on partners for data analysis and software vending.

The major threats to the biopharma sector are costs. The pricing pressure and the declining number of blockbuster drugs continue to challenge revenue growth while the costs of developing a drug remain high. The ongoing decline in the return on investment (ROI) of biopharma R&D is unsustainable. There has to therefore occur a change in the biopharma business models since otherwise the falling ROI will threaten the sector´s viability.

4.2. The development of new biopharmaceutical business models

The changes that the biopharmaceutical industry is undergoing will have a huge impact on the type of business models the companies in the sector will have to employ (Pisani and Arlington, 2009). The companies need to improve R&D productivity, reduce costs, exploit the potential of emerging economies and switch from selling medicines to managing outcomes. These are difficult for a company to achieve on its own. Biopharmaceutical companies must change their business models more rapidly as otherwise they may get displaced by prominent players entering from other sectors.

Two main business models – federated and fully diversified are proposed as potentially effective models for the biopharmaceutical industry (Pisani and Arlington, 2009). The payer pressure and the opportunities to build or buy the required networks will accelerate the shift to these new models. The traditional business model, where one company focuses on the entire value chain no longer suffices and will no longer meet the market´s needs. It has been shown that disruptive innovation in various industries dismantles the prevailing business model, where new players initially target the least profitable customer segment and gradually move upstream to satisfy the needs of other customers, and the old business model collapses. The biopharmaceutical industry is currently undergoing a period of innovation with the talks of shifting the payment system to be based on the results that drugs deliver.

All trends point towards the need for greater collaboration. New business models emerge to account for the social, economic and technological changes taking place in the biopharmaceutical and healthcare landscape. These focus on the development of multinational, multidisciplinary networks which incorporate more competences than are present in the biopharmaceutical sector alone. The value chains of the three parties involved, namely pharma, payers and providers are highly interdependent. These currently linear value chains are starting to form a single, circular value chain, where feedback loops are being created.

In the federated model a company creates a network of separate entities with a common supporting infrastructure and goals. It draws on the in-house as well as the external assets, and balances size with flexibility. The federated model has two variants: virtual and venture. In the virtual model some or all of the company´s operations are outsourced and the company forms a management hub coordinating activities of its partners. Advantages of this model include: lower initial capital outlay, more variable costs, more efficient use of resources, greater flexibility, greater opportunities for expansion into new product or service areas and into new geographical markets. A major disadvantage is a shift in the balance of power towards suppliers. The venture variant of the federated model involves investing in a portfolio of companies in return for a share of their intellectual assets or capital growth they generate instead of outsourcing specific tasks. This model is beneficial to the biotech sector as it reduces the funding challenges and allows smaller companies to learn from the established ones without restraining their working culture. It allows biopharmaceutical companies to make strategic, long-term investments, explore new avenues of R&D, and expand global manufacturing and marketing. Challenges include gaining investment skills, which are different to the core skills of the biopharmaceutical companies.

In a fully diversified model a company expands from its core business into the provision of related products and services such as diagnostics, devices, generics, nutraceuticals or health management. The disadvantages of this model include a substantial investment in new equipment, premises, personnel and major cultural changes. This model may be best adopted progressively – starting from opportunistic alliances, through more strategic, longer-lasting coalitions, and finally creating a fully federated network of long-term partners.

4.3. The illustration of the changing position of the incumbent firms in the biopharmaceutical value chain

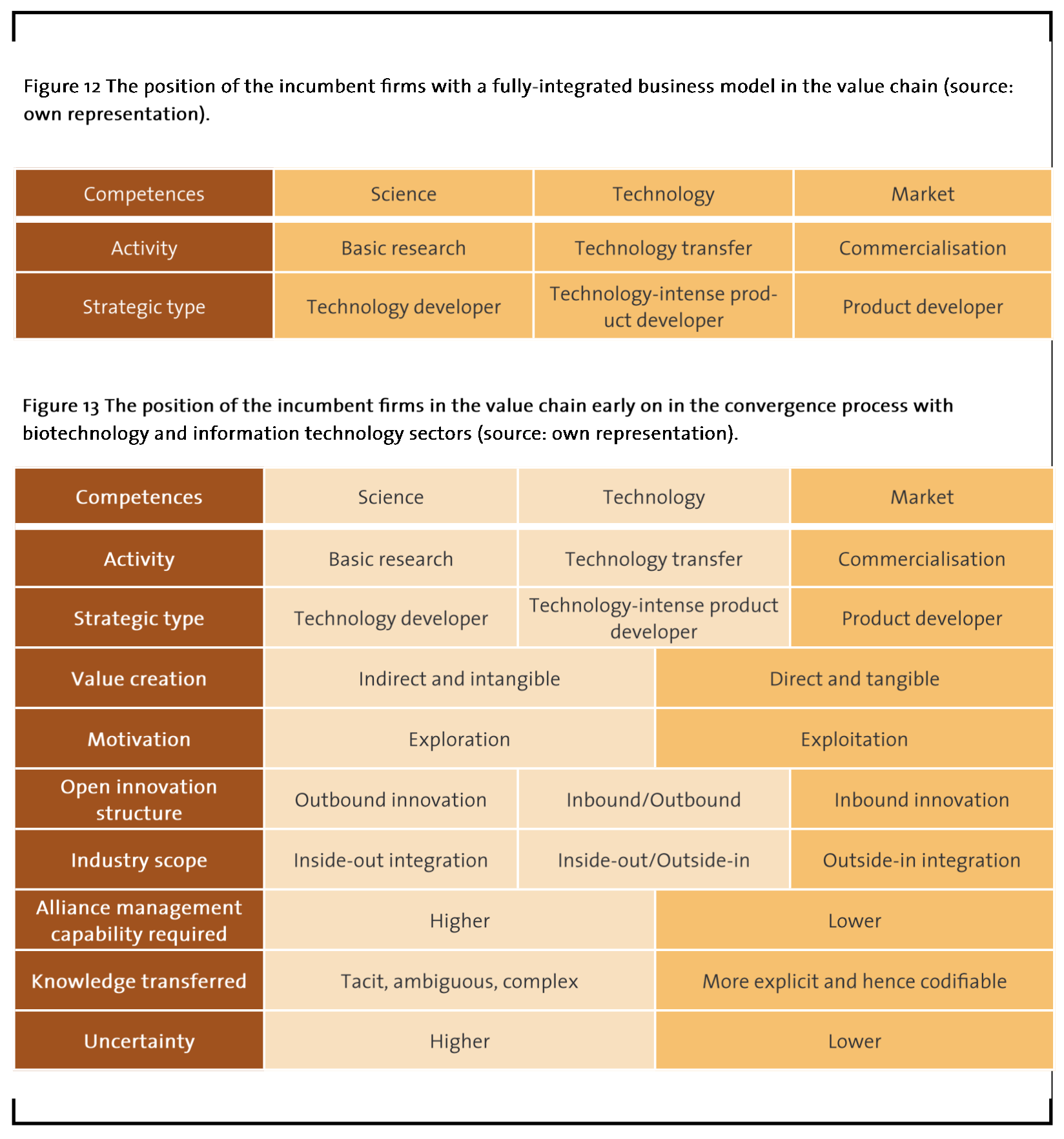

In Figure 12 the position of the incumbent pharmaceutical firms with a fully-integrated pharmaceutical company business model is shown in orange. The incumbent firms formerly covered the entire value chain with their internal competences spanning from science to market competences.

In Figure 13 the position of incumbent pharmaceutical firms in the initial convergence process with biotechnology and information technology firms is shown. The incumbent pharmaceutical firms have moved to the market end of the value chain providing primarily market competences, while science and technology competences have been supplied by the biotechnology and information technology firms.

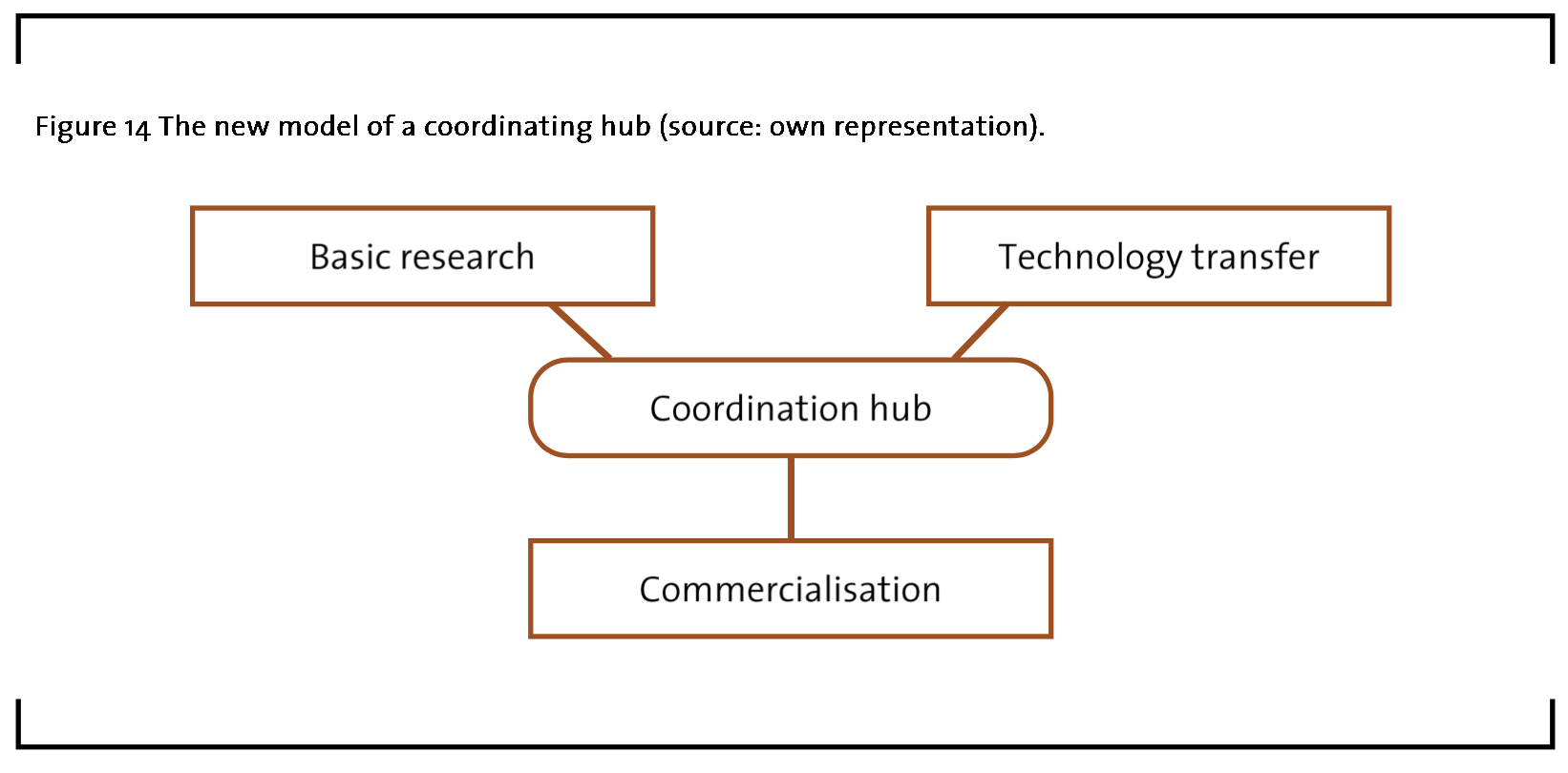

In line with our framework for the classification of collaborations, with the advent of new business models the incumbent firms would no longer just sit at a particular place in the framework but would instead form hubs coordinating the collaborations within the value chain network (Figure 14). Through the management hub model the transfer of knowledge competences within the network would be coordinated. Financial resources within the network would be coordinated through the investment hub. Lastly, through the diversified hub model the convergence process would be coordinated with partners coming from other sectors.

5 Summary and outlook

In summary, an overview of collaborations in the context of industry convergence has been provided. Collaborations have been discussed with regards to competence gaps that organizations seek to close during the convergence process, as well as with regards to the intensity of the resource and competence integration. The conceptual framework developed is illustrated by the example of the biopharmaceutical industry. The changes in the position of the incumbent firms within the value chain during the convergence process between the pharmaceutical industry, biotechnology and information technology are exemplified. The study provides a new perspective on the disintegration of the pharmaceutical industry value chain and on the development of new business models, which may lead to the disintegration of the dominant industry logic on a level beyond technological disruption. Future research could include applying the classification framework to investigation of the position of other types of organizations in the value chain – e.g. start-ups or small and medium enterprises, and their influence on the value chain disintegration. A further study could also look to apply the classification framework to another convergent industry.

References

Aaldering, L. J., Leker, J., Song, C. H. (2019): Uncovering the dynamics of market convergence through M&A, Technological Forecasting and Social Change, 138, pp. 95–114.

Bianchi, M., Cavaliere, A., Chiaroni, D., Frattini, F., Chiesa, V. (2011): Organisational modes for Open Innovation in the bio-pharmaceutical industry: An exploratory analysis, Technovation, 31 (1), pp. 22–33.

Bornkessel, S., Bröring, S., Omta, S. W. F. (2016): Crossing industrial boundaries at the pharma-nutrition interface in probiotics: A life cycle perspective, PharmaNutrition, 4 (1), pp. 29–37.

Bröring, S. (2010): Developing innovation strategies for convergence – is “open innovation” imperative? International Journal of Technology Management, 49 (1/2/3), p. 272.

Bröring, S., Cloutier, L. M. (2008): Value-creation in new product development within converging value chains: An analysis in the functional foods and nutraceutical industry, British Food Journal, 110 (1), pp. 76–97.

Campbell, M. (2017): Beyond Borders, pp. 1–15.

Colombo, M. G., Grilli, L., Piva, E. (2006): In search of complementary assets: The determinants of alliance formation of high-tech start-ups, Research Policy, 35 (8 SPEC. ISS.), pp. 1166–1199.

Curran, C. S., Leker, J. (2011): Patent indicators for monitoring convergence – examples from NFF and ICT, Technological Forecasting and Social Change, 78 (2), pp. 256–273.

Enkel, E., Gassmann, O., Chesbrough, H. (2009): Open R & D and open innovation: exploring the phenomenon, R & D Management, 39 (4), pp. 311–316.

Gallini N. T., Winter, R. A. (1985): Licensing in the Theory of Innovation, The RAND Journal of Economics, 16 (2), pp. 237–252.

Grant, R. M., Baden-Fuller, C. (2004): A Knowledge Accessing Theory of Strategic Alliances, Journal of Management Studies, 41 (1), pp. 61–84.

Hennart, J.-F., Reddy, S. (1997): the Choice Between Mergers/Acquisitions and Joint Ventures: the Case of Japanese Investors in the United States, Strategic Management Journal, 18, pp. 1–12.

March, J. (1991). Exploration and Exploitation in Organizational Learning, Organization Science, 2 (1), pp. 71–87.

Marks, L. A., Freeze, B., Kalaitzandonakes, N. (1999). The AgBiotech industry – a U.S. – Canadian perspective, Canadian Journal of Agricultural Economics, 47 (4), pp. 419–431.

OECD. (2006): OECD Biotechnology Statistics 2006., Statistics, 103.

Parmigiani, A., Rivera-Santos, M. (2011): Clearing a path through the forest: A meta-review of interorganizational relationships, Journal of Management, 37 (4), pp. 1108–1136.

Pisani, J., Arlington, S. (2009): Pharma 2020: Challenging business models.

Rikkiev, A., Mäkinen, S. J. (2013): Technology convergence and intercompany R&D collaboration: across business ecosystems boundaries, Journal of Innovation and Technology Management, 10 (4).

Rothaermel, F. T., Deeds, D. L. (2006): Alliance type, alliance experience and alliance management capability in high-technology ventures, Journal of Business Venturing, 21 (4), pp. 429–460.

Sabatier, V., Craig-Kennard, A., Mangematin, V. (2012): When technological discontinuities and disruptive business models challenge dominant industry logics: Insights from the drugs industry, Technological Forecasting and Social Change, 79 (5), pp. 949–962.

Sick, N., Preschitschek, N., Leker, J., Bröring, S. (2018): A new framework to assess industry convergence in high technology environments. Technovation.