A holistic framework and development agenda for accelerated transition towards a sustainable chemical industry

Abstract

The chemical industry is one of the biggest and most impactful sectors in society. Apart from its economic importance in terms of revenue and employment (CEFIC, 2018), it also plays a crucial role in the way mankind uses renewable and non-renewable resources now and in the future. Climate change, biodiversity challenges and waste pollution can only truly be tackled with the chemical industry as a partner. This means that the industry itself has to transition away from old and sometimes obsolete paradigms and ways of working. This paper suggests where and how to situate this change and presents essential mechanisms and concepts to help realize that change. The solution framework encompasses insights in environmental economics, new financial and non-financial valuation rules, different and more holistic leadership styles and specific technical levers. The aim is to trigger the reader’s curiosity to find out more about the aforementioned ingredients and to launch a call to action to start exploring and experimenting. The time is now (Webster, 2017).

1 The origin of environmental economics

Environmental economics looks at how economic activity and policy affect the environment in which we live. As we all know, both production and consumption can have negative effects on our environment. Energy intensive industries can be the cause of a variety of emissions and increasing consumption in households often leads to the rise of either incineration or waste pollution in our local or global ecosystems (Hanley et al., 2013).

All this is true, but not necessarily inevitable. In fact, it is a consequence of linear thinking and/or a very narrow point of view. Our contemporary economic system favors maximizing top or bottom line growth within each step of the value chain, but not across the entire value chain. In essence, the bulk of our economy is therefore focused on a zero-sum game. Whatever benefits one is usually at the cost of another. Even though this is the predominant economic paradigm, also this is not per se inevitable.

Today however, it seems that countering these negative effects or externalities as they are called in macro-economics, can only be done by incurring a fair amount of cost. Costs for control, costs for cleaner solutions and of course costs for clean-up. Perhaps this is more of a philosophical statement, but we cannot deny that probably our economic calculus was inaccurate up until now. Surely, the true societal cost of any activity is much more encompassing than the ‘naked’ economic cost defined by only those actors involved in its supply and demand (Decoster et al., 2013). Moreover, just as in science where each significant breakthrough or challenge has an ethical dimension that needs to be considered, we are seeing at least a growing awareness of completing the economic equations with additional factors (Schiltz, 2019; Schwab, 2016).

It would be far too easy to blame economists all over the world for this twist of fate. Back in 1915 Cambridge economist A. Pigou already suggested taxation to control the above mentioned externalities. Pigou realized that given normal market dynamics the true societal cost would not be taken into account.

In economic terms, this is called a market failure and it cannot be overcome unless we allow some form of public intervention and regulatory control. How, to which degree and at what local to supra-national level is the real question. Evidently, our environment doesn’t care about state borders, but policy making does play at different levels. In economics, the imperfections in decision making due to other and perhaps less rational or more individualistic elements are often referred to as bounded rationality.

Environmental economics provides a framework to craft a more subtle approach in which these known deficiencies are remedied. Nevertheless, it will be up to consumers, politicians and business leaders to stand up against the dominant logic of short-term financial pressure and zero-sum competition at all cost. In what follows, we will touch upon a few ingredients that could be part of the solution going forward. Win-win game theory, option valuation, system dynamics and complexity thinking, open innovation, venture financing, hybrid chemistries are just some of these concepts.

As I am writing this article today roughly 300,000 people – mostly students – are marching the streets of Australia, demanding more action to counter climate change and waste pollution. Many more marches have been planned and the intensity of these global protests seems to rise. In the late ’70’s and ‘80’s I remember growing up with Greenpeace’s slogan ‘NO TIME TO WASTE’. I believe they were right back then, but we cannot go back in time. We can and must find positive and balanced (people – planet – profit) answers to the obvious challenges. In a rational and creative way, with confidence and optimism. If we fear we cannot change the ways of our global economy just look at a recent initiative by Vertis Environmental Finance, launching a contemporary performance indicator: WMKP or Would My Kid Be Proud (Atkins, 2019). Each decision is subject to the question whether that decision would make your children proud. Despite the dominance of financial metrics, the mere suggestion of a more emotional performance metric tends to trigger at least part of the executive legion.

As we will be focusing on heavy industries and the chemical industry in particular, I strongly believe that despite the past and perhaps part of the public opinion, they will be part of the solution. They have to be.

2 Clarity on how sustainability, linear and circular economy are related

Public opinion matters and publicity for the topic of sustainable chemistry and the circular economy is a good thing. This being said, it is also important to be precise enough and add some quality to these hot topic discussions. Quite similar to the Six Sigma and lean manufacturing hypes around 2000 and the explosion of innovation consultants right after – often enough the same ‘experts’ by the way – we are seeing a lot of sustainability and circular economy experts popping up. There is of course plenty of work to be done, but we are completely missing the point if we throw sustainability and circular economy on one big pile. The two topics are quite clearly related, but there are important differences.

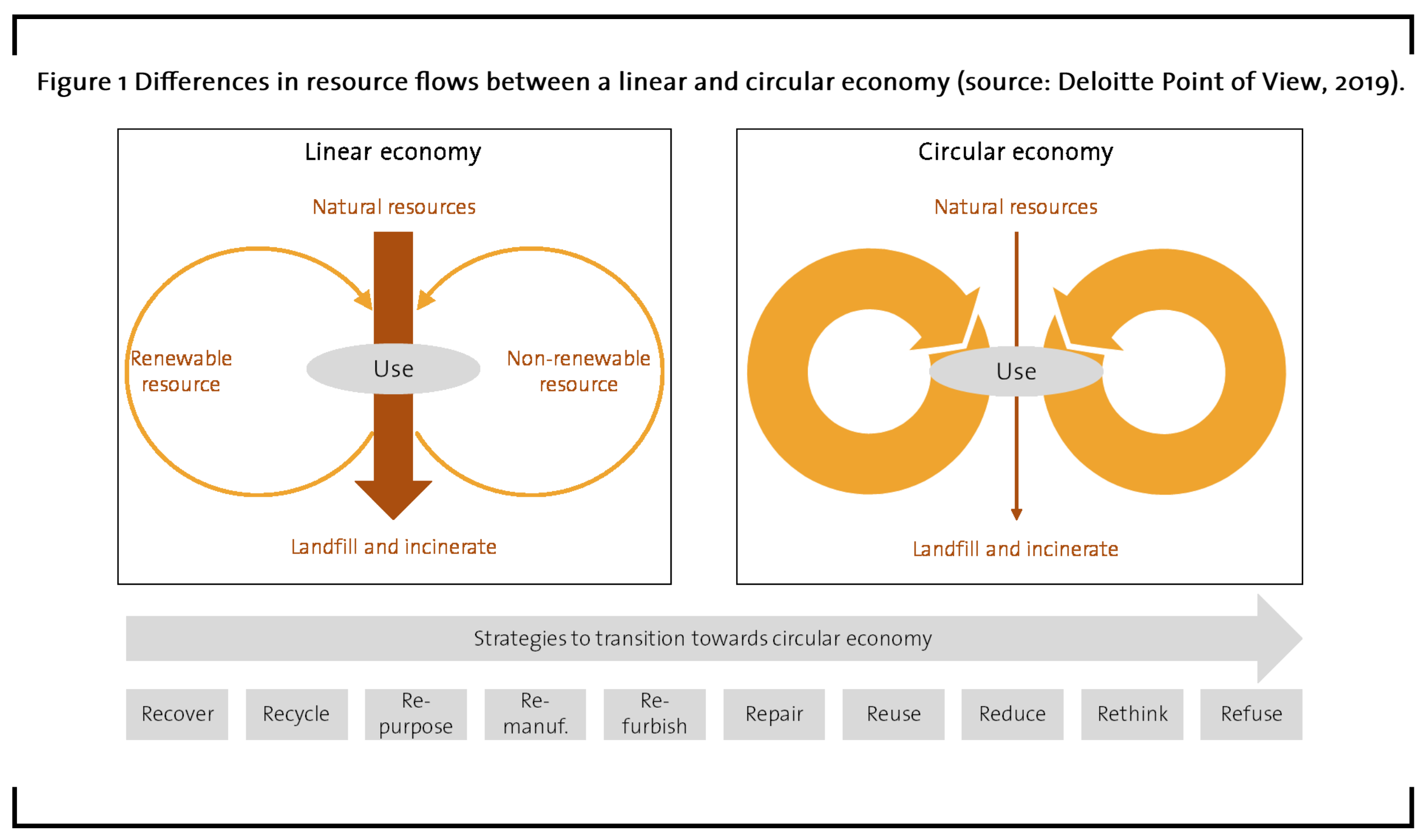

Figure 1 tries to explain the difference in flows between a linear and circular economy in terms of how resources are (re)used and or terminated as waste. It is not so much about definitions or semantics. It is about what we see happening in terms of implementation efforts.

Sustainability should take into account all 3 of its fundamental dimensions: economy, ecology and the social aspect. Quite often, the focus lies only on ‘more green’ or ‘more resource efficient’ because of the cost reduction potential. Two or all three dimensions are rarely combined. In that sense, sustainability is usually working on the ‘more or less’ side of things.

Nothing wrong with becoming more efficient and less polluting of course! The danger is that things don’t fundamentally change and needless to say there is always an upper limit to how far you can stretch efficiency.

We explicitly wish to support a radical rethinking of existing models, processes, value chains and technologies to take matters way beyond the borders of compliance. Compliance in itself is a precondition. The true question is what the standard for compliance needs to be. Quite often we gradually and unfortunately stretch the boundaries of what production and consumption needs to comply to as it is based upon negotiation between various stakeholders including conservative forces (Heene & al, 2016).

In that sense, good is indeed the enemy of great (Collins, 2001). On top of this, new opportunistic pools of business for service providers blur more existential decisions. Take digitization as an example. Digital is an important driver of change in the chemical industry and it will influence the way in which businesses or operations are managed. However, digital can assist in dematerializing the sector but its essence remains quite physical. Therefore, we should not forget the opportunities of making chemicals more sustainable or circular outside of the digital portfolio. If we were to assemble the digitization wave and the efforts into sustainable chemistry in one big container concept called Industry 4.0 or Chemistry 4.0, we must be honest in what this means (Deloitte & VCI, 2017). The alliance to fight plastic waste pollution had initially pooled one billion whereas an ERP software update for one of the major chemicals players amounts to 1.6 billion.

Becoming more circular forces us to rethink everything. From existing practices to shared governance & serving leadership, reverse logistics, open ecosystems, away from certain economies of scale and towards increased diversity and complexity.

It all sounds quite troublesome to become circular at first, but the contrary is true. If certain fundamentals are reconsidered, a lot of value can be unlocked as well. Plastics engineers all know the phenomenon of fountain flow and shearing. Let us use this phenomenon to explain a potential effect of circularity. In a planar market place, a linear approach will ‘hit’ a part of the market but given the zero-sum game it will also push aside a lot of market potential to either side of the linear force which could be thought of as an arrow (Strogatz, 1994). We will explain the concepts of zero-sum and zero-plus game below, but for now just think of the same planar market space in which a number of organizations have set up a circular value chain based upon a win-win payback for all involved and hence a zero-plus game for this ecosystem (Davis, 1983). This rotational force – so not an arrow – can based upon its negotiated stability and sustainable character be seen as a mechanism that sucks into the circle more and more market space. In system dynamics and complexity theory this phenomenon is also known as a virtuous cycle, as opposed to a vicious cycle (Von Bertalanffy, 1969). It is not unlike a black hole in astrophysics, although a lot less hostile as an environment, quite the contrary (Hawking, 2001). Perhaps this is the utmost important remark about circularity. It is not necessarily about physical material rotating in a perfect circle. It is about circular value chains with maximum material circularity that attract adjacent cycles and market potential into its equilibrium. Mathematicians will undoubtedly make the link with fractal geometries and the precipitation principle is indeed similar in logic to what a circular economy could instigate (Mandelbrot, 1977).

3 Contemporary leadership and governance for a fertile soil

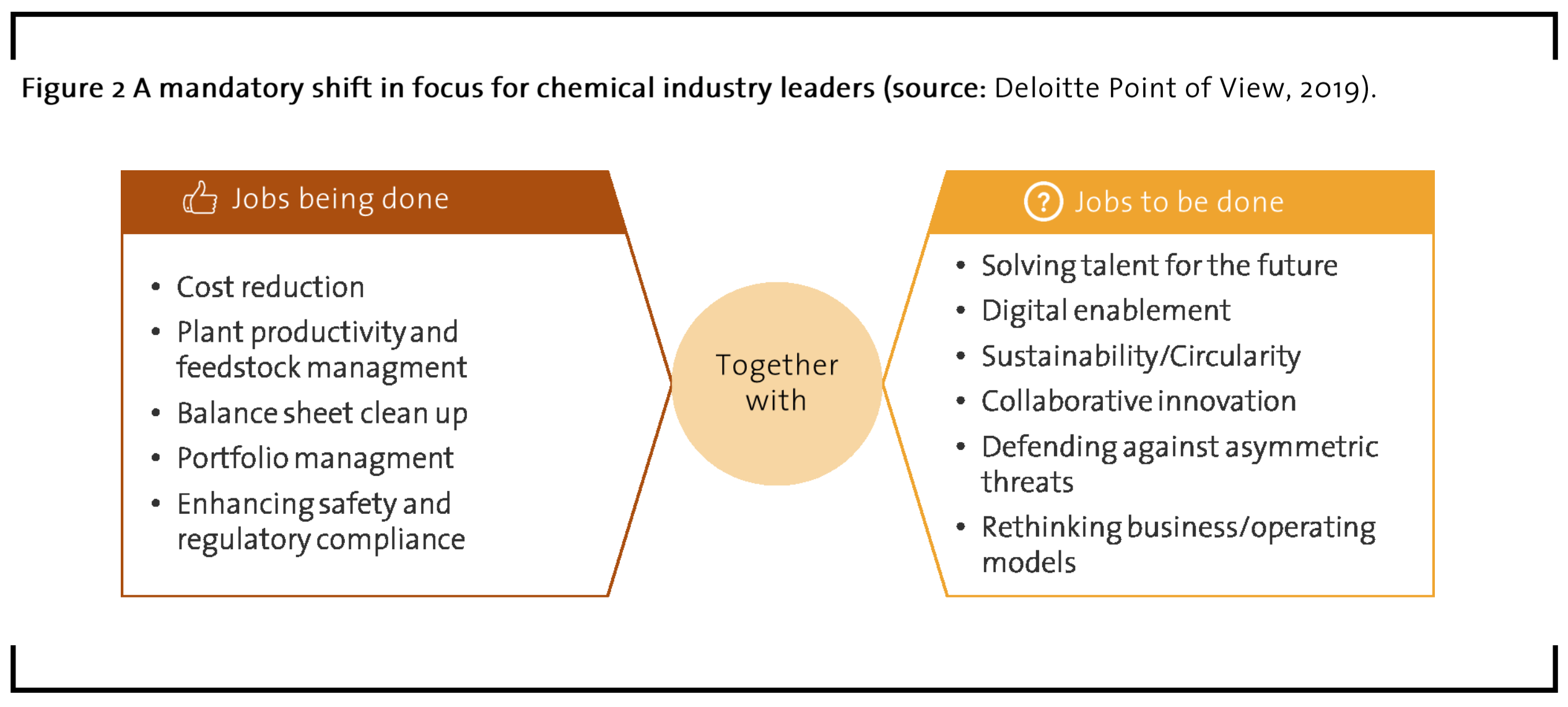

What to focus on is a leadership choice. Choices depend upon leadership style and vision. Hence, perhaps even more important than specific frameworks or knowledge is the difference in leadership style and decision making going forward. Blame, panic, negativity and opposition will not get us any closer to a fast-paced moving target. Chemicals executives must accept that most if not all of the old decision criteria remain part of the existing corporate dashboard. The way in which these targets in addition to new ones have to be realized however, is entirely different.

In 2019 Deloitte summarized this dichotomy as follows in Figure 2.

Interestingly, when talking to former C-level executives very few professionals consider this as something new. Quite often they mention that this balanced approach or mindset that should have been there all along.

To them, it is clear that the dominant dynamics of short-term financials have skewed the relationship between old and new, between ratio and creativity, between linear and complex. At the same time and after some introspection, it is also clear that it has been very hard to stand up against this unbalance unless committing career suicide. This is why we are still seeing more efforts put into debottlenecking old production facilities or upgrading ERP releases than experiments using the existing asset base with new forms of for instance hybrid chemistries or partial bio-based feedstock streams.

Luckily, there are some quick fix solutions to overcome this unbalance. I suggest the following:

3.1 Ambidextrous leadership & thinking

Athletes and coaches have been investing in the ambidextrous mind for some time now. The cognitive performance in sports, arts but also in education and of course in business management benefits from a balance between an optimally functioning left AND right side of the brain. Additionally, the link between both hemispheres is equally important. Whereas in sports, significant progress can be made by improving the peripheral sight resulting in more accurate movements, a healthy balance between strong analytical and creative skills results in a much broader range of options. Quite often, these extra dimensions of creative, intuitive and emotional intelligence allow leaders to stand out from the vast majority of mere managers. What’s more, these options become part of an automatic toolkit that can be called upon almost instantaneously. This stimulates a truly learning organization (Morgan, 1998 and Senghe, 2006).

When choosing our leaders, we should pay attention not only to go for the obvious profile using all the buzzwords and standard track-record. Instead, we also need to search for proof of creativity, an open mind and an affinity to deal with complexity and conceptual challenges. Also for creative thinking and cognitive learning, there are many training programs.

3.2 Diversity

Decision making in chemicals is quite predictable when observed from a distance. It is a small world in which many very specialized experts and executives know each other. The available options for almost any corporate event or situation seem to be known as if listed in the Big Book of Running a Chemicals Business. In fact, proposing something outside of that list could be deemed outrageous and irresponsible! The only way to change this is to bring in new and ‘unspoiled’ voices. In recent history and rightfully so, we have seen a number of initiatives focused on increasing diversity to enhance gender equality, break down racial impediments and overcome religious or sexual prejudice. What is missing somehow is an effort to allow divergent thinking, which might well be the mother of all diversity acceptance. Boardrooms and shareholders need to get accustomed to ‘difficult’ conversations with people who don’t necessarily talk the same language or are predestined to converge to known solutions. In that sense, why not use the medieval approach of teaming an experienced executive up with a creative youngster. Unlike the paternalistic oyabun – kobun relationships in a Japanese management culture that refers to parent – child like relationships based upon protection and loyalty, these junior – senior tandems actually try to harvest the best of both worlds, creativity from one side and experience from the other. Another mechanism is to install a fair degree of functional rotation within the senior ranks or to set a minimum number of different industries in the joint background at the boardroom table (and cascaded downwards).

3.3 Nested goal setting

Perhaps the easiest quick fix is to embed short to mid-term goals in a longer view envelope that forces decision making to take into account effect in the long run. By visualizing these potential consequences, it will also be easier to explain to stakeholders why evident but wrong decisions were not taken or were taken in a more nuanced way. As in mathematics, a local extremum is not necessarily the best outcome.

The principle of overarching targets is not new. It is also a mechanism to support collaboration across teams in cross-functional processes where otherwise internal competition could prevail. Obviously, the hardest part is to come up with meaningful longer-term goals (Key Performance and Key Result Indicators), but just translating the UN Sustainable Development Goals and what Europe has set out as targets for the chemicals (and in particular plastics) industry points us in the right direction.

Keep in mind that the younger generation won’t look surprised when these targets come into play. Contrary to that, not having a long-term sustainable perspective might cause young talent to forego working in your company.

4 True sustainability in a world with scarce resources requires a zero-plus mindset

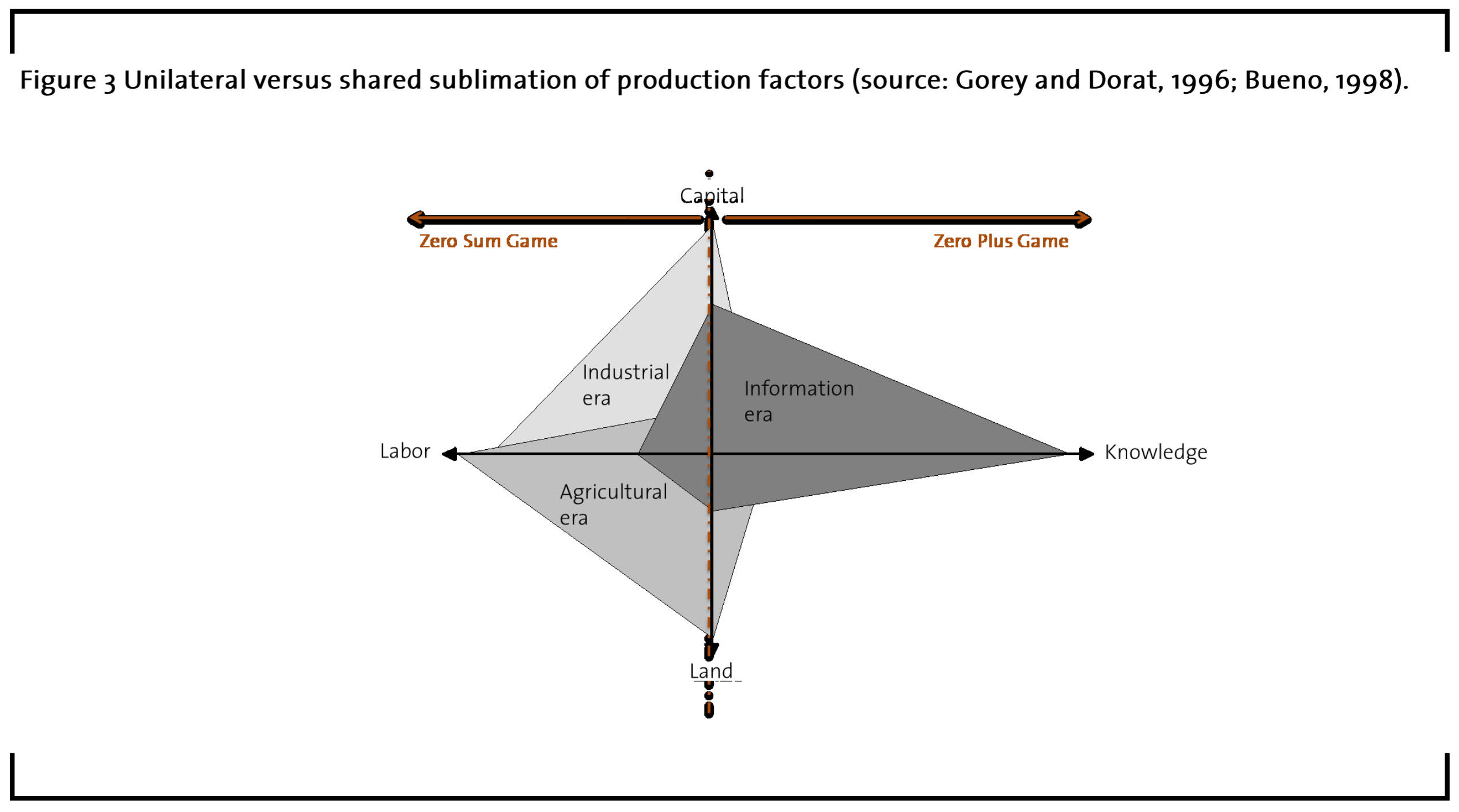

People Planet Profits (3P) and the zero-plus game are deceivingly simple concepts. I suggest using an analogy from a few years ago to explain the latter economic concept. The illustration below was created roughly 20 years ago when knowledge management became somewhat of a hype (Figure 3). Of course, nowadays we all see value in (big) data, but it was in fact the first time that economic production factors were shared to increase the overall economic value and not necessarily at the cost of another economic actor.

Simply put, the land, capital and labor you use to create your economic value can no longer be used by anyone else, whereas data or knowledge can be multiplied in its use as an economic production factor. It is fair to state that the old paradigm ‘knowledge is power’ is in fact not entirely true from an overall point of view. ‘Knowledge sharing’ on the other hand does maximize value creation.

The analogy is not quite perfect, but one can feel the philosophy behind. Our environment, rare earth materials and non-renewable goods are typically production factors that should be treated in such a way that they shouldn’t be held hostage to a single use by a single actor.

In terms of value creation and maximizing beneficial economic outcome, the overall equation is to stop harming our environment in any and every way, hence reducing the loss of societal wealth and economic wealth in the long run (Stahel, 2019 and Pauli, 2017). Of course, we can only but dream of turning the situation around and finding ways to create a positive vortex, i.e. a virtuous cycle that draws in proper use of resources to generate sustainable outcomes. We will now dive into a few pragmatic approaches and ideas to remedy the current situation.

5 Introducing Molecules as a Service (MolasaS) as a catalyst for circular valuation

How does one find a way to change the linear relationship between supply and demand, between one and the next cog in the value chain of a product or service? At least it should be as lucrative as before or the 3P scenario is off the table. That is what is currently blocking a lot of corporate initiatives. Environmentally safer solutions come at a cost and their business case seems to be less interesting. That is true, but only in part. It is true if we cannot expand our mental horizon beyond changing one or a few elements in the existing equation. It is not necessarily true if we change the equation altogether. A second hurdle is the linear horizon. If we find a way to rethink the equation, it is also key to review the pay-offs of all stakeholders involved. We need to look for beneficial linear relationships as well as an overall win-win situation. Earlier on, I already mentioned the virtuous cycle that attracts new and better business volumes. The stability and clear optimum for all is far more difficult to prove in the short run however. In what follows we will try to give a practical example of how this could work. For the interested reader who would like to learn more about the frameworks behind, I kindly refer to the work of people like Axelrod and Nash on game theory and economic equilibria. This theory explains the basic idea when economic actors are faced with different strategic options and how to maximize pay-offs given the choice of a strategic ‘opponent’. The pay-off for both depends on mutual decisions that are however unknown to each other. The so-called prisoner dilemma is probably the most famous example of such a ‘game’ and it revolves around asymmetric information. In the Axelrod experiment, the game is repetitive and both actors take decisions based upon their pay-off and eventually the pattern that arises from a combination of pay-offs and behavior, i.e. the choices made by all involved and how this evolves towards an equilibrium. Setting up a circular value chain holds many elements and challenges quite similar to this.

Let us turn to more managerial language. Changing the way we do business is often referred to as changing an organization’s business model. For instance, if a company is rewarded for the amount of physical goods it mines or produces, why would it change its way of working at the risk of losing shareholder value and damaging the careers of those in charge? It would not happen unless another way of value creation or value calculus were available. This is the point at which I would like to introduce the concept of Molecules as a Service (MolasaS).

Let us take the example of a chemical or petrochemical company drilling for oil or producing large volumes of chemicals. The economic reward, given the supply and demand balance, is based upon output volumes that are being sold to the market. Let us assume we leave inventory build-up aside for now. Let us also assume that all produced volumes are sold. This is not unrealistic if we look at crude oil and for instance MDI polyurethanes as our industries of choice (Randall et al., 2002).

Producing less volume means a direct hit on top-line revenues and because of we are dealing with asset heavy industries there might also be bottom-line effects. From a management point of view, the task at hand is clear. Regardless whether these organizations are triggered by top-line rather than bottom-line growth, volumes obviously must be replaced by a value increase in any other way. As we are dealing with the core of a business, a simple efficiency drill won’t structurally improve matters. So, dreadfully sorry for the operational and commercial excellence consultants, but the game itself needs to be changed. I see three big challenges:

5.1 Material identification

Suppose we found a way to identify material batches, even up to molecular level, that allow material tracking & tracing over a number of life cycles. The idea seems crazy at first, but in fact it is not that strange. We naturally do not wish to change material characteristics in an unfavorable way, but the use of certain bio-markers could come in handy. In fact, I am currently working on a solution to do this with the help of a few cross-discipline experts. If the concept is strong enough, we will succeed in finding a technical solution. It is no secret that material characterization is a very strong scientific playing field and supported by biochemistry, forensic and tribology skills, we can come very close to crafting molecular DNA-like identifiers. Of course, for the sake of the argument we are oversimplifying things, but even without diving into nanotechnology and more emerging scientific areas, the reader must feel inclined to believe that identification of molecules will be possible at one point. Other practicality objections can also be overcome. For example, what happens if material is burnt or degraded, etc… Well, when sustainable chemistry, circular economy and responsible use of our planet’s resources are the true drivers of our actions in MolasaS, we surely won’t keep on throwing away or burning all of the energetic value that is still in materials after its first or second use or lifecycle. Hence we will have to come up with recycling and upcycling ecosystems that make identification of materials worthwhile. This is where challenge 2 comes in.

5.2 Lifecycle counting in familiar ecosystems

When and where would we count the presence of materials in a value chain? Perhaps we can learn from the royalty system in the music industry, but that is not a flawless system and it has side effects we wish to ‘design out’ right from the start. For safety reasons (the redundancy principle), let us track materials as they leave one partner in the value chain and go to a next partner. This way we have proof of material transfer from 2 sides of a single transaction. Let us also keep in mind that we are moving in the direction of much more controlled value chains anyway. This is partly due to the fact that circular value chains are in need of full transparency certainly in its initial stages, but also to upcoming and ever more detailed requirements around end-of-life as in Extended Producer Responsibility (EPR) schemes. EPR is an environmental protection strategy to reach an environmental objective of a decreased total environmental impact of a product, by making the manufacturer of the product responsible for the entire life-cycle of the product and especially for the take-back, recycling and final disposal (Lindhqvist, 1992).

In short, transactions and physical flows are becoming more transparent, which in turn also allows for circular value chains – or ecosystems – to reduce volatility of supply, quality and pay-offs over a continued relationship (so far less one-off transactions similar to Axelrod’s ‘tit-for-tat’ experiment). Readers from the chemical industry will acknowledge the value of having less volatility in its system.

Without diving into the technical complexities of identifying product material’s origin – call it a sort of ‘appellation d’origine controllée’ similar to wine estates – we must realize that all players in the value chain will have to play ball. EPR rightfully places more responsibility into the hands of material OEM’s or product OEM’s, but we will have to include the participation of waste collectors, recyclers, B2B intermediates and even end consumers somehow (McDonough et al., 2013; Hawken et al., 2010 and Lacy et al., 2015). No doubt pilot cases will have to start small, but decent overviews of such ecosystems do exist. In Belgium for instance, industrial packaging waste and B2B waste in general is managed separately from public consumer waste by the organizations Fostplus and Valipac. They have a very thorough insight into who does what with which volumes and with which discrete material flows.

In terms of how cycles of use have to be counted, it seems that blockchain offers the right mix of big data capacity, real-time performance and global monitoring potential (Tapscott et al., 2016). Examples of tracking & tracing vast logistics flows are available, so also this second challenge can be considered ‘achievable’. This brings us to perhaps the most difficult challenge, as it is not a technical challenge, but demands a new way of working, a behavioral change in how our economic valuation system works.

5.3 Value for Cycles

We are now at the point that we can create or tag materials with unique identifiers that allow material flows to be traced along more than one lifecycle, even if these materials undergo some transformation through recycling, upcycling and/or remanufacturing processes. Knowing full well mechanical and chemical recycling are quite different, there is no reason not to assume that even in the case the original material changes radically, also this transformation can be identified for traceability purposes somehow. And even if we were to limit this thought experiment to very simple pilot cases, the logic and consequential societal benefits are still valid.

So, at each step we have been able to register these transitions and we can therefore count how many lifecycles molecules have had in our physical world and in our economic system. The following question is as evident as it is difficult to answer: who gets paid what and at which point? Remember that we need to replace the growth value otherwise generated by producing and selling more non-renewable goods. Carbon dividends, CO2 emission certificates and even carbon dividends are all partial solutions of this our awakening sustainable economy, but here we seem to be touching upon the very essence of our financial system. We have also seen that despite a near bankruptcy of that same system in the past global financial crisis, very little has changed and to say the least, it is a system that is powerful and influential in order to stay alive.

Without claiming to have the best and only solution, we feel that the core business of existing companies is improbable to transition first due to existing obligations. Rather, it will be up to new incumbents or non-core branches to come up with new and more daring business models.

Everything starts with not or only fractionally getting paid for new production and extending payments over a longer period of time with the frequency of lifecycles and the intrinsic value of materials and goods at that (re-)iteration point as main value drivers, on top of the normal market dynamics of supply and demand. Highly differentiated or unique offerings that are desired by B2B or B2C customers have to be offset by the discounted value over time of these iterations and transformation steps. Tricky business.

Nevertheless, we could think of the above mentioned controlled pilot ecosystems and we could perhaps apply such valuation principles in a context where margins are low anyway (commodity materials) or in those areas were new production is impossible due to lack of availability or prohibited for instance because of inhumane labor conditions. What is on the market already has a clear functional value and reuse or iterative cycles are only exposed to competition in light of substitution potential by better or more sustainable alternatives. That in itself is a positive economic driver towards more sustainable solutions.

How to value such scenarios is not straightforward, but we are seeing attempts to pilot in very specific areas. Also, on top of academia investigating how real options valuation and game theory can be used, big banks are also starting to explore what this could mean for them. At first in the form of risk mitigation, but pretty soon also for the discovery of new business potential.

There is no science behind, but as soon as traditional financial institutions start embracing these new valuation rules, we might really see a whole cascade of events and an acceleration of the new economy put in practice (Tol, 2019 and Wind et al., 2004).

6 Venture logic and fund structures to run and finance circular disruptive portfolios

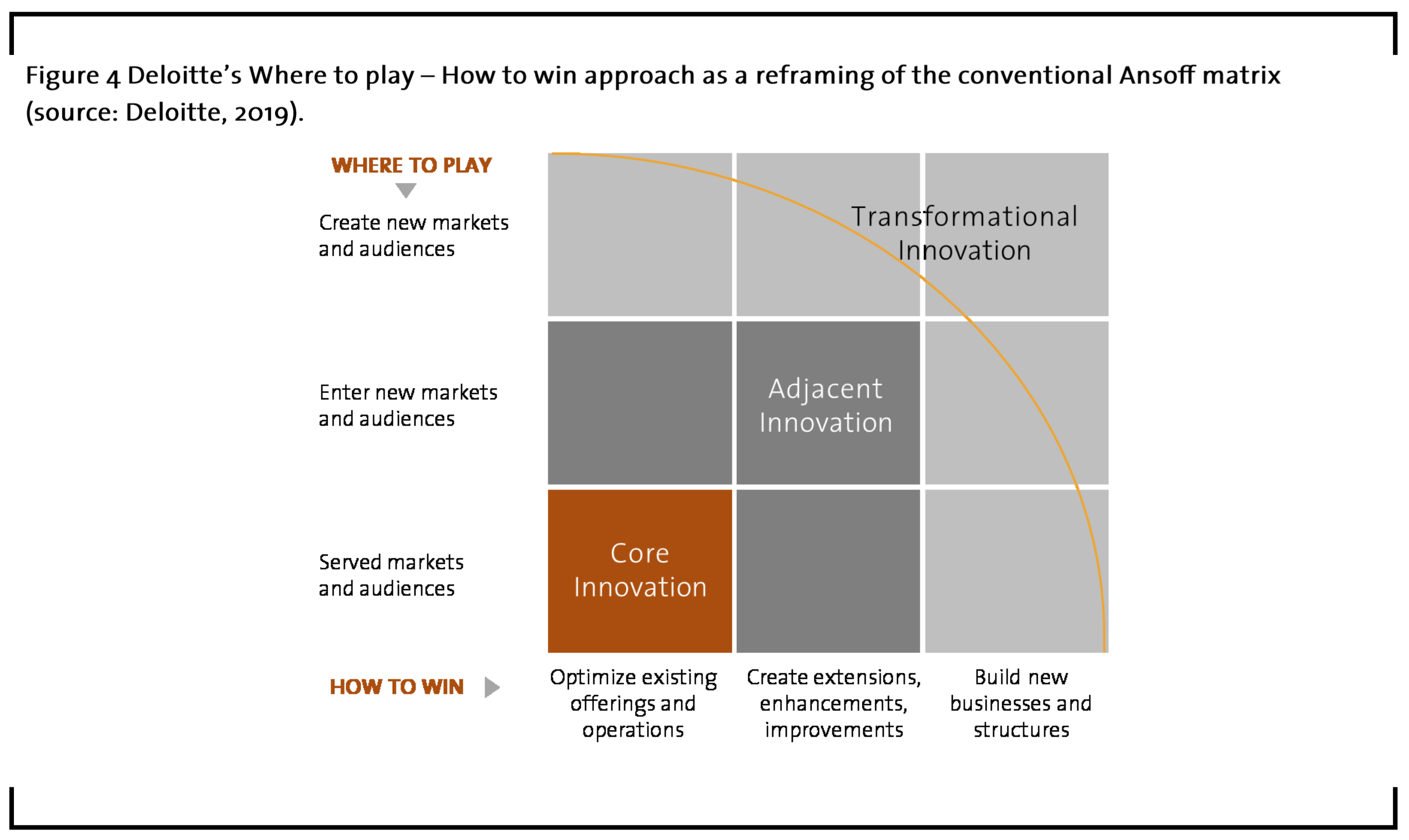

Mass demonstrations are a sign of the time and an emotional reaction to an underlying feeling of discomfort. Those economic actors capable of making a necessary transition more tangible should acknowledge this sign and act accordingly. We all know a status quo is causing harm to future generations and overall most economic actors are willing to change. The only question is how to move away from the current model. Similar to a black hole pulling in all matter and even light, our current dominant model leaves very little room to escape from. We also see this when reviewing companies’ innovation portfolios.

Depending on sector and organization up to 70% or more of the innovation efforts are situated in the core or incremental innovation arena. Technology and market extensions in line with what exists in that core make up for the rest with very little room to experiment away from that ‘envelope’.

Nevertheless, in challenging and highly uncertain – one could say fluid – times, options for the future or future core business areas have to be created in the top right corner of the above graph. Commercial organizations take the existing or near finished portfolio to customers typically with a short-term focus. This is a natural dynamic of supply and demand where given the role of sales organizations immediate questions ideally get immediate answers. Technology experts have another hurdle to overcome when leaving behind their comfort zone. Apart from sometimes having very little maneuvering room in terms of time horizon and budgets, they are experts at what they currently do and diving into totally new and unknown areas would mean they are no longer experts. For true scientists that is quite often an uneasy feeling that requires very sound leadership to balance out (Magretta, 2012 and Lafley et al., 2013).

A solution on the rise is the strategic marketing function that can work as a gear box or tooth rack between both worlds. However, even though this function has very little to do with the traditional 4P marketing or let alone with marketing communication only, also strategic marketing will be under time pressure and will have to fit into the overall risk profile the organization wishes to accept.

This is why we see a big advantage in organizing the work that needs to be done by a small but very particular task force, almost a guerilla task force: the venture team. We will briefly describe how this works, what the key principles are and how to finance it. The reader can then take these suggestions to his or her own organization, tailor and try out. At first as a protected experiment somewhat under the radar, later with more vocal and structural support (Vander Velpen, 2016).

6.1 Why? Different dynamics!

Core business is core for a reason. The timely manner in which business is conducted in this area has direct impact on the organization’s P&L and of course on the reward of those conducting it. Launching initiatives in the domain of sustainable chemistry and more circular ways of organizing value chains, is for nearly all organizations new and to some extent exotic. Applying the same rules and principles of core business and for that matter running this with the same people simply does not work. Many organizations have tried to set up disruptive innovation cells or studios, but most of them have failed as they had maternal DNA and/or a corporate footprint right from their very birth.

The solution for this alienating way of doing business, the venturing way, is to build in enough independence and a specific form of governance that fosters entrepreneurship but with the backing of a large corporate to tap into. Things need to go fast, are not necessarily always polished, might upset some people, question certain crown jewels and have a much higher risk/reward profile. It implies operating at the borders of and beyond the comfort zone of what is known and reasonable. We all know the G.B. Shaw paraphrase that all progress must come from the unreasonable man. We suggest a small but hard hitting venture cell populated by only those who can and wish to make a difference, even if it jeopardizes their traditional career path. In the end, these teams are creating options on core business of the future. There are no expected ROI’s or average targets to chase. Coming up with NPV’s is pointless. Rather, use downside accounting principles: what does it cost to find out how big it can get! In short, when you start, please keep performance management, sales directors and operational excellence executives far away and sponsor at the highest level. Without commitment at the highest level this will not work, so it is paramount to get the CEO’s support.

Also, as soon as things start to shape, bring in the performance, sales and operational excellence colleagues as coaches to scale up successful initiatives.

6.2 How it works

There are many ways to start up a venture cell, but the crucial elements are enough support, enough independence, the right mix of capabilities, the right mentality of the guerilla team and clear governance. The ideal corporate venturing accelerator – because this is basically what we are talking about – would take us too far to describe, but we can give a few rules of thumb:

- Use the dreams of your quite people: there’s often a lot of malcontent technology aces and very experienced market facing professionals out there. They have plenty of ideas on what needs to happen to head into a new direction. It gives an enormous motivational boost if such a program and visible structure suddenly allows these specialist to voice their opinion and contribute to a new story. Mix this with known out-of-the-box thinkers and do not be afraid to also include semi-corporate profiles, even external ones, that have an entrepreneurial track record of making things happen.

- Create a separate legal structure: be bold enough to allow for daily management to be outside of the hands of those responsible for the core. Of course there needs to be alignment, but this can be done through the board and an advisory board. These structures cannot wait for the decision making slowness of the corporate environment

- Reserve separate financing: project based financing, zero based budgeting is all good and well, but here we are in the area of venture logic. Work with a portfolio budget and allocate budgets according to business case pitching and portfolio roadmaps

- Manage one overarching portfolio but in dual logic: the C-suites of the mother company or joint initiative must oversee a balance across the core and the venturing portfolio. Nevertheless they must treat the venture portfolio in a different way as discussed above. It has to complete what is missing but cannot get stuck in solving today’s problems.

- Set a very ambitious target based upon a clear vision: this seems to be a semantic and philosophical requirement, but it might be the most important one of all. The venture team needs a clear vision, ideally from the CEO, what is a future and desired state for all. This allows thinking without prejudice or predefined boundaries on what projects could be part of the portfolio of the venture team. There’s plenty of time and opportunity afterwards to align this with the overall company portfolio.

6.3 How to finance

Organizations are sometimes struggling to find budgets for initiatives that are outside of the normal activities and structures. This is particularly true when the underlying initiatives were not known at the time these budgets had to be foreseen. Typically many of these disruptive ideas emerge unpredictably and by definition they miss the most recent budget cycle.

Nevertheless, there are lots of possibilities to provide oxygen to organizations and to finance projects, including the enormous subsidies made available by EU programs such as Life or Horizon 2020 (Deloitte, 2018), but we wish to suggest a mechanism that can scale up carbon neutral and sustainable chemistry investments at an entirely different level (Hudson, 2014; Tirole, 2006; Van Peteghem et al., 2018 and Block et al., 1993).

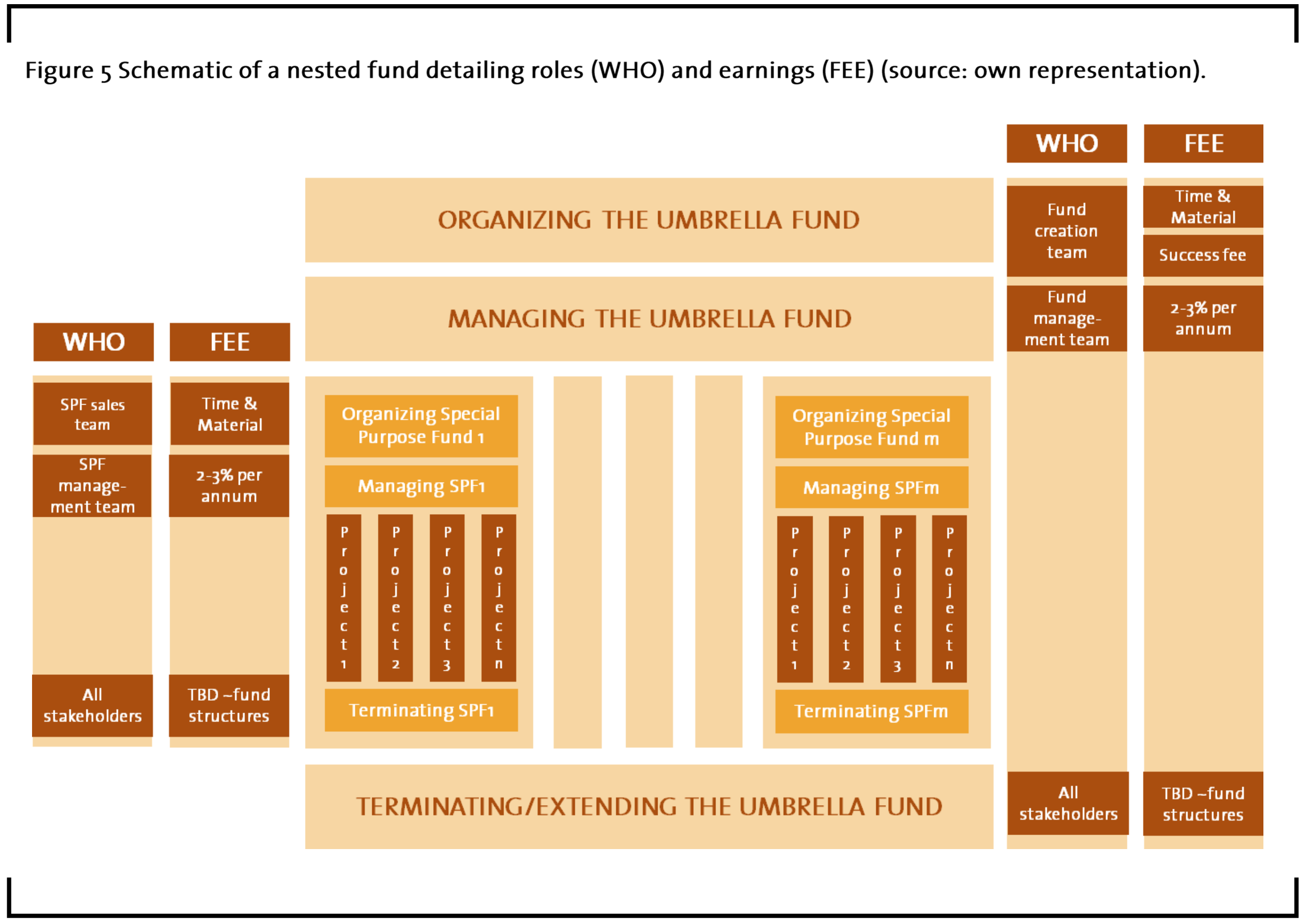

I suggest the following structure (Figure 5) that I will briefly explain as a way of introducing this channel:

I propose the creation of a nested fund, composed of an umbrella fund and several single company purpose or specific ecosystem purpose funds. As a side note, it is important to stress that the term fund is not necessarily a true fund in technical financial or legal terms, but it could be. The inner funds or SPF’s in the nested structure will mostly be separate legal entities with a specific starting budget. Should they be big enough and/or populated by a few investing companies or for instance a specific circular value chain then a true fund structure is of course possible. Even the umbrella fund can take on different forms. If not a true fund, a foundation is a logical working structure. Nevertheless, technicalities taken aside the proposed structures have the following characteristics in relation to their nature and objective:

Umbrella Fund

- A leverage fund or foundation that can multiply the stakes and gets its rewards out of the IP, carbon credits and other benefits created by the underlying special purpose vehicle funds (SPF)

- ROI only comes when tapping into the resources of this fund

- Financial investors in this umbrella fund are carefully selected and must include a.o. ‘patient capital’ institutional investors and humanitarian influencers

Special Purpose Vehicle/Fund

- These funds can be organized as the venture portfolio extension of a specific company but also as a portfolio for a specific ecosystem as would be logical for circular economy endeavors

- The funds can for instance be financed by materializing corporate social responsibility (CSR) promises or can make use of revenues from CO2 emission trading that are reinvested

With such a structure – and almost by design – all 3 P’s can be part of the equation and sustainable innovation can foster. After all, there are plenty of technological developments at the verge of a breakthrough (Hawken et al., 2017).

7 Closing remarks

The chemical industry is a cornerstone of our economy and a driver of welfare and comfort in today’s society. The sector also plays a vital role in moving away from old industrial habits and finding new solutions to the challenges at hand. Disregarding personal beliefs and emotional reactions, the chemical industry with its technology base, its processing power, its reach and its business impact must be part of a movement that seeks to face challenges in climate change, waste pollution and biodiversity. Based upon economic theory and management practice, it is equally evident that real breakthroughs will only take place given a radical rethinking of the current dominant linear model. In this paper, I have tried to outline a few basic principles and levers to do just that. Without being too specific for it to exclude one or the other sector or market, I have proposed different leadership style and mindset, subtle changes in our reward system, revised supply chains and material flows and a suggested roadmap to change valuation rules altogether. In an attempt to offer a very practical starting point, one that I am practicing on a daily basis, I have also described very briefly how to set up an innovation cell in venture fashion and how to finance it. I hereby welcome the reader to try out the above mentioned elements today. I also invite the reader to reach out whenever connections need to be established to get things done. To myself or to any other professional. We can turn things around in all prosperity!

References

Atkins, J. (2019): Responsible Business ad in Raconteur, The Times Publishing.

Block, Z., MacMillan, I.C. (1993): Corporate Venturing, Beardbooks.

CEFIC (2018): Facts and Figures of the European Chemical Industry.

Collins, J. C. (2001): Good to great: Why some companies make the leap … and others don’t, New York, NY: HarperBusiness.

Davis, M.D. (1983): Game theory – a nontechnical introduction, Dover Publications.

Decoster (2013): Economie – een inleiding, Universitaire Pers Leuven.

Deloitte and VCI (2017): Chemistry 4.0.

Deloitte Annual GI3 Report (2018): Survey of global investment and innovation incentives.

Good, I. J. (1977): The Fractal Geometry of Nature (Benoit B. Mandelbrot).

Hanley, N., Shogren, J., White, B. (2013): Introduction to environmental economics, Oxford University Press.

Hawken, P. (2018): Drawdown, Penguin.

Hawken, P., Lovins, A. B., & Lovins, L. H. (2010): Natural capitalism: The next industrial revolution, Routledge.

Hawking, S. (2001): The universe in a nutshell, Prometheus.

Heene, A. (2016): Bruggen naar het onvoorspelbare: wegwijzer voor bewust omgaan met onvoorspelbaarheid bij strategische keuzes, Die Keure.

Hudson, M. (2014): Funds: Private Equity, Hedge and All Core Structures, John Wiley & Sons.

Lacy, P., Rutqvist, J. (2015): Waste to wealth, Palgrave Macmillan.

Lafley, A. G., Martin, R. L. (2013): Playing to win, Harvard Business School Publishing.

Lindhqvist, T. (1992): Towards an analysis of experiences and proposals.

Magretta, J. (2012): Understanding Michael Porter, Harvard business review press.

McDonough, W., Braungart, M. (2013): The Upcycle, North Point Press.

Morgan, G. (1998): Images of organization: The executive edition, Better-Koehler Publishers and SAGE Publications.

Pauli, G. (2017): The Blue Economy 3.0: The Marriage of Science, Innovation and Entrepreneurship Creates a New Business Model That Transforms Society, Xlibris Corporation.

Randall, D., & Lee, S. (2002): The polyurethanes book, Randall, John Wiley&Son.

Schwab, K. (2016): The Fourth Industrial Revolution by Klaus Schwab, Penguin Random House UK.

Senghe, P. M. (2006): London: The Fifth Discipline, The Art & Practice of The Learning Organisation, Revised and Updated Edition.

Stahel, W. R. (2019): The circular economy: A user’s guide, Routledge.

Strogatz, S.H. (1994): Nonlinear dynamics and chaos, Perseus Books Publishing.

Tapscott, D., & Tapscott, A. (2016): Blockchain revolution, Penguin.

Tirole, J. (2006): The theory of corporate finance, Princeton University Press.

Tol, R. S. (2019): Climate economics, Edward Elgar Publishing.

Vander Velpen, K. (2016): Corporate Entrepreneurship, Flanders Business School Syllabus.

Van Peteghem, D., Mohout, O. (2018): Corporate Venturing, Die Keure Professional Publishing.

Von Bertalanffy, L. (1969): General system theory, New York (George Braziller) 1969.

Webster, K. (2017): The circular economy: A wealth of flows, Ellen MacArthur Foundation Publishing.

William, M., Michael, B. (2013): The upcycle: beyond sustainability–designing for abundance, North Point Press.

Wind, Y.J., Crook, C., Gunther, R. (2004): The Power of Impossible Thinking: Transform the Business of Your Life and the Life of Your Business, Wharton School Publishing.

Source of inspiration

Afuah, A. (2004): Business Models, McGraw Hill Irwin.

Ball M., Wietschel, M. (2009): The Hydrogen Economy, Cambridge University Press.

Chesbrough, H., Vanhaverbeke, W., West, J. (2006): Open Innovation: – Researching a new Paradigm, Oxford University Press.

Elkington, J., Hartigan, P. (2008): The Power of Unreasonable People, Harvard Business School Publishing.

Gray, D., Vander Wal, T. (2012): The Connected Company, O’Reilly

Murphy, J. (2008): The power of your subconscious mind, Penguin.

Nalebuff, B.J., Brandenburger, A. M. (2002): CO-OPETITION, Profile Books Ltd.

Normann, R. (2001): Reframing Business, John Wiley and Sons Ltd.

Schwartz, E., Trigeorgis, L. (2004): Real Options and Investment under Unvertainty, MIT Press.

Webster, K. (2017): The Circular Economy – a Wealth of Flows, Ellen MacArthur Foundation Publishing.

Zook, C. (2004): Beyond the Core, Bain and Company.