Start-ups as an indicator of early market convergence

Abstract

Owing to ever shorter innovation cycles, it has become more and more challenging to predict approaching market convergence. This study aims to overcome this problem by providing a novel method for anticipating market onvergence using start-up formation as an indicator. Life cycle analysis is employed in this article to examine the anticipation of the convergence process. The analysis is conducted on the field of probiotics in the nutraceutical and functional foods, cosmeceutical and nutricosmetic cross-industry sectors. The results of the analysis, which monitored start-up formation throughout the process, indicate that formation of start-up companies can be used to predict the transition from technology to market convergence. To this end, the present study also proposes a novel approach to identify start-up formation based on data from press releases.

1 Introduction

When two industries converge, the dominant industry logic is subject to significant changes. Established firms need to position themselves adequately in the market, acquire new required competences and increase their awareness of competitors from vastly distinct fields. In order to achieve this, firms must be able to observe the emergence of a new industry (Curran and Leker 2011).

Convergence, defined as ‘the blurring of boundaries between formerly distinct industries’ (Hacklin 2007) has been seen in several industrial sectors, starting with telecommunications and information technology and more recently between chemicals, food and beverages and pharmaceuticals (Bröring et al. 2006). The three industries of focus in this article – nutraceuticals and functional foods (NFF), cosmeceuticals and nutricosmetics – are convergent sectors developed on the intersection of pharmaceuticals and foods, pharmaceuticals and cosmetics, and foods and cosmetics respectively.

Convergence can be caused by new scientific findings, technological developments as well as changes in customer demand or even regulatory frameworks (Gambardella and Torrisi 1998). In this article the assumption of an idealised convergence process driven by scientific developments is adopted. The convergence process leads to the launch of hybrid products into the market, which incorporate features of products from different industries. NFF, cosmeceuticals and nutricosmetics are examples of complementary convergence, where the hybrid product increases the utility of the old product in a joint use wherein the former products continue to exist separately (Curran and Leker 2011, Bröring and Leker 2007).

Early prediction of how markets will develop is an essential competitive advantage for firms (Borés et al. 2003). Literature on anticipation and evaluation of convergent processes has addressed the front end of the process in depth, i.e. science and technology convergence (Caviggioli 2016, Curran et al. 2010, Gambardella and Torrisi 1998). During these early stages of convergence scientific publications and patents are used to monitor and anticipate industry developments. Literature on assessment of the next step in the convergence process, i.e. market convergence, is still limited. Recent studies propose a Mergers & Acquisitions (M&A) transaction analysis, which examined the dynamics of market convergence of the biotechnology industry with adjacent market segments (Aaldering et al. 2019). The evaluation of developments on the level of market convergence in the emerging convergent industry and the old industrial segments is currently still primarily addressed by observing convergent product launches (Lee and Cho 2015, Lee et al. 2009). This instrument while useful for evaluation is not sufficient for anticipation of market convergence since companies already launching new products in the market are significantly ahead of the competition. Therefore, there remains a significant knowledge gap with respect to the transition from technology to market convergence, when firms secured patents but products of the convergent industry are not yet observable in the market. Hence, a tool to predict market developments at this stage of the process is desirable. This leads to the research objective to investigate how the gap between the technology and the market convergence indicators can be filled.

To enable a more comprehensive understanding of the transition from technology to market convergence, start-up formation is proposed as a new indicator. Start-ups are an ideal type of organisation to provide transfer of technology into the market since they offer proximity to research-intensive environments as well as organisational flexibility (Swamidass 2013). This approach builds on the previous work of Sick et al., where start-ups were introduced as an indicator in the context of technology life cycles (Sick et al. 2018). This study applies the concept of start-ups to the cross-industry sectors of NFF, cosmeceuticals and nutricosmetics with a focus on probiotics, building on the work of Bornkessel et al. (Bornkessel et al. 2016a).

This study contributes to the theory and practice in several ways. It expands the market forecasting literature on the convergence process where early information on new market developments is crucial. It also contributes to the understanding of the use of the life cycle concept in convergence by applying the life cycle methodology to the new indicator. Furthermore, this paper answers the call for research that bridges the gap at the academia-industry interface by showing that start-up companies are positioned at the intersection of the technology and market indicators of convergence. Established companies can learn from start-ups by considering the combination of their technology and market focus.

The remainder of this article is organised as follows: Section 2 presents theoretical background on indicators of convergence, the life cycle concept, start-ups and probiotics. Section 3 elaborates on the methodology used to obtain the relevant data based on databases of publications, patents and press releases. Section 4 provides discussion of the results, where the new indicator is positioned along the convergence process. Lastly, Section 6 concludes the work and suggests implications of the study and further research.

2 Theoretical Background and Research Questions

2.1 Measurement of Convergence

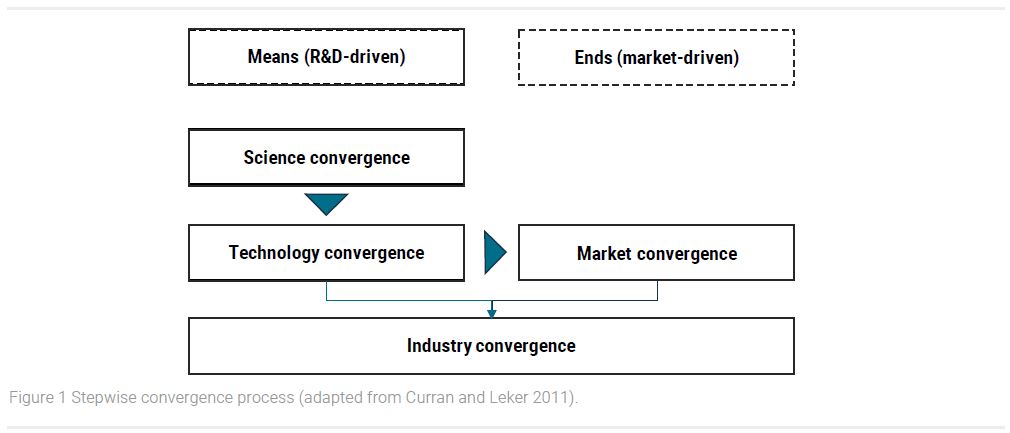

Convergence can be divided into converging scientific and technological fields, convergence of formerly distinct markets and finally converging industries, where new industry sub-segments emerge (Figure 1) (Curran and Leker 2011, Bröring and Leker 2007, Bröring et al. 2006). The convergence process can be measured through either qualitative or quantitative research methods using data ranging from primary sources, such as expert surveys or case studies, to secondary sources, such as publications, patents, product launches or mergers and acquisitions.

More specifically, convergence of scientific fields can be indicated by cross-industry scientific publications, technology convergence by cross-industry patents, market convergence by launches of cross-industry products and industry convergence by fusion of firms or industry segments (Sick et al. 2019, Curran et al. 2010).

Cross-industry scientific publications can be assessed by co-citations, co-authorship and co-word analysis in scientific publications (Rinia et al. 2002). Technology convergence patterns can be found in patent data through growing overlap of Standard Industry Classification (SIC) codes and through an increase in citations between different patent classes (Pennings and Puranam 2001). Lastly, newspaper articles, reports and press releases are considered to be a suitable data source to analyse developments of uncertain market environments in convergence and offer information on both new products during market convergence and firm collaboration patterns during industry convergence (Kim et al. 2015).

2.2 The Life Cycle Concept in Convergence

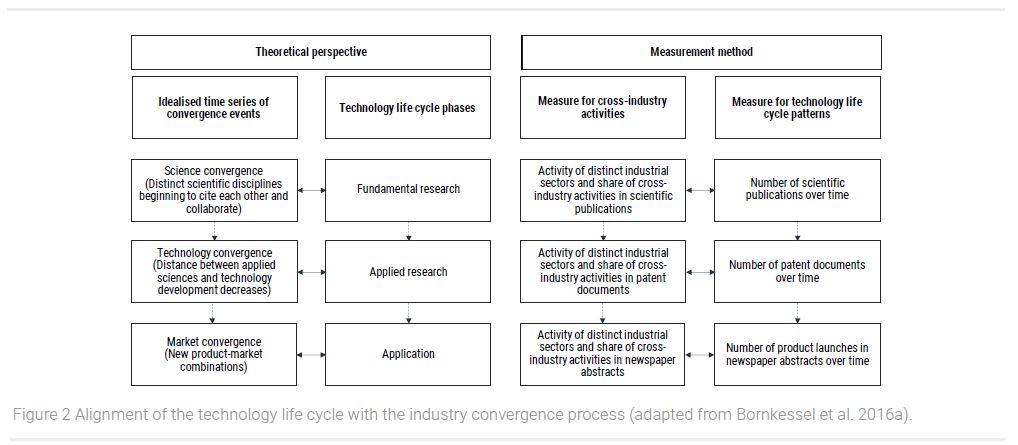

The convergence measurement methods have been recently expanded by application of the life cycle concept to measure the convergence process, previously used for technology life cycle analysis (Bornkessel et al. 2016a). The technology life cycle consists of phases such as fundamental research, applied research, and application. It has been shown that on a theoretical level the phases in the technology life cycle are parallel to the phases of industry convergence (Figure 2). Fundamental research corresponds to science convergence, applied research to technology convergence and application to market convergence. Regarding the measurement model, the phase indicators in the technology life cycle are respectively scientific publications, patents and new product launches reported in newspaper abstracts, parallel to the measures for cross-industry activities in convergence (Bornkessel et al. 2016a, Watts and Porter 1997).

2.3 The Role of Start-ups in the Technology Life Cycle and Start-up Formation in Convergence

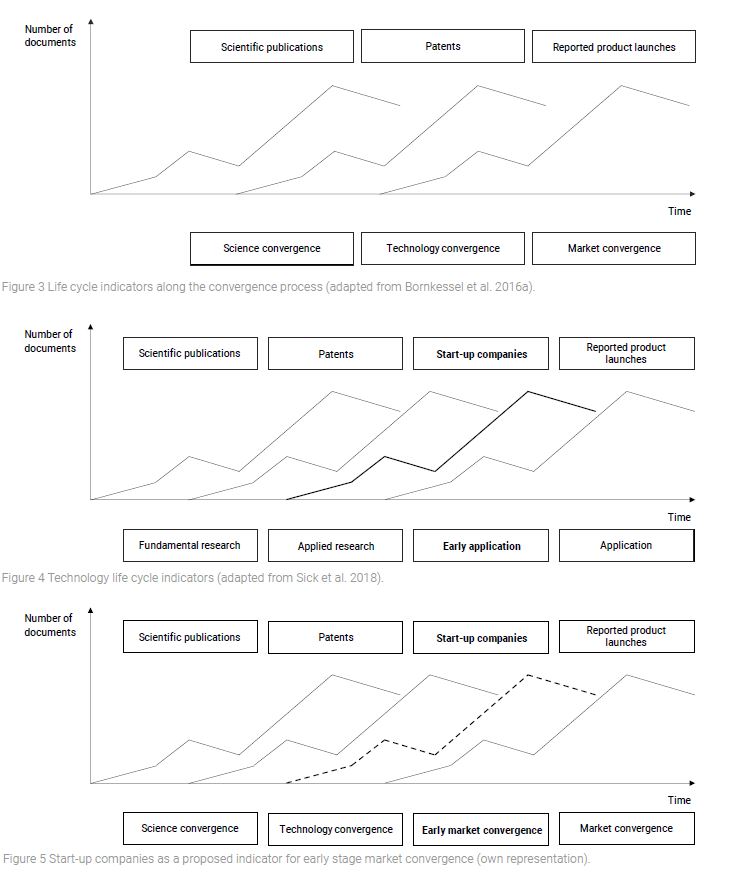

The convergence life cycle comprises of life cycles of scientific publications, patents and newspaper abstracts reporting product launches, which represent science, technology and market convergence respectively (Figure 3) (Bornkessel et al. 2016a). This is based on the patenting activity within a technology life cycle, which describes the evolution process of a technology including phases such as emergence, consolidation, market penetration and maturity (Ernst 1997). In an idealised activity, the life cycle curve is expected to grow during the emergence phase, reach the first plateau in the consolidation phase, grow again during the market penetration phase and reach a final plateau in the maturity phase.

The investigation of convergence processes has so far focused on the examination of universities, research institutes and established firms. Over recent decades, a new type of organisation – start-ups – has however gained an important role in the structural transformation of R&D-intense industries, especially in innovation processes. European Start-up Network (ESN) defines a start-up as “an independent organisation, which (…) is aimed at creating, improving and expanding a scalable, innovative, technology-enabled product with high and rapid growth” (ESN, 2016). Start-ups often arise as spin-offs from universities or other research institutions but are also market-oriented (Zhang 2009). Literature suggests that start-ups form the needed bridge between academia and industry (Festel 2013). Therefore, it may be hypothesized that they are present in the technology and market convergence processes. Start-ups are an important player in technology development and are characterised by organisational flexibility as well as combinative capabilities to exploit their knowledge while exploring the potential of new technologies (Kogut and Zander 1992). This ability to drive technological trends and hence be the first to offer new technologies and products to the market (e.g. new food technologies) is vital in a fast-developing convergence scenario.

In the research on technology life cycles, reported start-up companies formation has recently been shown to act as an early indicator of the application phase in the context of the lithium-ion battery value chain (Figure 4) (Sick et al. 2018). Start-ups have hence been shown to fill the gap in the time lag between technology development and product launch in a technology life cycle.

Considering the parallels between the indicators of the phases of the technology life cycle and the phases of convergence, as depicted in the work of Bornkessel et al. (Bornkessel et al. 2016a), should start-ups be observed in convergence process, it is hypothesised that their formation will occur at the transition from technology to market convergence (Figure 5). It is built on the research objective: to investigate how the gap between the technology and the market convergence indicators can be filled, stated in the Introduction Chapter and the literature background presented in this chapter, to devise the following research questions:

Research question 1: Is start-up formation present when two or more sectors converge?

Research question 2: Can start-up formation act as an indicator of early market convergence?

2.4 Probiotics in nutraceuticals and functional foods, cosmeceuticals and nutricosmetics

To investigate the role of start-ups in convergence processes, the field of probiotics is chosen. Probiotics are a product family present in several cross-industry sectors such as NFF, cosmeceuticals and nutricosmetics. These cross-industry segments have emerged at the intersections of the three previously distant fields – the pharmaceutical industry, the fast-moving consumer goods (FMCG) industry and the cosmetics industry. They belong to the family of process industries, defined as ‘industries in which the primary production processes are either continuous or occur on a batch of materials that is indistinguishable’ (Institute of Industrial and Systems Engineers), which spans a range of industrial sectors including chemicals, petrochemicals, food and beverages, pharmaceuticals, mining and metals, mineral and materials, pulp and paper, and steel and utilities (Lager 2010). Probiotics are defined as ‘a preparation of, or a product containing viable, defined microorganisms in sufficient numbers, which alter the microflora (by implantation or colonization) in a compartment of the host and by that exert beneficial health effects in this host’ (de Vrese and Schrezenmeir 2001). Probiotics act on a number of sites in the human body, including the oral cavity, the intestine, the vagina and the skin. Nutraceuticals are defined as ‘products isolated from foods, sold in medicinal forms and demonstrated to have a physiological benefit, whereas functional foods are similar in appearance to conventional foods but demonstrated to have physiological benefit beyond the nutritional function’ (Curran 2013). For example, dairy products containing probiotics have been among the most successful functional foods on the market (Saxelin et al. 2005). Secondly, cosmeceuticals are defined as cosmetics with drug-like functionalities on the skin (Newburger 2009). Lastly nutricosmetics, the least explored of the segments, are defined as ‘foods or oral supplements consumed to produce an appearance benefit’ (Anunciato and da Rocha Filho 2012).

Nutraceuticals and functional foods have been extensively studied in the literature in the context of converging industries. The research of Bröring and Curran belong to the most cited in the field. In their research Bröring et al. focus on closing of the competence gaps in firms entering an emerging convergent industry from previously distinct fields. Frequently cited works include the examination of how organisations with different R&D competences are able to seize opportunities for innovation emerging from convergence (Bröring et al. 2006); the study of technology and market-oriented absorptive capacity in the approaches through which firms engage in innovation in convergence (Bröring and Leker 2007); the investigation of the value-creation in new product development exploring projects characterised by different buyer-seller relationships (Bröring and Cloutier 2008); or the inquiry into innovation strategies that firms with different industry backgrounds employ to address new industry segments resulting from industry convergence (Bröring 2010). These studies show how during the convergence process firms identify their competences and competence gaps and how they subsequently position themselves in relation to other firms aiming to close these gaps. Hence, they provide additional relevant background for this work, in which an inquiry into a new type of organisation along the convergence process aims to help researchers and practitioners to understand the players involved in convergence and their positioning. On the other hand, in their work Curran et al. mainly focus on the anticipation and monitoring of convergence. Most popular works include investigations of how publicly available data such as scientific publications and patents can be used to monitor convergence in R&D-intense fields including NFF and cosmeceuticals (Curran et al. 2011, Curran et al. 2010). These works provide a relevant background to the practical measurement of convergence processes, especially their early stage. The convergent area of nutricosmetics remains less explored.

3 Methodology

3.1 Data Collection and Analysis

Quantitative, publicly available data is particularly useful in a highly time-sensitive innovation process (Curran et al. 2010). Therefore, this study uses secondary data sources such as scientific publications, patents and press releases. To identify the specifics of the transition from technology to market convergence in the field of probiotics, life cycle analyses were conducted. Owing to the time lag in publishing patent applications, the analysis included 2016 as the last full year available.

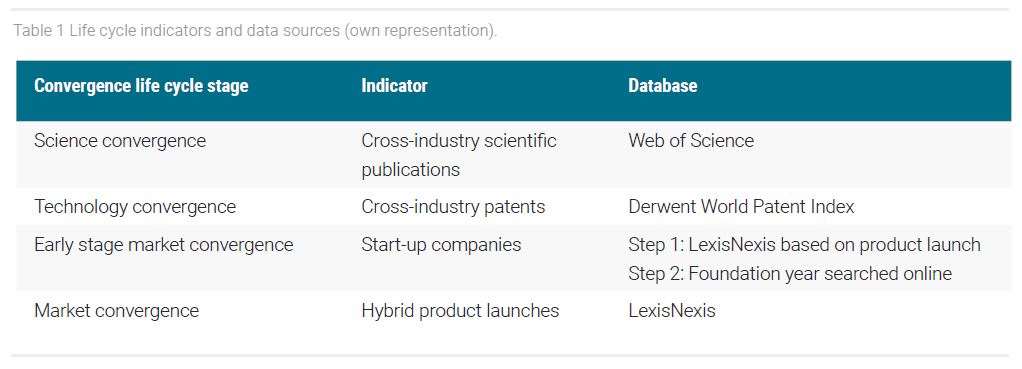

The industry convergence life cycle analysis was conducted based on the abovementioned indicators – scientific publications, patents, start-up companies and reported hybrid product launches (Table 1). Science convergence was captured via scientific publication analysis as carried out by Bornkessel et al. (2016a). The “Web of Science” database was used with the search term “probiotic*” over the 20-year period 01.01.1997 – 31.12.2016. This term was searched for in the “Topic” field, which included the fields of Title, Abstract, Author Keywords and Keywords Plus®. To identify technology convergence, patent analysis was conducted using the “Derwent World Patent Index” as in the work of Bornkessel et al. (2016a). The search term used was “CTB=(probiotic*) AND (PRD>=(19970101) AND PRD<=(20161231))”, where CTB stands for a search in title, abstract and claims and PRD stands for Priority Date-Earliest. The records over the time period 01.01.1997 to 31.12.2016 were searched in all collections worldwide, focusing on the earliest priority year in order to identify the first time that an invention was registered. The patents were searched for in patent family groups, where a patent family is defined as all registrations referring to a single invention. This is to avoid counting one invention multiple times because of multiple registrations. Hybrid product launches were depicted using the “LexisNexis®” database of press releases in the manner of Bornkessel et al. (2016a) and Sick et al. (2018). The search string was “(new w/5 product*) OR (product w/5 launch) and HEADLINE(probiotic*)”. The search was conducted over the 20-year period and restricted to All English Language News. Additionally, duplicates with high similarity level were grouped and non-business news excluded. The resulting documents were carefully reviewed to identify real product launches and exclude irrelevant announcements. For the identification of start-up companies, the companies responsible for the product launches from the “LexisNexis®” database were investigated and their foundation years identified through internet searches, a method developed specifically for this work. The existing methodology of Sick et al. which uses “Crunchbase” database to obtain information about start-ups was investigated, however it proved to be less comprehensive than “LexisNexis®”. The companies founded prior to 1997 were classified as established companies. The companies founded over the period 1997-2016 were selected as the start-up companies.

During the data analysis, firstly descriptive information on the four convergence indicators was discussed. The life cycle fragments of the four indicators over the period 1997-2016 were then plotted graphically in order to establish the positions of the indicator curves. The indicator curves were compared to derive the order of events in the convergence process, especially to determine the position of the new indicator curve of start-up formation. The study only investigated the field of probiotics, so greater generalisability and reliability of the findings for other convergent sectors would need to be tested in future research.

4 Results

4.1 Descriptive Statistics

“Web of Science” yields 22,878 scientific publication results for the search term “probiotic*” over the 20-year period 01.01.1997 – 31.12.2016. Increasing publication activity over time is observed and the top five subject categories in which the articles are published are microbiology, food science technology, biotechnology applied microbiology, gastroenterology hepatology and nutrition dietetics. The variety of subject categories reflects the interdisciplinary nature of the probiotic research. The five most active countries with regard to the number of publications are the USA, Italy, China, India and Canada, representing 40% of all publications. Furthermore, the top five institutions with the highest number of publications are the University College Cork (Ireland), the Spanish National Research Council (Spain), the French National Institute for Agricultural Research (France), the University of Turku (Finland) as well as the National Scientific and Technical Research Council (Argentina).

Regarding patents, 40,486 documents in the database were identified, grouped into 16,269 INPADOC families. The two clear leader firms with the highest number of patents are Nestle, with 1,551 INPADOC patent families, and Med Johnson Nutrition with 1,234 patent families. Interestingly, despite having the highest number of patents in the field, these companies were not among the top firms in respect of the number of products launched identified through press releases. Considering five top regions where the patents were registered in order to access these geographical markets, China is at the forefront with 8,413 INPADOC patent family registrations, followed by the World Intellectual Property Organization (2,715 patent family registrations), the USA (2,468), the European Patent Office (2,000) and the Australian Patent office (1,325).

Concerning start-up companies, 1,250 press releases were identified in LexisNexis®, out of which 102 were grouped as duplicates. After manually scanning 1,148 documents, formation of 86 companies was identified in the field of probiotics over the 20-year period. These new companies constitute 32% of all companies launching probiotics over the specified time. The exact market share was not investigated in this study. The identification of start-ups along the convergence process hence allows for a positive answer to the first research question.

Finding 1: When two or more sectors converge, start-up formation is present.

Regarding product launches, 845 new products were identified. 328 of all products come from companies formed between 1997-2016, constituting 39% of all launched products. Although the LexisNexis® database may not have information on all product launches, since it is the main database used to identify product launches in previous literature that this study builds on, it provides an adequate point of comparison. The five companies with the highest number of products launched were: Lifeway Foods, USA (34), Red Mango, USA (28), NextFoods, Netherlands (27), Ganeden Biotech, USA (27) and Danone, France (26), three of which were founded in the 20-year time window 1997-2016. Additionally, Ganeden’s probiotic bacterial strains are used as a basis for products of many other companies. The example of Ganeden Biotech illustrates well the possibility of developing bacterial strains separately to their application. The firm offers probiotics-derived ingredients to over 200 companies worldwide for food, beverage and personal care products. Its bacterial strains are shelf-stable and viable throughout most manufacturing processes and can tolerate the low pH of stomach acid. It can be concluded that for start-ups from the biotechnology sector developing probiotic strains, business-to-business (B2B) offering may be more attractive with a lower entry threshold than the business-to-consumer (B2C) model.

4.2 Start-up Formation as a Novel Indicator of Convergence

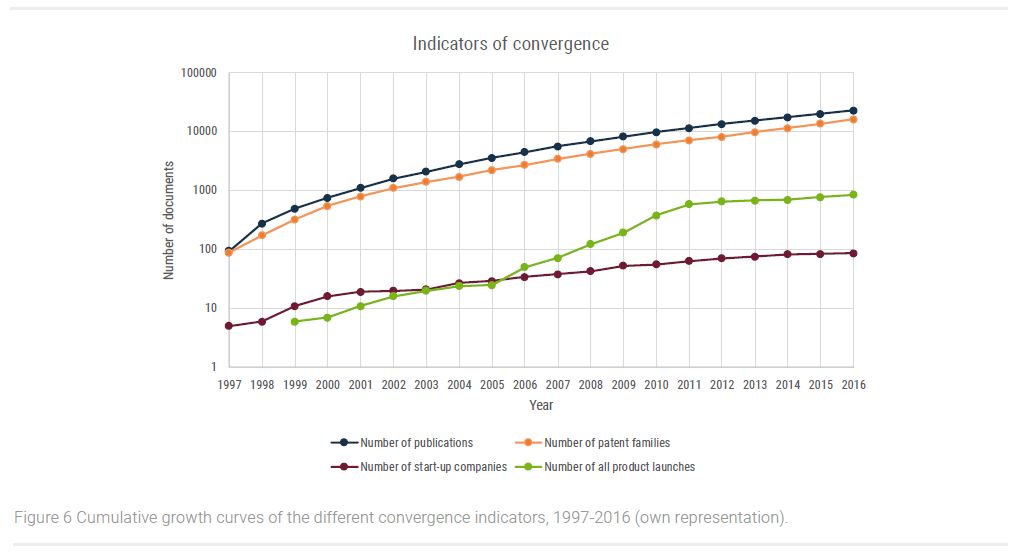

To assess the suitability of start-up formation as an indicator of early market convergence, we analysed the cumulative growth curves of publications, patent families, start-up companies and product launches for the period 1997-2016 (Figure 6).

The first two indicator curves, namely the scientific publications and patents, both show a slow growth rate at the beginning followed by exponential increase in the later years. The life cycle of patents follows the life cycle of scientific publications, with a time lag ranging from one year at the start of the 20-year interval to around three years in the second half of the specified time interval. Unlike in the battery value chain study of Sick et al. (2018), where no time lag is observed between scientific publications and patents because every technology is tailored to an application, in our study of probiotics the observed time lag indicates a greater distance between scientific research and product development. This is related to the complexity of the technology. Since the complexity of technology in the food sector is lower than in the battery sector, the absorptive capacity is also lower.

The start-up formation growth curve shows more complex behavior compared with the exponential growth observed in publications and patents. The curve could be divided into two areas of growth with a plateau following the first growth period.

The product launch curve can be divided into three stages – emergence (1997-2011), consolidation (2012-2013) and market penetration (2014-2016). A sharper than expected increase in product launches from 2006 could have been stimulated by the NHCR (European Commission 2006). The regulation, postulated in 2006, requires firms across the EU to comply with a set of unified rules on the use of nutrition and health claims. The regulation aimed at ensuring fair competition as well as protecting and promoting innovation. Furthermore, health-promoting properties of functional foods allow firms the opportunity to engage in product differentiation and to gain a strategic competitive advantage (Bröring et al. 2017).

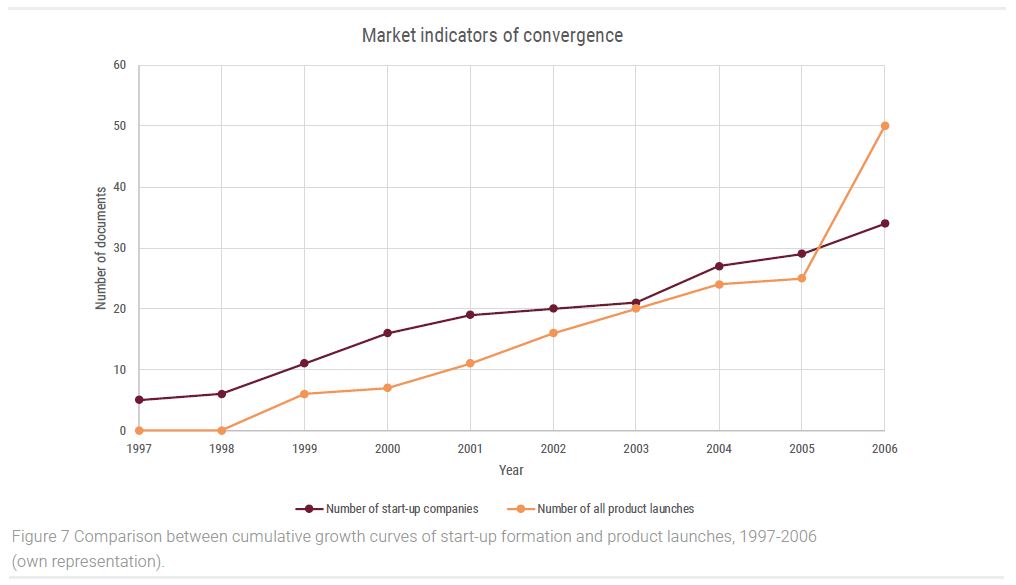

To compare the behavior of the growth curves of start-up companies and product launches over the early convergence years, an enlarged picture of these two curves over the years 1997-2006 is shown in Figure 7.

The life cycle of product launches follows the life cycle of start-up companies with a time lag of two years during 1997-2001 and around one year during 2002-2004. From 2006 the product launch curve overtakes the start-up companies’ curve probably because product launches were stimulated by the regulatory-push of NHCR. The presence of start-ups in the early years when product launches are still lagging behind allows for the conclusion that it is a suitable indicator of early market convergence.

Finding 2: Start-up formation can act as an indicator of early market convergence.

A time lag observed between the different indicator life cycles suggest that the different stages in the probiotics value chain are not tightly bound. This also agrees with the high proportion of B2B relationships observed via the press releases on Ganeden Biotech. When comparing all four indicators, the growth curves of publications and patents show exponential growth while the growth curves of start-up formation and product launches are more complex. The reason for this could lie in the different nature of these indicators. Start-up companies and product launches are market indicators limited by market demand. On the other hand, scientific publications and patents could behave differently, since they are research indicators and they are not driven by market demand limitations. Furthermore, the documents were studied in an aggregated form under the probiotic topic, where more specific key words or topics were not differentiated. In future work it could be useful to focus on specific keywords or topics and investigate how they reoccur over these years and in consecutive indicators. The picture observed does not fully correlate with the idealised theoretical model of the sigmoidal indicator curves following one another, and this puts the theoretical model into question. This is not surprising since the idealised time series of convergence is a theoretical model, whereas in practice market convergence can occur even without prior technology convergence. It provides an invitation for researchers to revisit the topic of life cycles and suggest a more fitting theoretical alternative, where the indicator curves could be more accurately positioned, for example, possibly underneath one another rather than horizontally shifted.

5 Discussion and Conclusions

When industries converge, previously vertically integrated value chains begin to disintegrate (Hacklin 2007). Cross-industry spill-overs increase, new entrant firms infringe on existing margins and existing firms have to diversify horizontally or specialise vertically. Further in the process vertical deconstruction and horizontal competition increase and a new ecosystem starts to emerge, where established firms have to position themselves in new roles. In order to position themselves adequately in the new industry, established firms have to be able to anticipate and monitor the convergence process. This study addresses convergence anticipation in the transition from technology to market convergence, where no suitable indicator has been available so far. Start-up companies are shown to be a valid indicator at this stage of convergence with one to two-year time lag observed in the growth curves between start-up formation and product launches over the first nine years of the relevant time period.

Established companies coming from the pharmaceutical industry lack the market competences required to successfully bring functional foods to the market (Bornkessel et al. 2016b). Meanwhile, companies stemming from the FMCG industry lack the research competences essential for development of functional foods. Establishing collaborations with partners to gain the relevant competences takes time and pushes incumbents away from the forefront of the emerging new industry. This can be seen for example in the investigation of patents, where it was shown that established companies may be dominant in patents but have few products on the market. Start-ups, which emerge directly at the interface of the two industries, can develop the competences required in both areas from the beginning of their activity.

5.1 Implication for Theory

Start-up formation is introduced as an indicator of early stage market convergence. The work deepens the understanding of the steps in the convergence process. The study extends the previous literature on the connection between the technology life cycle and the convergence process (Bornkessel et al. 2016a) and on the role of start-ups in the technology life cycle (Sick et al. 2018). Hence, this work fills in the existing research gap on the role of start-ups in the convergence process.

From an academic perspective, a more detailed method to analyse convergence processes is also offered. Researchers may include the search of start-up formation as an additional step when investigating convergence processes on top of the searches of scientific publications, patents and product launches as prescribed by previous literature. Moreover, using one database to obtain information on the company formation as well as the product launches extends the currently available methodology. Expanding the conceptual approaches available so far, products are directly linked to the companies from which they originate.

5.2 Implication for Practice

From a practical perspective, the additional indicator allows insight into the critical transition from technology convergence to market convergence, where product launches may not yet be observable. It allows identification of early transfer opportunities along the convergence process. Moreover, practitioners in the field of industry forecasting benefit from having the formation of start-ups as an additional data source for analysis of industry life cycles. The life cycle perspective offers a dynamic view, allowing analysis of current developments and the formulation of predictions. Further managerial implications arise from the strategic importance of converging industries for innovation, enabling firms to identify these processes early and prepare for changes in demand, technology and competition. This allows firms to better analyse the competitive environment as well as to depict newly forming, cross-industry relationships. The results are also of interest to start-ups and other players trying to enter a new field. A further practical application may lie in the transferability of the methodology to other convergence sectors.

5.3 Limitations

The limitations of the study include incompleteness of the databases, in particular LexisNexis®. Not all companies announce their product launches via press releases; hence only a partial view of the market is reported. In future research one could cross-reference data on product launches with other databases such as Mintel or Euromonitor. Our research is also restricted to the given time period, the specified search term and only English language news, which potentially excludes valuable information from some non-English speaking countries. The study also assumes an idealised time series of the four indicators, whereas in practice, the life cycles will not fully take on the idealised shape. Furthermore, multiple industries would have to be analysed to validate the suitability of start-ups as convergence indicators.

5.4 Further Research

Avenues for further research could be derived by addressing some of the limitations of our study. A longer time period could be investigated, including a broader search term and all language news. Furthermore, one should analyse multiple industries to test if the time series of the four indicators is evident in all of them. Lastly, this paper focused on studying the phases of convergence ranging from science to market convergence. An important phase of the convergence process is the industry convergence phase, once technology and market become integrated (Sick et al. 2019). Cross-sector collaboration was previously identified to be the indicator of industry convergence. So far collaborations between established companies were studied in the literature. Since start-ups companies are shown to be an important organisational type in the convergence process in this study, in future research one could investigate collaborations between start-ups and incumbent companies.

References

Aaldering, L.J., Leker, J. and Song, C.H., (2019): Uncovering the dynamics of market convergence through M&A. Technological Forecasting and Social Change, 138, pp. 95-114.

Anunciato, T.P. and da Rocha Filho, A.P., (2012): Carotenoids and polyphenols in nutricosmetics, nutraceuticals, and cosmeceuticals. Journal of Cosmetic Dermatology, 11, pp. 51-54.

Borés, C., Saurina, C. and Torres, R. (2003): Technological convergence: a strategic perspective. Technovation, 23(1), pp. 1-13.

Bornkessel, S., Bröring, S. and Omta, S.W.F., (2016a): Crossing industrial boundaries at the pharma-nutrition interface in probiotics: A life cycle perspective. PharmaNutrition, 4(1), pp. 29-37.

Bornkessel, S., Bröring, S. and Omta, S.W.F., (2016b): Cross-industry collaborations in the convergence area of functional foods. International Food and Agribusiness Management Review, 19(1030-2016-83125), pp. 75-98.

Bremmers, H.J. and van der Meulen, B., (2013): Opportunities, problems and pitfalls of nutrition and health claims. APSTRACT: Applied studies in Agribusiness and Commerce 7(1033-2016-84224), pp. 97-101.

Bröring, S., (2010): Developing innovation strategies for convergence – is “open innovation” imperative?. International Journal of Technology Management, 49(1), pp. 272.

Bröring, S. and Cloutier, L.M., (2008): Value-creation in new product development within converging value chains: An analysis in the functional foods and nutraceutical industry. British food journal, 110(1), pp. 76-97.

Bröring, S., Cloutier, L.M. and Leker, J., (2006): The front end of innovation in an era of industry convergence: evidence from nutraceuticals and functional foods. R&D Management, 36(5), pp. 487-498.

Bröring, S., Khedkar, S. and Ciliberti, S., (2017): Reviewing the Nutrition and Health Claims Regulation (EC) No. 1924/2006: What do we know about its challenges and potential impact on innovation? International Journal of Food Sciences and Nutrition, 68(1), pp. 1-9.

Bröring, S. and Leker, J., (2007): Industry convergence and its implications for the front end of innovation: a problem of absorptive capacity. Creativity and innovation management, 16(2), pp. 165-175.

Caviggioli, F., (2016): Technology fusion: Identification and analysis of the drivers of technology convergence using patent data. Technovation, 55, pp. 22-32.

Curran, C.S., (2013): The anticipation of converging industries: A concept applied to Nutraceuticals and Functional Foods. Springer, Heidelberg.

Curran, C.S., Bröring, S. and Leker, J., (2010): Anticipating converging industries using publicly available data. Technological Forecasting and Social Change, 77(3), pp. 385-395.

Curran, C.S. and Leker, J., (2011): Patent indicators for monitoring convergence–examples from NFF and ICT. Technological Forecasting and Social Change, 78(2), pp. 256-273.

de Vrese, M. and Schrezenmeir, J., (2001): Probiotics, prebiotics, and synbiotics – approaching a definition. The American Journal of Clinical Nutrition, 73(2), pp. 361-364.

Ernst, H., 1997. The use of patent data for technological forecasting: the diffusion of CNC-technology in the machine tool industry. Small business economics, 9(4), pp. 361-381.

European Commission (EC), (2006): Regulation (EC) No. 1924/2006 of the European Parliament and of the Council of 20th December 2006 on nutrition and health claims made on foods. Oj. L404:9-25.

European Start-up Network (ESN), (2016): https://europeanstartupnetwork.eu/vision/, accessed on 16.04.2020

Festel, G., (2013): Academic spin-offs, corporate spin-outs and company internal start-ups as technology transfer approach. The Journal of Technology Transfer, 38(4), pp. 454–470.

Gambardella, A. and Torrisi, S., (1998): Does technological convergence imply convergence in markets? Evidence from the electronics industry. Research policy, 27(5), pp. 445-463.

Hacklin, F., (2007): Management of convergence in innovation: strategies and capabilities for value creation beyond blurring industry boundaries. Springer Science & Business Media.

Institute of Industrial and Systems Engineers (IISE), https://www.iise.org/Details.aspx?id=887, accessed on: 27.09.2019

Kim, N., Lee, H., Kim, W., Lee, H. and Suh, J.H., (2015): Dynamic patterns of industry convergence: Evidence from a large amount of unstructured data. Research Policy, 44(9), pp. 1734-1748.

Kogut, B. and Zander, U., (1992): Knowledge of the firm, combinative capabilities, and the replication of technology. Organization science, 3(3), pp. 383-397.

Lager, T., (2010): Managing process innovation: from idea generation to implementation. World Scientific Publishing Company.

Lee, M. and Cho, Y., (2015): Consumer perception of a new convergence product: A theoretical and empirical approach. Technological Forecasting and Social Change, 92, pp. 312-321.

Lee, M., Lee, J. and Cho, Y., (2009): How a convergence product affects related markets: The case of the mobile phone. ETRI Journal, 31(2), pp. 215-224.

Newburger, A.E., (2009): Cosmeceuticals: myths and misconceptions. Clinics in Dermatology, 27(5), pp. 446-452.

Pennings, J.M. and Puranam, P., (2001): September. Market convergence and firm strategy: new directions for theory and research. In ECIS Conference, The Future of Innovation Studies, Eindhoven, Netherlands (Vol. 20, No. 23.09).

Rinia, E.J., Van Leeuwen, T.N., Bruins, E.E., Van Vuren, H.G. and Van Raan, A.F., (2002): Measuring knowledge transfer between fields of science. Scientometrics, 54(3), pp. 347-362.

Saxelin, M., Tynkkynen, S., Mattila-Sandholm, T. and de Vos, W.M., (2005): Probiotic and other functional microbes: from markets to mechanisms. Current opinion in biotechnology, 16(2), pp. 204-211.

Sick, N., Bröring, S. and Figgemeier, E., (2018): Start-ups as technology life cycle indicator for the early stage of application: An analysis of the battery value chain. Journal of cleaner production, 201, pp. 325-333.

Sick, N., Preschitschek, N., Leker, J. and Bröring, S., (2019): A new framework to assess industry convergence in high technology environments. Technovation, 84, pp. 48-58.

Swamidass, P.M., (2013): University startups as a commercialization alternative: lessons from three contrasting case studies. The Journal of Technology Transfer, 38(6), pp. 788-808.

Watts, R.J. and Porter, A.L., (1997): Innovation forecasting. Technological forecasting and social change, 56(1), pp. 25-47.

Zhang, J., (2009): The performance of university spin-offs: an exploratory analysis using venture capital data. The Journal of Technology Transfer, 34(3), pp. 255-285.

Appendix

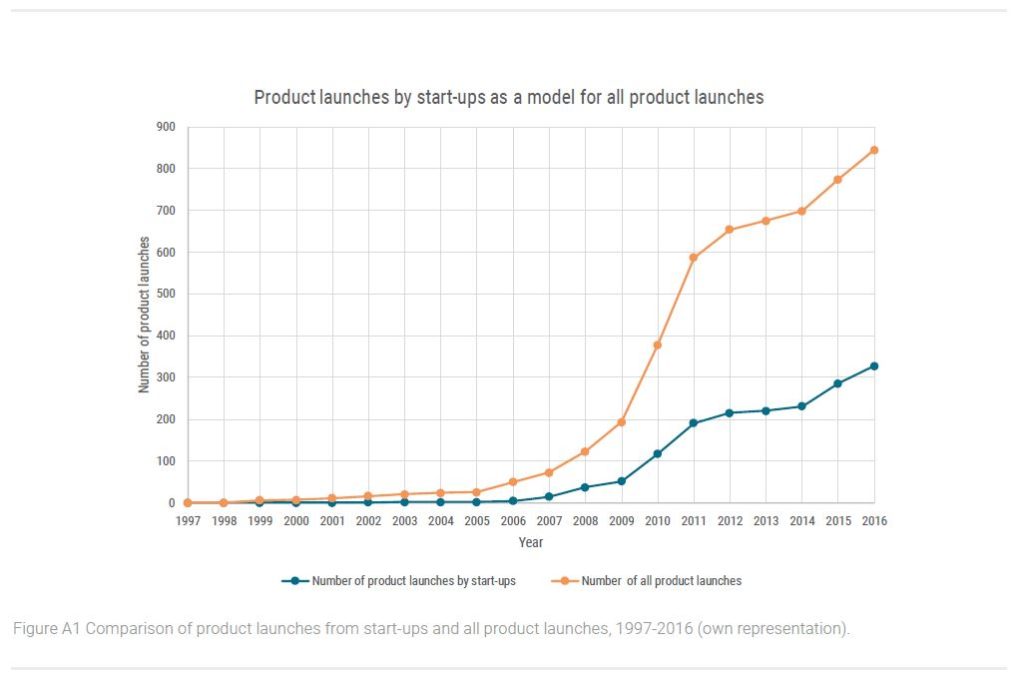

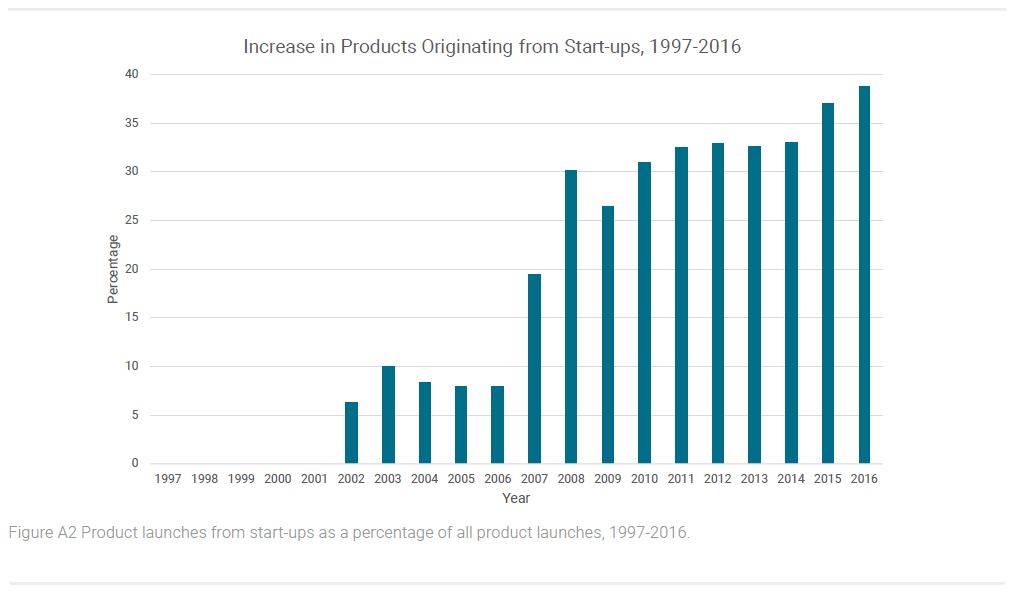

The growth curves of product launches from start-ups and all product launches were investigated separately and shown to have a similar shape (Figure A1). Both curves can be divided into three stages – emergence (1997-2011), consolidation (2012-2013) and market penetration (2014-2016). The information on product launches from start-ups can hence be used as a model for all product launches. Furthermore, the percentage of products coming from start-ups was examined in relation to all products (Figure A2). Over the 20-year period there is an increase in products from start-ups as a percentage of all products. An unusually steep increase in probiotic products originating from start-ups, from 8% in 2006 to 30% in 2008, may have been caused by the NHCR. The NHCR may be particularly favourable to start-ups since there is no exclusivity on health claims, meaning a company can use a health claim paid for and approved by another company (Bremmers and van der Meulen 2013). Furthermore, to comply with the NHCR, some recipe formulations may have needed redesigning to remove ingredients without a valid health claim. This could be advantageous to start-ups, which enter the market fresh without the need to rethink their products.