Structural analysis of petrochemical clusters in Germany: What can be learned for the transformation towards climateneutrality?

Abstract

The petrochemical industry is among the most relevant sectors from an economic, energetic and climate policy perspective. In Western Europe, production occurs in local chemical parks that form strongly connected and densely integrated regional clusters. This paper analyzes the structural characteristics of the petrochemical system in Germany and investigates three particularly distinct clusters regarding their challenges and chances for a transition towards climate-neutrality. For this, feedstock and energy supply, product portfolios and process integration as well as existing transformation activities are examined. We find that depending on their distinct network characteristics and location, unique and complex strategies are to be mastered for every cluster. Despite the many activities underway, none of them seems to have a strategic network to co-create a tailored defossilization strategy for the cluster – which is the core recommendation of this paper to develop.

1 Introduction

The production of basic petrochemicals is responsible for at least 15% of the demand for mineral oil products in Germany, both in terms of energy and feedstock (BAFA, 2021). The bulk of this flows into the production of high-value chemicals (HVC), which in turn form the basis for the manufacture of polymers and plastics. The latter are of greatest relevance to the industry: of the nearly 75 billion euros in sales generated by the German petrochemical industry in 2022, almost half was attributable to the polymers market segment alone (VCI, 2023). The production sites in Germany are of particular relevance, since their sales account for 38% of European petrochemical industry turnover (VCI, 2023; Cefic, 2023). However, these activities result in carbon emissions of 56 Mt per year, equating to 28% of the EU chemical industry emissions [1], and significantly more if scope 3 are regarded (Cefic, 2021; FutureCamp & DECHEMA, 2019). A transformation of today‘s petrochemical industry based on fossil raw materials to a circular system based on renewable resources is thus of utmost importance for a climate-neutral economy.

However, this change is associated with particularities that go beyond the challenges in other sectors. The production of petrochemicals not only utilizes fossil raw materials for energetic purposes, but also as feedstock for a diverse range of processes. Additionally, the manufacturing of HVC and its further processing into polymers largely takes place in chemical clusters which are characterized by deeply integrated multi-step production routes and heterogeneous product portfolios. These clusters are closely interconnected with each other by a system of pipeline infrastructure, interacting by exchange of feedstock and intermediate products, thus forming a wide-span petrochemical network in northwestern Europe. As each industrial cluster is unique, there will be no one-size-fits-all pathway towards climateneutrality (Rattle & Taylor, 2023). Instead, local conditions that have developed over the last century must be taken into account if change is to be successfully realized.

Gaining an in-depth understanding of this system and the respective characteristics of its individual components therefore represents an important prerequisite for a successful transformation towards climate neutrality. This paper thus aims to answer the following three research questions:

- How is the current petrochemical production system in Germany and Western Europe structurally constituted?

- What are regional particularities and which special interdependencies exist between the individual petrochemical clusters?

- To what extent do these factors constitute significant points of influence for a successful transformation of the clusters, and what lessons can be learned for the overall transition of the petrochemical industry?

This paper is structured as follows: First, the methodologies and tools that were used for the analyses [2] are explained. Then, the characteristics of the petrochemical system in Germany and Western Europe are described and illustrated with maps that help to explain the clustering. This part contains a model-based balance of petrochemical production in Germany, including its respective demand and supply of energy and raw materials. Following this, a selection of three clusters is presented in more detail. Here, the current production structure and the existing infrastructural network are first analyzed before special regional particularities are examined with regard to their impact on a climate-neutral transformation. Finally, conclusions for decision-makers on the regional level are discussed.

2 Methods

In this section, we outline the various methods and tools employed in our analysis, which include database evaluation, desk research, GIS mapping, model calculations, process flow analysis and criteria-based assessment. These methods were essential for conducting a comprehensive investigation of the research questions outlined in the previous chapter.

Database evaluation with value chain analysis: Leveraging a Wuppertal Institute proprietary database on plants and production sites, an assessment of entire petrochemical value chains associated with the subject of polymers was conducted.

Desk Research: Extensive desk research in online media, scientific publications and company websites was conducted, supplemented by expert interviews and stakeholder consultations. This qualitative data collection process provided valuable background information to gather a contextual understanding of the subject matter as well as site-specific information on infrastructure, product portfolios and innovation activities.

GIS Mapping: To analyze and represent both production sites and infrastructure relevant to this study, public Geographic Information System (GIS) data was utilized. This approach allowed for creating detailed maps using the software QGIS, supporting the spatial representation of critical factors within the research scope.

Model Calculation using WISEE EDM-i: We applied the WISEE EDM-i model, a tool regularly utilized at the Wuppertal Institute for scenario generation. Using a technoeconomic approach, this model simulates a cost-effective, geographically diverse system of petrochemical production in Europe. The model’s objective was to economically optimize production in order to meet predefined demand for a range of polymers. The manufacturing of intermediate and final products was simulated via a set of production processes, for which mass input and output data as well as cost parameters were specified. Such processes were for example naphtha steam cracking and polymerization, and all processes are represented as vertical bars in Figure 2. Known processing capacities in Europe, as well as refineries, terminals and transport options for feedstocks, platform products and intermediates were locationally specified based on the site-specific data from the database and additional gathered information (see above). The economic optimization was performed in the model by taking into account the cost parameters for the processes, market prices of the different feedstocks and the costs of transporting the materials. A linear optimization procedure allocated the annual production to the various sites, resulting in sitespecific utilization of the available capacities and transport options. Finally, these results were combined with data from the database on specific primary energy- and feedstock use for the included processes and with data on CHP capacities and their utilization, yielding a primary energy balance for the regional and national production systems. To validate the results for Germany, Eurostat and industry association production statistics for the year 2018 as well as the energy balances at the national and federal state level were used.

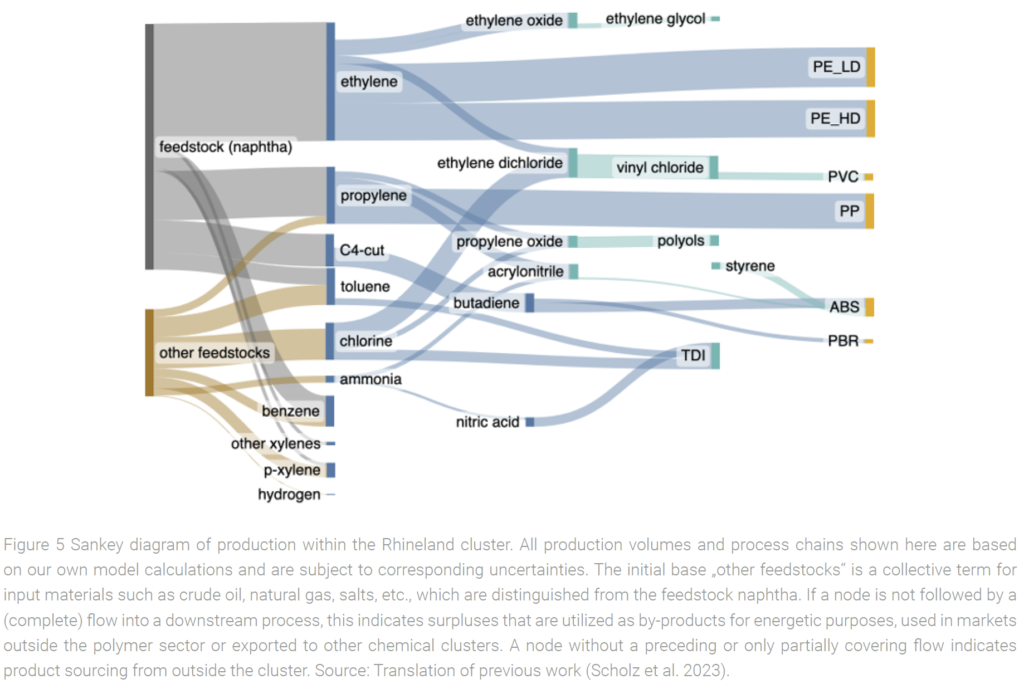

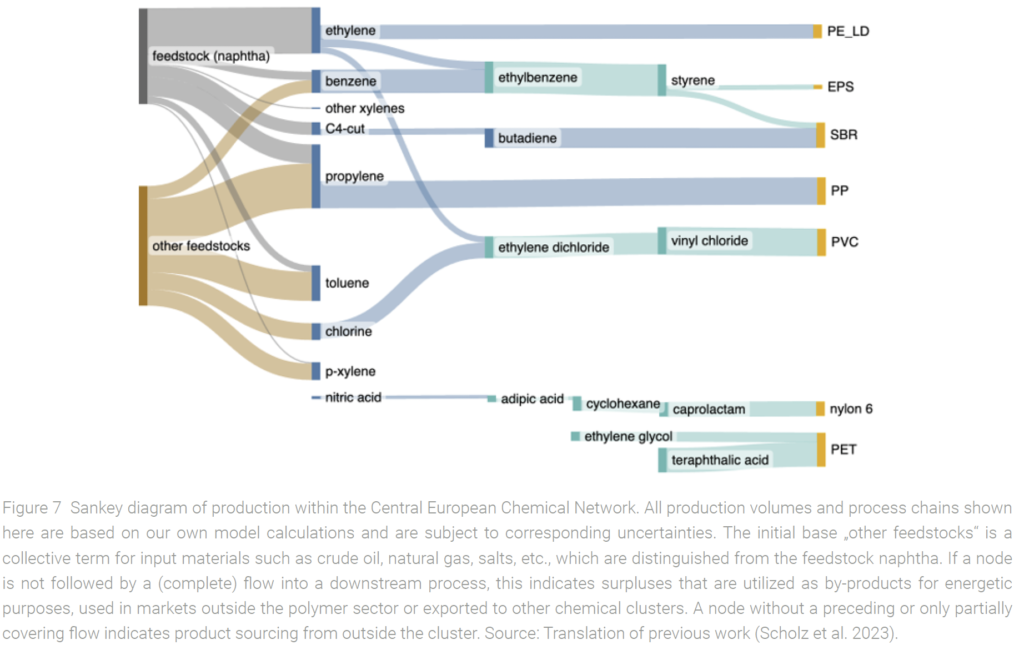

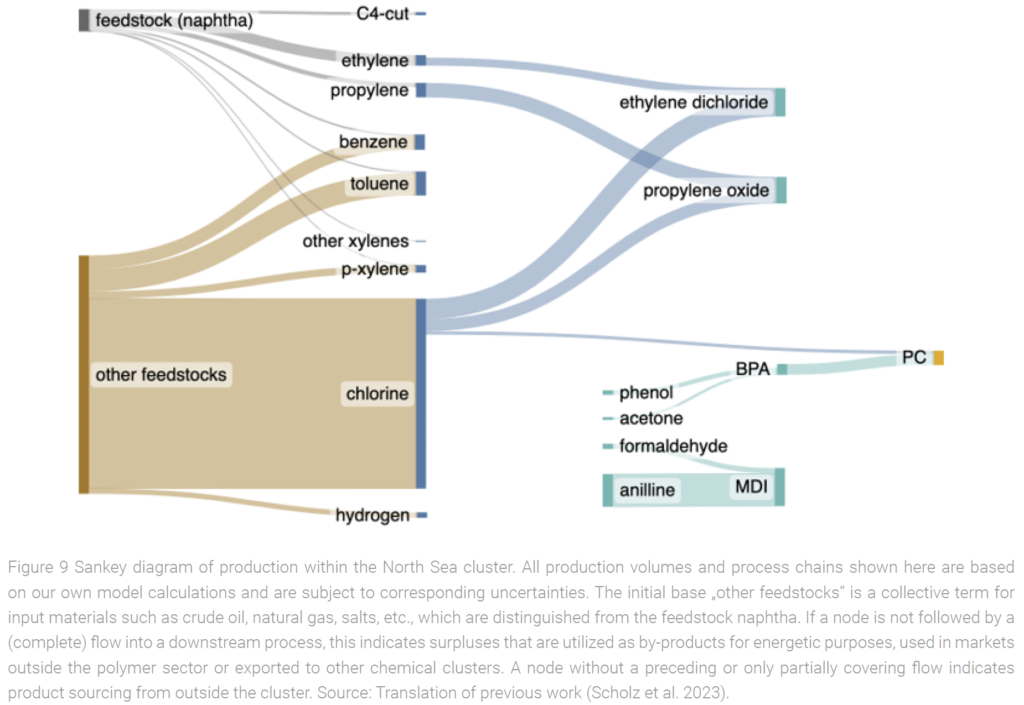

Process Flow Analysis using Sankey Diagrams: To gain insights into and visualize the flow of processes and resources, we generated several Sankey diagrams. These visual representations help to understand the distribution and transformation of materials and energy within the studied systems, aiding in identifying crucial points and interrelations in supply chains.

Criteria-based assessment of petrochemical clusters: Four categories were pre-defined, that structure the examination of the regional characteristics for their implications on a climate-neutral transformation.

In summary, the combination of these methods and tools provided a multifaceted approach to our analysis, incorporating quantitative and qualitative elements.

3 Results

3.1 The petrochemical system in Germany and Northwestern Europe

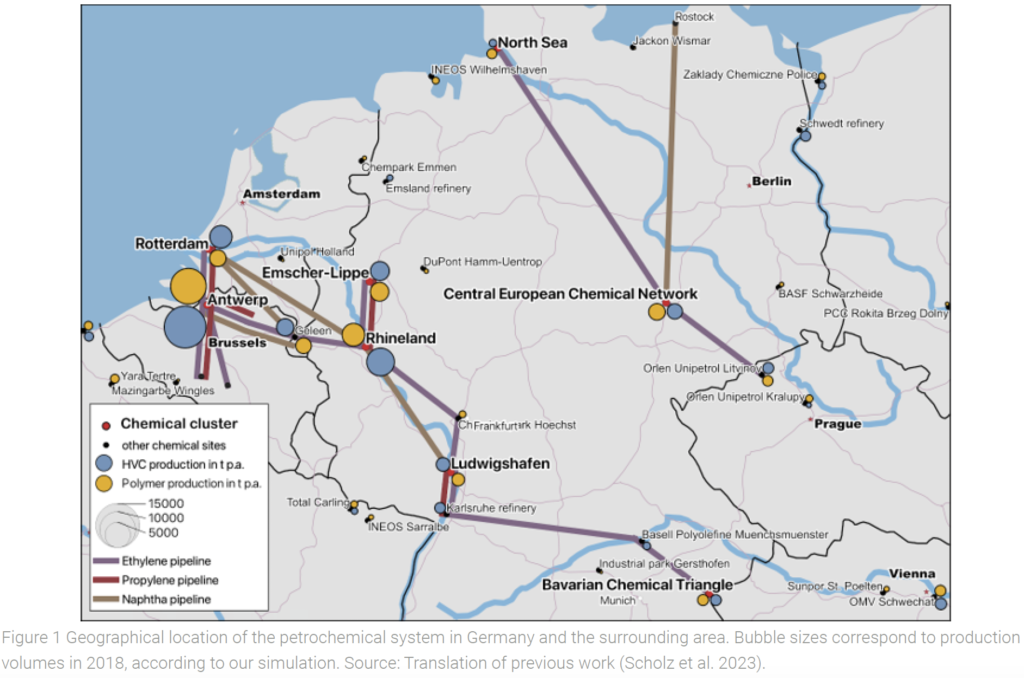

Steam crackers are at the core of petrochemical production in Germany and Europe. Typically, these are closely colocated to refinery complexes, which provide naphtha and liquified petroleum gas (LPG) distilled from crude oil and thus the feedstock for the operation of the steam crackers. The crackers primarily produce high-value chemicals, which serve as the basis for various production routes up to polymers. These HVC include the olefins ethylene, propylene and butadiene, as well as the aromatics toluene, benzene and xylene. Figure 1 displays all relevant petrochemical sites in Germany and neighboring countries. It shows that the production of HVC and its processing into polymers largely takes place in regions with a particularly high density of individual sites and that these are closely interconnected in a system of pipeline infrastructure. For the present analysis, the regions with a particularly high concentration of petrochemical production are grouped into the following eight clusters.

- Bavarian Chemical Triangle: The cluster consists of a collection of chemical companies in the southeastern part of Bavaria, of which the plants in the two chemical parks Burghausen and Burgkirchen/Gendorf are particularly important for the petrochemistry.

- Ludwigshafen: With a plant area of about 10 km2, BASF SE‘s Verbund site in Ludwigshafen, RhinelandPalatinate, is considered the largest contiguous chemical site in the world.

- Rhineland: The Rhineland cluster is characterized by a very high density of chemical companies located to the south and north of Cologne along the Rhine and concentrated in particular in the chemical parks of Wesseling, Knapsack, Leverkusen and Dormagen.

- Emscher-Lippe: The Emscher-Lippe region is located in the northern part of the Ruhr area, bounded by the two rivers after which it is named. With a very high density of industrial companies, it is one of the economic core zones of the Ruhr area and also ranks among the most important chemical regions in Germany and Europe.

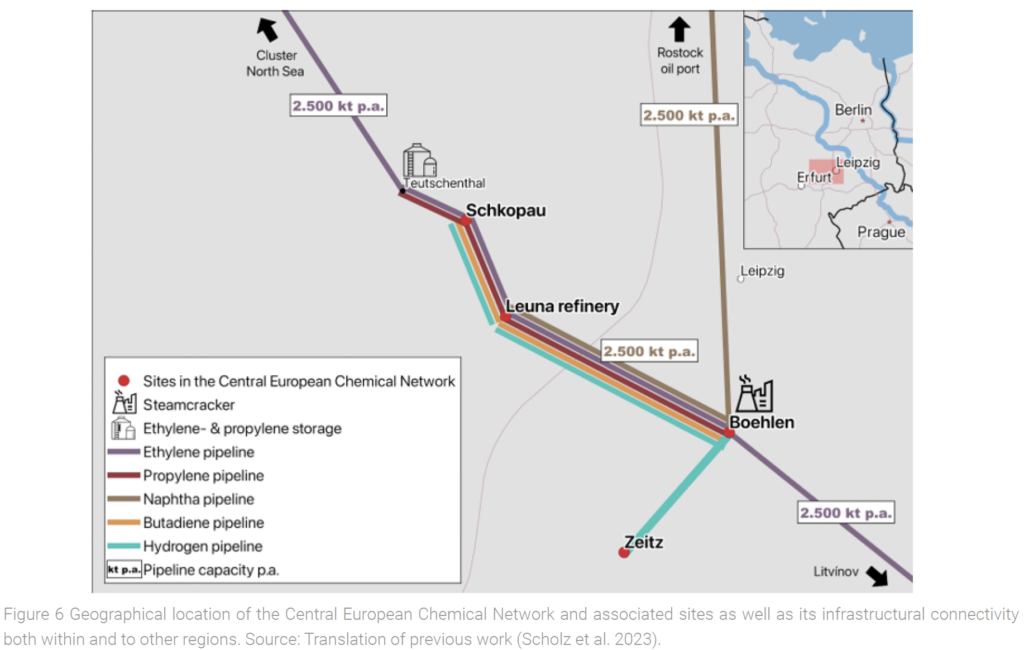

- Central European Chemical Network: This cluster is a regional consortium of the chemical industry in SaxonyAnhalt, Saxony, and Brandenburg. It comprises the chemical parks in Zeitz, Böhlen, Leuna and Schkopau. Deviating from the official characterization of this region, the locations in Schwarzheide and Bitterfeld Wolfen are not considered part of the cluster in the present analysis (CeChemNet, n.d.).

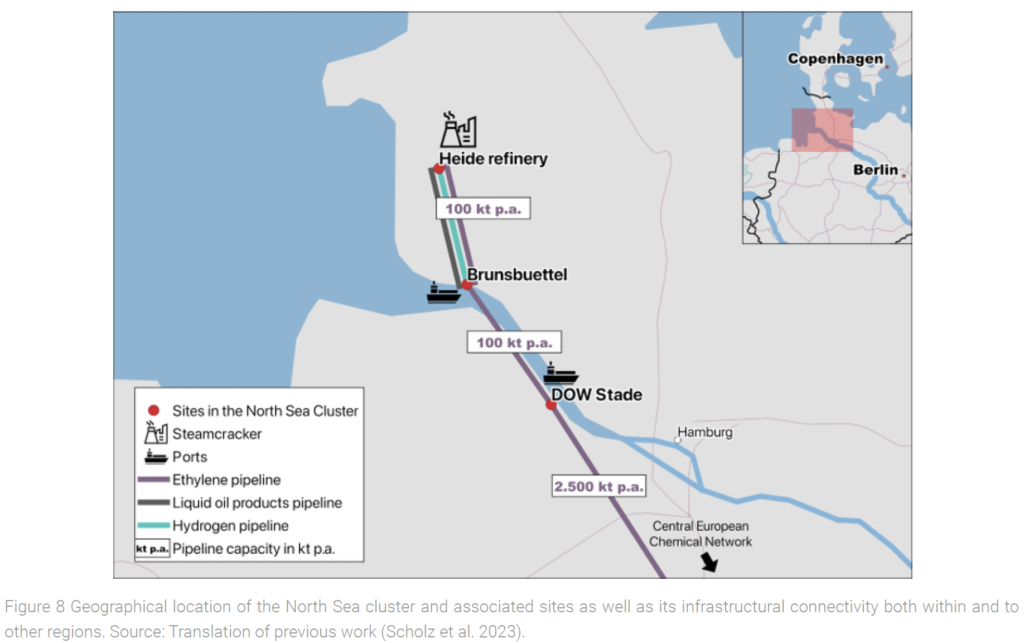

- North Sea: The North Sea cluster consists of the Heide refinery and the petrochemical locations in Brunsbüttel and Stade, which are located in the northern German states of Lower Saxony and Schleswig-Holstein. Strictly speaking, physically and economically independent clusters, but they are combined for the purposes of the following analyses.

- Rotterdam: The cluster is situated in and around the Port of Rotterdam in the western Netherlands, including the sites in Moerdijk. This is the largest seaport and the second-largest chemical site in Europe, closely integrated with the supra-regional chemical industry.

- Antwerp: The Port of Antwerp is regarded as the largest chemical cluster in Europe and the second-largest globally. With its connection to international maritime traffic and an extensive pipeline network, the cluster serves as a central hub for the transportation of raw materials and feedstocks within the broader European petrochemical industry.

In addition to these regional clusters, the AntwerpRotterdam-Rhine-Ruhr Area (ARRRA) can also be identified as a supercluster on the map in Figure 1. This consists of the regional clusters Rhineland, Emscher-Lippe, Rotterdam and Antwerp and is the most important chemical region in Europe.

Production balance for Germany

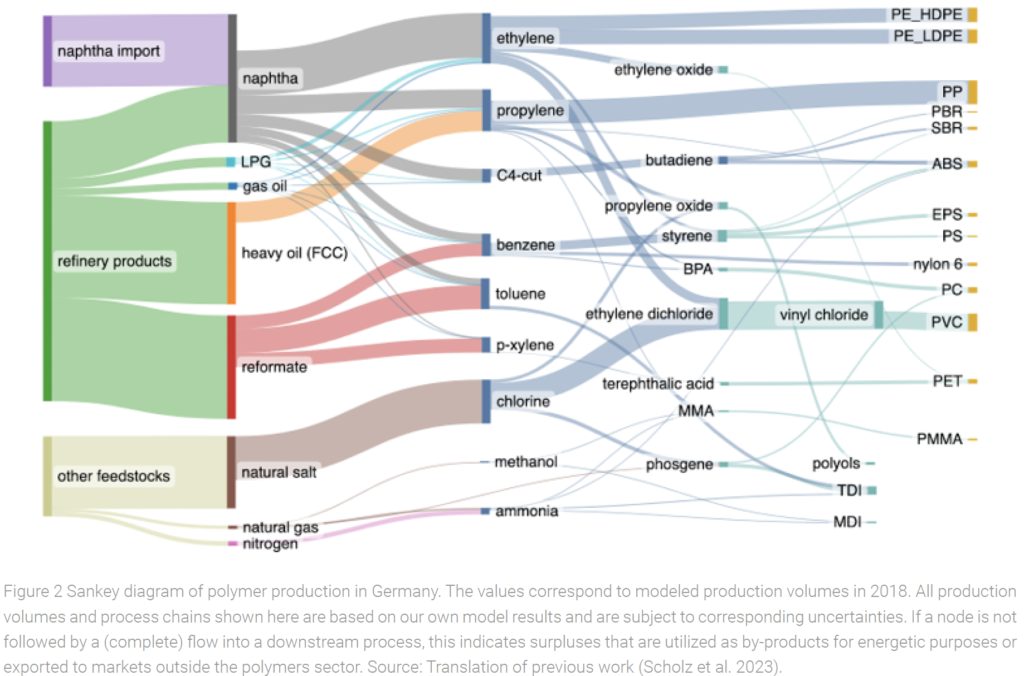

The following Sankey diagram in Figure 2 illustrates polymer production in the German clusters and the preceding processing of relevant raw materials and intermediates. All production volumes, flows and process chains shown are based on own model calculations.

Approximately half of the naphtha required for steam cracking in Germany is directly imported, while the other half is distilled from crude oil in local refineries. In addition to naphtha, other refinery products are also supplied as organic feedstock. These include heavy oil, LPG, gas oil for olefin production and reformates which play a crucial role for aromatics extraction. Other raw materials are needed to supply inorganic feedstock for polymers, primarily rock salt for chlorine production, as well as, to a lesser extent, natural gas and nitrogen for ammonia.

The various organic and inorganic raw materials form the basis of all polymers. The most significant in terms of quantity are the production of various-density polyethylene (PE), polypropylene (PP) and polyvinyl chloride (PVC). In addition to these mass-produced polymers, a range of others are manufactured in Germany, including acrylonitrilebutadiene-styrene (ABS), polycarbonate (PC), polyethylene terephthalate (PET), expanded polystyrene (EPS), nylon 6, styrene-butadiene rubber (SBR), polymethyl methacrylate (PMMA), polybutadiene rubber (PBR) and polystyrene (PS).

Primary energy balance for the production system in Germany

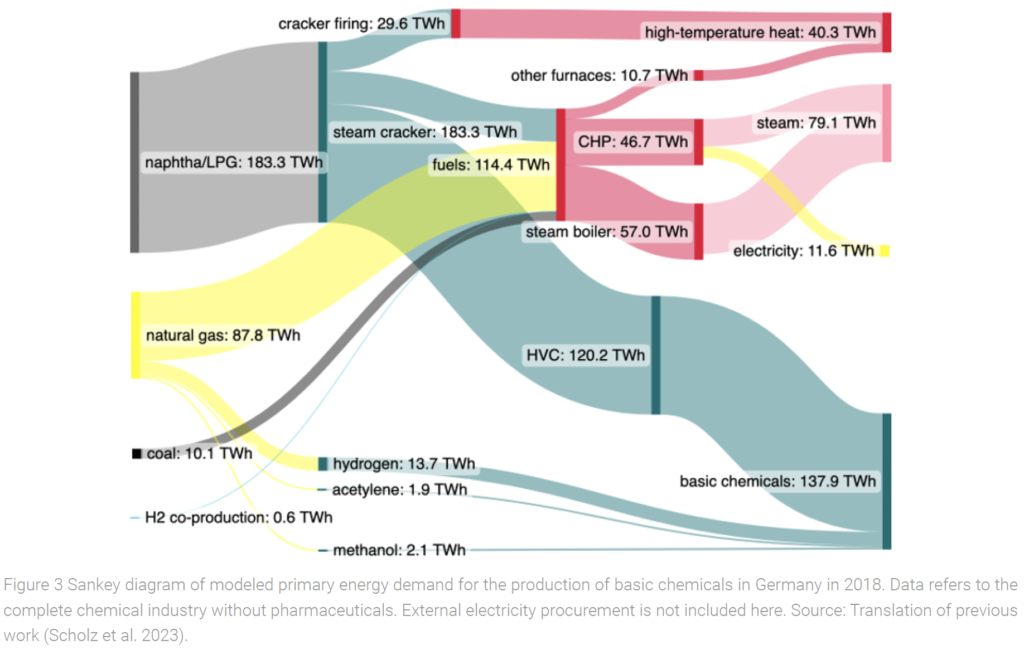

The primary energy balance of chemical energy carriers of the production system has been generated for Germany via model calculations and is presented as a Sankey diagram in Figure 3. In addition, regional insights into energy data can be found in the appendix.

The production has a primary energy demand of 280 TWh from fossil energy sources, of which over 260 TWh or 93% are located within the six studied clusters.

Over 70% of the total primary energy demand is needed as feedstock to produce chemical products. However, a portion of the feedstock used in the processes is not converted into the target products, resulting in energetically usable byproducts. Steam cracking of naphtha and LPG in Germany requires 180 TWh, with over half of it being consumed in the Rhineland alone. After cracking, 63 TWh by-product fuel is available. However, this is only gross, as more than 50% is needed again to operate the cracking furnaces in the steam cracker. Typically, the cracked light gas component of the steam cracker products, consisting of methane and hydrogen, is used for this purpose. Contrary to occasional representations, the operation of a naphtha steam cracker does not require natural gas but actually shows a surplus of gas produced as a by-product (Cefic, 2013; Dehandschutter, 2006). The excess fuel, amounting to over 30 TWh, is utilized in steam boilers or combined heat and power (CHP) plants, where it supplies about one quarter of their fuel demand. In addition, coal is (still) used, with North Rhine-Westphalia being the regional focus. In some locations, surplus hydrogen is also used, which refers to hydrogen generated as a by-product of chlorine production that cannot be utilized onsite as a molecule. The resulting fuel demand of CHP and steam boilers in our model calculations is covered by natural gas. Natural gas is also used for the operation of other industrial furnaces. The highest demand here is in the production chain for PVC with the precursor products ethylene dichloride (EDC) and vinyl chloride monomer (VCM). Finally, the material demand for natural gas is also significant: a total of 14 TWh is required for hydrogen production, with the majority going to ammonia production, followed by acetylene and methanol. The clear regional focus of both material and absolute use of natural gas is the Ludwigshafen site, accounting for almost one-third of total demand of the basic chemicals industry in Germany (as of 2018).

Our model calculation also shows that the total electricity demand of the basic chemicals industry in Germany is approximately 46 TWh, of which 25% is self-generated, thus external electricity purchases account for approximately 35 TWh (not shown in the graph). Taking into consideration these procurements, the total primary energy demand in Germany increases to nearly 320 TWh per year.

3.2 In-depth analysis of three selected clusters

Of the eight clusters shown in Figure 1 and briefly characterized in Section 3.1, the three German clusters Rhineland, Central European Chemical Network and North Sea will be discussed in detail below. We selected these three examples due to their high degree of differentiation in terms of regional location, infrastructural connectivity and product portfolios.

Cluster 1: Rhineland

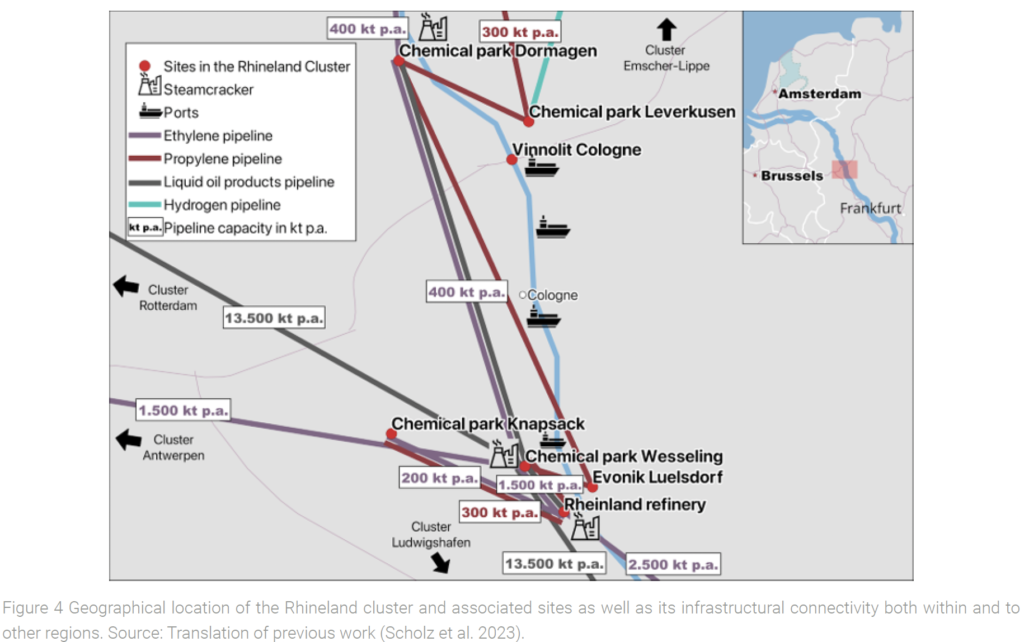

The Rhineland cluster, illustrated in Figure 4, is situated along the river Rhine to the south and north of Cologne and is a major industrial hub comprising 260 chemical companies with approximately 70,000 employees. In 2021, these companies collectively generated 30 billion euros in sales, constituting a significant 22% of Germany‘s total chemical revenue (ChemCologne, 2021).

The historical roots of this cluster can be traced back to the 18th century when the first fragrance producers settled and with increased industrialization in the 19th century, a significant chemical industry evolved within the Rhineland (Arbeitgeberverband Chemie Rheinland e.V., n.d.; ChemCologne, 2021). This development progressed with the emergence of coal chemistry at the beginning of the 20th century when chemical companies used the raw materials from local coal mining and the byproducts of coke production (Meijering & van Leeuwen, 2021). In the 1950s and 1960s, the region grew in the course of the West German economic boom and gradually transformed from a coal- to a petroleum-based chemical industry, enabled by the locational advantages of integrated production, i.e., the exchange of raw materials and intermediates between companies via pipelines. The disintegration of large chemical firms like Bayer, Höchst and Hüls led to the creation of so-called chemparks in the 1990s, integrating ever-more companies that took over part of the existing production chains. The location is indeed decisive in this success story, because the Rhine-Ruhr area offers a large sales market nearby and the river serves as a vital transport link to the major chemical sites of Rotterdam and Antwerp (Arbeitgeberverband Chemie Rheinland e.V., n.d.; ChemCologne, 2021).

Today, crude oil is mainly obtained from the large tank terminals of the Rotterdam harbor via pipeline which supplies the Shell refineries in Godorf and Wesseling, collectively processing approximately 18 Mt of crude oil. As shown in Figure 4, the Rhineland maintains strong connections and interdependencies with other petrochemical clusters. Naphtha and other liquid products are transported via pipelines to steam crackers in Wesseling and Dormagen, owned by Shell, LyondellBasell and Ineos. Approximately one quarter of these steam cracker feedstocks is provided by the Shell refinery, the remaining is imported from external sources. The produced olefins are distributed via product pipelines within the cluster and to the Ruhr area, along the Rhine to Ludwigshafen, Antwerp and the Chemelot cluster in the Netherlands. Inland waterways are utilized for transport as well, connecting Godorf with Duisburg (in the Ruhr area), Rotterdam, Antwerp and Ludwigshafen.

As shown in Figure 5, the Rhineland cluster boasts a diverse product portfolio, with a strong emphasis on basic chemicals. These encompass crucial HVC such as ethylene, propylene and butadiene, primarily produced through naphtha steam cracking while propylene is also derived via fluid catalytic cracking (FCC) at the refineries. The inorganics chlorine and ammonia are important building blocks as well, although they are used for processes outside the polymer segment as well. The most important intermediates in the cluster in terms of volume include EDC, toluene diisocyanate (TDI) and acrylonitrile, while the most relevant polymers are PE (both low and high density), PP and ABS. The Rhineland cluster exhibits a very high degree of self-supply regarding its use of intermediates. According to our simulation, only styrene and nitric acid are respectively fully and partly imported from external sources, as there are notable production surpluses in almost every other segment that can be exported.

The scale and breadth of production result in the Rhineland cluster having by far the highest energy demand of all the regions studied (see appendix for an overview on energy related data). Excluding purchased electricity, primary energy demand amounts to 106 TWh, almost entirely (99 TWh) covered by naphtha and LPG as feedstock for the large steam cracker fleet. A significant portion of the total energy demand is required to provide high-temperature heat (18.1 TWh) and steam (18.5 TWh), which are predominantly sourced from by-products of the cracker process. Additionally, the Rhineland cluster features a 300 MW coalfired CHP plant located in Dormagen, as well as a power plant in Wesseling fueled by cracker by-products to generate electrical power. These various sources of energy and feedstock supply underscore the highly-integrated nature of the cluster‘s activities, but also its dependence on fossil raw materials and structures.

Cluster 2: Central European Chemical Network

The Central European Chemical Network (CeChemNet) is a regional consortium of the chemical industry in SaxonyAnhalt, Saxony and Brandenburg. The cluster, as illustrated in Figure 6, is geographically rather dispersed but linked with a strong pipeline infrastructure. It encompasses the chemical parks in Zeitz, Böhlen, Leuna and Schkopau. Further important sites in the region are located in Schwarzheide and Bitterfeld-Wolfen but these are not defined as part of the cluster in the present analysis. The entire region comprises some 600 companies over an area of 5,500 hectares, employing 27,000 people (CeChemNet, n.d.).

Historically, the development of this region has been closely intertwined with the presence of lignite coal deposits, which served as both energy and carbon source for chemical production. Until the end of World War II, significant segments of Germany‘s basic chemical industry were located here. Interconnected through pipelines, the sites formed a tightly integrated raw material network with the local coal mines. The transition to petrochemical processes was only partially accomplished during the period of the German Democratic Republic. Consequently, the sites underwent substantial restructuring and privatization during the reunification of Germany in the 1990s. While lignite continues to play a crucial role from an energy perspective, the restructuring resulted in the establishment of a petrochemical raw material network, featuring an oil refinery in Leuna and a steam cracker in Böhlen.

As illustrated in Figure 6, the sites are connected through pipeline infrastructure, facilitating the transport of ethylene, propylene, butadiene and hydrogen within the cluster. Additionally, the storage facility in Teutschenthal, where ethylene and propylene are stored in caverns, as well as connections to neighboring chemical regions contribute to the network‘s supply security. The feedstock for Dow Chemical‘s steam cracker in Böhlen is supplied by two ways: The first is through a dedicated naphtha pipeline to the oil port of Rostock, where the feedstock is imported directly – formerly from Russia, but now mainly from Algeria, Qatar and the United States. The second way is via a pipeline connection to the Leuna refinery where up to 50% of the cluster’s naphtha needs are distilled from crude oil. The intermediate products manufactured on this basis in Böhlen supply the sites in Schkopau and Leuna. The cluster is infrastructurally connected to the North Sea with Stade as another important site owned by Dow and with facilities in the Czech Republic.

The following Sankey diagram in Figure 7 provides a detailed breakdown of material flows within the cluster’s polymer production system. On site, crucial HVC such as ethylene, propylene and benzene are produced by naphtha steam cracking, while propylene is also derived via FCC at the Leuna refinery. Chlorine is important as well, but is also used for processes not related to polymer production. It seems that significant amounts of HVC are not further processed into polymers within the cluster (e.g. ethylene to approximately 50%, propylene to one-third). On the other hand, the production of butadiene seems to be insufficient for the rubber manufacturing on site, which results in import requirements. The most important intermediates in terms of volume include styrene (with considerable surpluses), EDC and vinyl chloride. Various intermediates appear to be sourced from outside, especially terephthalic acid. The most relevant polymers are PET, PVC, SBR and PP.

With a primary energy demand of 36 TWh (excluding purchased electricity), the Central European Chemical Network ranks in the middle of the analyzed German clusters. A little more than half of this demand is attributed to naphtha and LPG used as steam cracker feedstock. Natural gas is utilized in a similar order of magnitude, primarily for steam generation (17 TWh). The 900 MW lignite-fired power plant in Schkopau is another source of energy supply. Presently, lignite, crude oil products and natural gas dominate the structures in the Central European Chemical Network (see the appendix for more details on the cluster’s energy-related data).

Cluster 3: North Sea

The North Sea cluster, as illustrated in Figure 8, consists of the Heide refinery and the petrochemical sites in Brunsbüttel and Stade, which are located in the northern German states of Lower Saxony and Schleswig-Holstein. The refinery has a capacity of 4 Mt of crude oil distillation and 450 kt of chemical products (Raffinerie Heide, n.d.). The Chemcoast Park Brunsbüttel accommodates 15 firms on 2,000 ha, DOW‘s facility in Stade covers an area of 550 ha and is one of the largest industrial plants in Lower Saxony (ChemCoast Park Brunsbüttel, n.d.; DOW, n.d.).

The formation of the cluster dates back to 1940 when the Heide refinery was founded due to the availability of local crude oil (Raffinerie Heide, o. J.-a). The establishment of the petrochemical plants in Brunsbüttel and Stade was facilitated by the favorable logistical access to the Elbe waterway (Metropolregion Hamburg, n.d.).

As shown in Figure 8, the cluster offers key infrastructural features such as linkage to the national and international shipping network, with the port of Stade mainly importing propylene, phenol and acetone and Brunsbüttel hosting storage facilities for oil imports. From Brunsbüttel‘s port, a pipeline supplies crude oil to the Heide refinery. An ethylene pipeline links the Heide refinery to the Chemcoast Park Brunsbüttel and the DOW site in Stade. Ethylene is also delivered to Stade via pipeline from the Central European Chemical Network. Additionally, a hydrogen pipeline links Heide and Brunsbüttel. Furthermore, national railways are important in the company supply chains of Covestro and Dow. Aniline and nitrobenzene are supplied from the Emscher-Lippe cluster, while various basic chemicals are imported from the CeChemNet.

According to our model calculations, the Heide Refinery utilizes 0.3 Mt of naphtha as feedstock for its steam cracker on an annual basis. This cracker can utilize diverse feedstocks quite flexibly according to market conditions, and is also compatible with ethane or LPG, which are sourced via the Brunsbüttel port and (for the latter) by the refinery. In Brunsbüttel, feedstock is mainly supplied from the oil ports and the refinery. Germany‘s largest oil field, Mittelplate, is nearby and supplies 1 Mt/year to the sites in the cluster as well (Wintershall Dea, n.d.). Chlorine production in DOW Stade benefits from nearby rock salt deposits.

The following Sankey diagram in Figure 9 provides a detailed breakdown of material flows within the cluster’s polymer production system. Chlorine is the most important basic chemical, followed at a distance by various aromatics and olefins. Several intermediates are derived from the basic chemicals, in particular methylene diphenyl isocyanate (MDI), EDC and propylene oxide. The MDI produced via aniline derivation by Covestro at Brunsbüttel is a significant export commodity, with Brunsbüttel being one of the largest MDI producers in Europe. With regards to polymers, only PC is produced. From Figure 9, it is evident that both imports and exports are significant contributors to the cluster‘s portfolio. It seems that one quarter of DOW Stade‘s chlorine production is subject to further polymer processing within the cluster. Other basic materials and intermediates are also only proportionally processed on site and presumably exported or used in processes outside of polymer production. Also, some intermediates have to be sourced externally, such as aniline and formaldehyde (used in the production of MDI) for the Brunsbüttel site and phenol and acetone (used in the production of BPA and PC) for the Stade site.

With approximately 11 TWh [3], the North Sea has the lowest primary energy demand of all German clusters. The predominant energy source is natural gas (7.8 TWh), which primarily fuels CHP plants and steam boilers but is also used as a feedstock for ammonia production (not shown in Figure 9). Additionally, the partial oxidation of natural gas generates hydrogen which is subsequently utilized for ammonia production. The second major energy source (besides electricity) is naphtha with 3.5 TWh. At Brunsbüttel and Stade, CHP plants are operated by natural gas, with an additional 0.4 TWh of hydrogen that results from chlorine production also being utilized for combustion in Stade. Although the cluster is comparatively less energy-intensive, its dependence on fossil energy sources, particularly natural gas, remains significant (see appendix for more energy data).

3.3 Criteria-based assessment of the three clusters

Approach

In this chapter, the regional characteristics of the clusters described above are examined for their implications on a climate-neutral transformation. In order to identify and interpret such regional strengths and challenges, the particularities of the clusters are grouped into the following four criteria:

Feedstock supply: This criterion assesses the existing feedstock infrastructure regarding its diversity as well as its connectivity to other clusters and import possibilities. We assume that a cluster with multiple exchange possibilities for feedstocks and intermediates as well as connections to international import options for future green molecules is more robustly positioned.

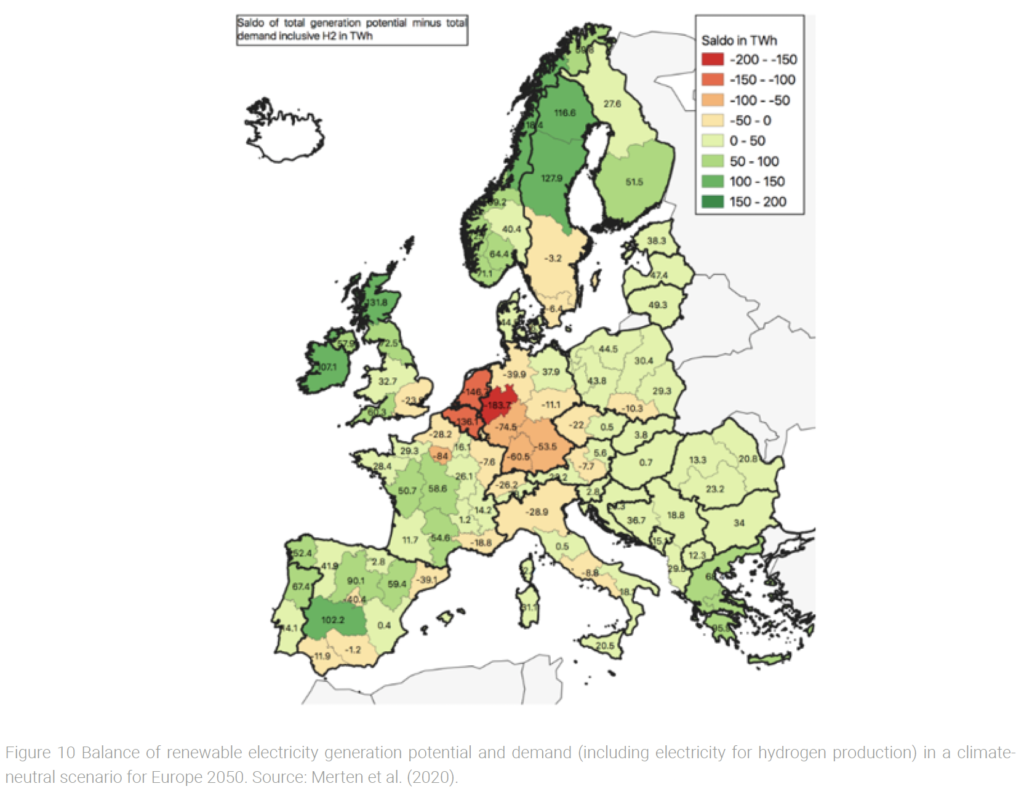

Energy supply: This criterion evaluates the regional availability of renewable energy potentials in relation to industrial demand. Decarbonization in Germany poses high economic challenges for energy-intensive processes and these are therefore particularly prone to renewables pull [4] (Samadi et al., 2023) or carbon leakage [5]. Therefore, clusters with high total energy demand face particular challenges. A region with high local potentials is also less dependent on electricity imports from other regions and the development of corresponding energy infrastructures. To examine the clusters on the latter point, we use a prior analysis by Merten et al. (2020), in which some of the authors were directly involved. As depicted in Figure 10, this work compares the balance between technical generation potentials for electricity from renewable energies with a model-based scenario for long-term demand in European regions. Thus, it can be estimated whether surpluses or deficits of renewable energy are to be expected for a region in the long term.

Supply chain challenges: The analysis of the current production system of the clusters revealed a variety of interdependencies in the processes (see Sankey diagrams in chapter 3.2) and in energy demand (see appendix), but also very diverse situations. This criterion interprets the results by highlighting supply chain challenges with regard to the cluster’s:

- product portfolio and underlying production processes: Some processes face particular technological challenges in operating with renewable energy, such as the provision of high-temperature heat. Others are associated with technological uncertainties, as there is a lack of large-scale experience with low-carbon solutions that are currently debated. This is the case for aromatics production, as it appears that only low yields can be achieved with synthetic feedstocks and the alternative methanol-to-aromatics route is still at a low stage of development with high anticipated costs (Li et al., 2021).

- integration factor: Horizontal and vertical integration have proven to be advantageous in the past, as they have enabled synergies in production and reduced dependencies on external supply chains. However, the transformation of a highly integrated system is extremely complex and is subject to lock-in risks (Janipour et al., 2022).

- flexibility: Some processes allow a certain degree of flexibility because they can be run intermittently or their output product can be easily stored – others do not. These properties offer advantages in an increasingly volatile energy system.

Current transformation agenda: Here, clusters are assessed in terms of their existing transformation agenda. These include recently initiated and announced pilot projects for low-carbon production as well as overarching transformation strategies. Another aspect is integration into regional or supra-regional transformation initiatives, which Rattle and Taylor (2023) describe as a key factor for industrial change.

Assessment: Feedstock supply

The Rhineland cluster utilizes hydrocarbons as 90% of its total feedstocks, thus heavily relying on supply with naphtha, LPG and refinery products. Due to its large demand, the cluster is more dependent on external feedstock supply than most others in Germany, which is reflected in the high import quotas (75% of total feedstock demand). At the same time, it is less reliant on the continued operation of local refineries due to its extensive infrastructural integration. Connected by six different feedstock and product pipelines to four other clusters and as part of the most important European chemical region (ARRRA), the Rhineland offers a wide range of options for the supply and exchange of resources. Concerning the future use of green hydrogen, the existing grid linking the Leverkusen sites to the Emscher-Lippe cluster can facilitate the market-entry, as it is clear that the RhineRuhr industrial area will be among the first to be connected to long-distance hydrogen import pipelines. Although the cluster is not located at the coast, the river Rhine also allows for shipping between the cluster and the ports of Rotterdam and Antwerp, both of which are particularly well positioned to take a lead in a future maritime trade with green molecules. As significant parts of the supra-regional industry is located alongside the Rhine, it could also facilitate the procurement and exchange of waste-derived or bio-based raw materials and feedstocks. However, the river is already affected by seasonal low water levels, which could restrict this transport route further in the long term due to climate change.

The Central European Chemical Network utilizes hydrocarbons as 92% of its total feedstocks, thus heavily relying on naphtha, LPG and refinery products. The cluster sources naphtha via the pipeline from Rostock’s oil port and the Leuna refinery, the latter is capable of satisfying at most 50% of the demand. The caverns at Teutschenthal for the extraction of brine and storage of hydrocarbons provide a degree of flexibility in terms of feedstock supply. The production sites within the cluster itself are well interconnected through railway transportation for organic basic chemicals and pipelines for ethylene, propylene, butadiene, and hydrogen. However, with regard to other petrochemical regions, the Central European Chemical Network is connected solely by ethylene pipelines to the North Sea cluster and Litvinov in the Czech Republic. Currently there is a substantial production surplus of ethylene and propylene that is exported. Rock salt sourced via long-distance trains for the purpose of chlorine production constitutes 8% of total feedstocks and therefore plays a subordinate role. UPM’s bio refinery in Leuna employs locally sourced beechwood as a biomass feedstock (UPM Biochemicals, n.d.) and the Leuna refinery has announced plans to produce green methanol, which both could decrease naphtha dependency – although it is not yet foreseeable to what extent.

The North Sea Cluster has an advantageous position due to its coastal location. With access to international waterways, the region has favorable conditions for importing a variety of resources. However, just 25% of the feedstock employed in the cluster originates from hydrocarbons. These are currently acquired through the oil ports in Brunsbüttel and Stade and processed in the Heide refinery. The other 75% primarily comprises rock salt for chlorine production. Besides port access, the cluster is connected to pipelines and the national railway system, which plays a crucial role in its reliance on imported chemical intermediates. This diversified infrastructure and the steam cracker at Heide refinery which has a very flexible input characteristic facilitate a robust feedstock provision. The coastal location also offers beneficial conditions for a future supply of green feedstocks either from regional production or imports. Currently, RWE is planning a green ammonia import terminal in Brunsbüttel which is expected to be operational from 2026 (RWE, 2022).

Assessment: Energy supply

The Rhineland has the highest primary energy demand (106 TWh) among the German clusters by far, mainly due to the vast production of HVC. As this HVC production generates by-products that can be used as fuel, the Rhineland cluster ISSN 1613-9623 © 2024 Prof. Dr. Jens Leker (affiliated with University of Münster) and Prof. Dr. Hannes Utikal (affiliated with Provadis School of International Management and Technology) Vol.21, Iss.1, February 2024 16 | 44 URN: urn:nbn:de:hbz:6-47978441054 DOI: 10.17879/47978440806 is today able to utilize the provided primary energy efficiently through its highly integrated structure. This is also the reason why dependence on natural gas is very low here. However, this advantage builds on the initial import of primary energy, today in the form of fossil naphtha and LPG, as well as on the HVC production taking place in the cluster. In a future defossilized system, more HVC may instead be sourced from other sites, which would jeopardize this existing integration advantage. Furthermore, excluding fossil resources for feedstock and energy, the importance of electricity becomes more significant to the chemical industry. In this regard, the Rhineland cluster has a disadvantage as it is located in the area with the biggest deficit in local generation potentials versus demand (see Figure 10). Thus, the cluster will be heavily dependent on external renewable electricity supply and corresponding infrastructure.

The primary energy demand of the Central European Chemical Network (36 TWh) ranks in the middle of the observed German clusters. By-products from HVC production can also be utilized for energetic purposes here, but to a lesser extent. Unlike in the Rhineland cluster, about half of the primary energy serves however not as a feedstock, but is natural gas directly used to produce steam. Since steam can be generated from a range of energy sources, this implies that a large share of the energy supply is not fundamentally dependent on fossil resources and infrastructure, and could thus potentially be more easily transformed (e.g., via direct electrification or hydrogen). The cluster is also located in a region with substantial renewable energy potentials, it could be able to meet a majority of its electricity demand if local potentials are fully utilized (see Figure 10). There are already efforts to increase renewable electricity production that are accompanied by an expansion of the electricity grid with a new connection between Boehlen and Zeitz already completed and a connection between Boehlen and Schkopau planned (Bundesnetzagentur, n.d.).

With a primary energy demand of 11 TWh, the North Sea is the least energy-intensive cluster among the studied regions. Similarly to the Central European Chemical Network, natural gas is the predominant energy source. A large share is used for steam purposes and is thereby relatively flexible in terms of the energy source used, but substantial amounts are also utilized as a feedstock for ammonia production. Electricity plays a significant role in the cluster already today due to its large chlorine production and could become even more important in the future. This is because the cluster holds vast potentials for offshore wind energy that exceed the regional demand substantially (see Figure 10). In theory, excess renewable electricity could also be used for hydrogen generation and replace the natural gas that is currently used as a feedstock for ammonia production. From an infrastructural point of view, the cluster is already well positioned: Both Heide and Brunsbüttel are presently linked to offshore wind parks via a newly established grid and expansion to further offshore sites is already planned (Bundesnetzagentur, n.d.). It is therefore quite conceivable that more industry will settle in this cluster or that existing plant capacities may be expanded in the future.

Assessment: Challenges in supply chains

The Rhineland cluster’s production structure displays an exceptional degree of self-integration. This is particularly evident in the large steam cracker fleet, whose by-products are energetically utilized in various processes and thus enable extensive self-sufficiency with energy. The Rhineland also covers the entire petrochemical value chain and therefore only a few intermediates have to be bought in. However, the central prerequisite for maintaining this high degree of integration is the continued supply of feedstock to the steam crackers and the maintenance of bulk HVC production. This could prove challenging if the naphtha route becomes uncompetitive in comparison to other routes for olefins production. The supply of butadiene and toluene, which are an important basis for technical (pre-) polymers such as ABS, PBR and TDI, could also become problematic in the future due to uncertainties and limitations associated with low-carbon process alternatives. The same applies to other aromatics, such as benzene, but these are not involved in downstream process chains here (at least not for polymers). The production in the Rhineland cluster is also relatively heat-intensive and shows the highest absolute demand for high-temperature heat among all German clusters. The production of TDI, PVC and polyols are particularly relevant here, as they require not only steam but also temperatures above 500° C, with the production of PVC consuming the most per ton. This presents a particular transformation challenge, as high-temperature heat is more difficult to deliver with low-carbon energy sources than for lower temperatures. The extensive chlorine production in the cluster is relatively straightforward to decarbonize, but will require substantial amounts of renewable electricity and downstream processes have high heat requirements. Although the chlorine process could be run relatively flexible depending on electricity prices, the product itself is toxic and corrosive and therefore difficult to store. However, most chlorine for polymers is used for the production of EDC, which can respond very flexibly to changing electricity prices because the product can be conveniently stored (Ausfelder et al., 2018).

The Central European Chemical Network demonstrates a high level of process integration, facilitating versatile energy and feedstock usage. However, this integration also presents transformation challenges and risks for fossil lock-in effects. As in the Rhineland, the extensive aromatics and butadiene demand poses a major challenge here, as the technological uncertainties if low-carbon routes can still supply these are very high. Chlorine is also produced in substantial quantities for EDC and subsequent PVC production. The same challenges and flexibility options apply here as described for the Rhineland. Additionally, the production of PET as well as styrene and the following SBR require substantial amounts of heat and steam. After all, the provision of heat in the cluster accounts for nearly 60% of the primary energy demand, a proportion significantly higher than in other clusters. The significant proportion of steam in the energy profile of the cluster provides a certain degree of flexibility between the steam-consuming processes present in the cluster. When considering PET production, it is noteworthy that the cluster imports the inputs of terephthalic acid and ethylene glycol. This production is therefore relatively detached from other processes, which makes change easier. The production of Nylon 6 shows a deep vertical integration via the production of adipic acid, cyclohexane and caprolactam as well as nitric acid coming in from the nearby Piesteritz site.

The North Sea Cluster exhibits relatively limited horizontal and vertical integration. This situation might open up the opportunity to close value chains by integrating novel decarbonized processes dedicated to specific products. The significant potential for renewable energy at the North Sea sites offers an advantage in this regard, possibly enabling production of green hydrogen. HVC production at the Heide refinery constitutes a relatively small part of the production volumes and only the olefins ethylene and propylene are further processed on site. On the intermediate level, it is noteworthy to mention the production of EDC as it consumes a significant amount of energy. EDC and further intermediaries that are exported from or imported into the cluster provide flexibility due to their storability. The production of MDI holds a significant position in the North Sea cluster due to its high production volumes. However, it is completely reliant on the import of aniline and formaldehyde as input materials. The same applies for BPA as an input for PC production, which is dependent on phenol and acetone imports. Approximately half of the primary energy demand is attributed to the supply of steam (4.3 TWh) and hightemperature heat (1 TWh). Steam is more versatile and can be used for multiple processes, such as in hybrid systems. The majority of the steam is produced in CHP plants which account for 1/3 of the total primary energy demand and therefore requires attention towards decarbonization options. The cluster´s high dependency on natural gas could be reduced by local green hydrogen production, as 40% of natural gas is currently consumed for conventional hydrogen production.

Assessment: Current transformation agenda

Within the Rhineland cluster, there are a number of activities aiming at converting the current production system to more sustainable routes. A number of smaller pilot-scale plants using alternative feedstocks are being operated, but larger commercial-scale facilities have been announced as well. Most notably, crude oil processing in Wesseling – currently at 8 Mt/a and representing almost 50% of total capacity at the Rhineland refinery – is planned to be discontinued by 2025 and be replaced by several new technologies, including increased use of biomass and plastics-based pyrolysis oil (Shell Deutschland, 2023). The latter is also to be increasingly used in the nearby steam crackers. In addition to an existing 10 MW electrolysis plant producing electricity-based hydrogen, a further 100 MW plant is scheduled for construction before 2025. INEOS is also planning to construct a 100 MW electrolysis plant to supply green hydrogen, which will then be used to produce green ammonia and methanol for fuel applications (INEOS, 2021). Additionally, there are plans for a bio-methane and a powerto-liquid facility, although both focus on fuel-production. While these pilot projects are important components, orders of magnitude more capacity is needed to cover the vast energy demands of the cluster. At the Dormagen Chempark, Covestro operates a pilot plant at the Leverkusen site to chemically recycle polyurethane foam from used mattresses by chemolysis (Covestro, 2021). LyondellBasell uses bio-based hydrocarbons from Neste as a feedstock for their steam crackers in Wesseling to produce partially bio-based polyethylene and polypropylene with approval for food packaging (LyondellBasell, 2021), however the scale of this use is not given. The companies LyondellBasell and INEOS also announced that they will build commercial scale chemical recycling facilities in Wesseling and Dormagen with 50 kt and 100 kt/year capacities respectively in order to supply their steam crackers with alternative feedstocks (LyondellBasell, 2022; Schneider, 2020). To offer context, it‘s noteworthy that the clusters’ steam crackers boast a collective processing capacity exceeding 7 Mt/year of naphtha. Consequently, the planned recycling plants will only be able to supply a modest portion of the required feedstock.

For a climate-neutral production system, transformation activities that aim at the energy supply are required as well. One example is the CO2NEICHEM research project, a consortium of science and industry that develops new energy concepts for chemical parks in North Rhine-Westphalia and focusses particularly on the challenging heat supply based on renewable energies (SPIN, 2022).

In addition to these individual projects, companies in the Rhineland cluster are involved in various transformation initiatives that go beyond the scope of their respective organizations. These include ChemCologne, Spitzencluster für industrielle Innovationen e.V. and IN4Climate.RR (all regional), IN4Climate.NRW (federal state level) and Trilateral Chemical Region (cross-border), in which industry, politics and academia cooperate on transformation aspects (ChemCologne, 2021; SPIN, 2022; NRW.Energy4Climate, n.d.-a, n.d.-b; VCI NRW, n.d.).

The Central European Chemical Network displays numerous transformation projects located on different sites and executed at varying scales. Nevertheless, there are some notable outliers including planned projects utilizing alternative feedstocks in the scale of hundred kilotonnes capacities. Largest in scale is the biorefinery by UPM being constructed in Leuna with a total capacity of 220 kt/ year, where bio-based chemicals like monoethylene and monopropylene glycols are to be produced from deciduous hardwood (UPM Biochemicals, n.d.). Fraunhofer IMWS operates a pilot plant in Leuna for a scaled gasification of plastic waste and residual biomass, with a processing capacity of 25 kt/year (Fraunhofer IMWS, 2018). DOW announced plans for a chemical recycling plant for plastic waste in Böhlen, which is expected to be the largest project of its kind in Europe with an annual processing capacity of up to 120 kt/year (Heitkamp, 2022). Equipolymers in Schkopau are planning to use 25% chemically recycled PET as a feedstock in their PET production (KunststoffWeb, 2022). Altogether, the processing capacities of these alternative routes would sum up to 400 kt/year and could therefore make a relevant contribution. However, it is important to note that the annual processing capacity of the clusters’ steam cracker amounts to 1.6 Mt of naphtha. Concerning green hydrogen production, Linde is currently building a 24 MW PEM electrolysis plant that will feed into the cluster‘s existing H2 grid (MVU Sachsen-Anhalt, 2022). The Total Energy refinery in Leuna is also planning a pilot plant for green methanol based on electrolysis hydrogen and CO2 from refinery processes. However, this methanol is to be used primarily in aviation and not as a feedstock in the chemical industry (TotalEnergies, 2022). In terms of initiatives targeting the energy system, LEAG has commissioned a so-called Gigawatt Factory in Böhlen, which currently consists of a 17 MW solar park that is to be increased to 14 GW by 2040. Flexible, hydrogen-ready power plants or pure hydrogen power plants with a capacity of 4.5 GW are about to complete the park by 2040 (LEAG, 2023). Linde is also active in the development of green hydrogen production and is currently building a 24 MW PEM electrolysis plant that will feed into the cluster‘s existing hydrogen network, but has to be scaled up significantly in order to make a relevant contribution (MVU Sachsen-Anhalt, 2022).

Besides these individual projects, the industrial parks and some larger chemical companies in the cluster are organized within the eponymous CeChem-Network. However, this is not a transformation initiative, but is primarily about safeguarding and communicating economic interests of the companies (CeChemNet, n.d.). The chemical parks Leuna and Zeitz are partners in the so called BioEconomyCluster which develops innovative uses of biomass for applications in various industrial sectors (BioEconomy e.V., n.d.). Last but not least, the Centre for the Transformation of Chemistry (CTC) is currently under construction in Delitzsch and will be a new research center bringing together partners from academia, industry and society (CTC, n.d.).

The North Sea cluster is planning a number of demonstration scale projects for the transition to climate neutral processes, mainly focused around locally produced green hydrogen. The Heide refinery is undertaking the HyScale 100 initiative, entailing the generation of green hydrogen with an electrolysis capability of 500 MW by 2026 (and then, if successful, up to 2.1 GW). Combining this hydrogen with CO2 from refinery processes and a local cement plant, green methanol will be marketed both as a fuel and a feedstock for the production of green propylene and ethylene via an MTO route and therefore holds considerable potential for the cluster (Raffinerie Heide, 2022). The Heide refinery‘s second transformation project, which entailed installing a 30 MW electrolysis unit and the production of sustainable aviation fuels, was recently canceled due to excessive construction costs (Rauterberg, 2023). The larger HyScale initiative has not yet been affected by this, but it remains to be seen whether it will be successful. Yara, a significant producer of ammonia located in Brunsbüttel, aims to decarbonise its production process by replacing natural gas with green hydrogen as a production input. There are plans to produce the green hydrogen on-site using a 250 MW electrolyser (Wasserstoffwirtschaft SH, n.d.). DOW Stade also implements a project to produce 200 kt of methanol per year from hydrogen and CO2 from the Stade gas-fired power plant for chemical processes, shipping and heavy goods traffic (DOW, n.d.; future.hamburg, 2021). With regard to climate-neutral energy supply, there are various activities ongoing in the cluster due to its advantageous coastal position for wind power. One specific project that stands out is a cooperation between European countries bordering the North Sea that aims at significantly expanding wind energy production in the region. The German contribution is set to increase from the current 8 GW to 70 GW by 2025 (Reich, 2022). Another example is the AquaVentus project that aims at installing 10 GW of green hydrogen generation capacity from offshore wind energy by 2035, as well as to produce 1 Mt/year of green hydrogen from wind power (AquaVentus, n.d.).

Besides individual projects, most of the North Sea cluster companies are also linked through the ChemCoast stakeholder network which is a cross-state initiative uniting business and politics and advocating for industrial development. In line with its mission to connect companies that contribute to the energy transition, the network mainly consolidates activities related to green hydrogen and wind power (ChemCoast, n.d.).

To summarize, all three assessed clusters have several pilot-scale projects for renewable hydrogen production as well as chemical production using alternative feedstocks, some of which are already in operation. Significantly larger projects and demonstration plants in the scale of 100 kt/ year capacities are also planned in all three clusters, usually announced to come into operation around 2025. However, compared to the current processing capacities of the steam crackers (0.3-7.6 Mt of naphtha), it is clear how far the clusters still have to go to achieve complete defossilization.

4 Conclusion & Discussion

This paper aims at shedding light on the structural characteristics of the petrochemical production system in Germany and its regional clusters with the help of intensive energy, material and production asset research supplying a model-based analysis. The main objective was to derive critical points, specific challenges and local advantages that are highly relevant for a transition towards climate neutrality. For the three clusters under consideration, fundamental conclusions are:

The Rhineland Cluster is the largest and energetically most relevant chemical region in Germany. It is highly dependent on external feedstock supply, but infrastructurally also exceptionally well-connected, thus offering diverse opportunities for sourcing and exchange of resources. Concerning the future supply with renewable electricity, the Rhineland is located in the area with the biggest deficit in generation potentials versus demand. Its high degree of vertical and horizontal integration has been advantageous historically but poses a complex challenge for transformation, entailing significant risks of fossil lock-in effects. Several processes which are currently important value creators are associated with specific challenges in transitioning to low-carbon alternatives, thereby jeopardizing significant components of the value chains. This is especially the case for toluene and butadiene as well as the generally substantial demand for high-temperature heat. There are a large number of pilot projects and the cluster is involved in several regional and supra-regional transformation initiatives, but they need to be scaled up significantly.

The Central European Chemical Network is positioned in the mid-range concerning size and energy demand but is less embedded in the overall petrochemical system in terms of location and infrastructure. Consequently, it will need to utilize the existing substantial local green energy and biomass potentials while simultaneously strengthening existing connections to the coast for feedstock supply. Similar to the Rhineland, several processes that are important components of the clusters value chains are associated with specific challenges, such as benzene and butadiene as well as the generally substantial demand for high-temperature heat. There are a large number of pilot projects in place and a new transdisciplinary research institute is under construction that could foster the required collaboration and networking.

The North Sea Cluster is by far the smallest cluster with a low degree of vertical and horizontal integration, which results in a less complex situation. Moreover, the cluster‘s coastal location positions it well to produce and import green energy as well as molecules, thus playing a crucial role in supplying other clusters in the future. It is also conceivable that further parts of the petrochemical value chain might settle here in the future. The extensive chlorine production in the cluster requires very large quantities of renewable electricity for a climate-neutral transition, but is significantly less complex from a technical and logistical standpoint due to electrification and local supply with feedstock. Local projects and initiatives are in place and focus strongly on the advantages of the location but they have been colored by failures in the recent past.

Overall, a critical challenge in the transition of petrochemicals towards climate-neutrality lies in uncertainties regarding feedstock supply. The multifaceted options and their technological consequences lead to a high degree of complexity and open questions: How will the particularly energy-intensive parts of the value chain be affected by relocation and what impact will this have on the often highlyintegrated industrial clusters? Is it more advantageous to experiment with a variety of approaches, or should the focus be on aligning with the existing production structure? Here, the importance of regional specificity cannot be overstated. Unlike other industries where one-size-fits-all solutions may be applicable, the diversity of regional conditions in the petrochemical sector necessitates a tailored approach for every cluster. In navigating this landscape, decisionmakers can refer to the criteria presented here, such as the local uniqueness in infrastructure, product portfolios and supply chains. Factors such as technical suitability, regional availability and infrastructural options for future green resource supply to existing structures should be carefully evaluated.

In every cluster, there is already substantial transformation effort visible. However, none of them seems to have a strategic network that is fully able to co-create a tailored defossilization strategy for the cluster – which is the core recommendation of this paper to develop. The integration of individual, often small-scale projects into overarching transformation initiatives will be crucial to reduce uncertainty, scale up plant capacities, consolidate expertise along the value chain and, with the help of political support, coordinate change in line with regional and national targets. Networking and increased collaboration between different companies might display a valuable strategy, despite individual firms being competitors. The existence of cases, such as IN4Climate.NRW, BioEconomy Cluster, Voltachem, Cracker of the Future and more, highlight the potential benefits of cross-industry collaboration that should be strengthened within and between clusters.

Coming back to the present work, it is important to state that the analysis is associated with a number of methodological and conceptual limitations.

First of all, there are fundamental restrictions to the model‘s validity: The quantitative results depict an ideal situation based on a synthetic year in which production satisfies intra-European demand in the overall system. Secondly, the procurement of electricity from the grid is not included in the balance, which means that part of the energy demand is not accounted for. Thirdly, the analysis focuses on polymers and leaves out other important areas of chemical production – such as chlorine and ammonia – if they are not part of regional polymer value chains. However, qualitative supplements partially address these restrictions.

Other limitations prevail with regard to the qualitative assessment: Further aspects are relevant to examine the positioning of individual clusters for a climate-neutral transformation. These include questions of future market development and competitiveness, strategic behavior of competitors outside Germany and the EU, local political support, availability of skilled labor, attractiveness of the region and others. However, since this work aims at drawing conclusions from the structural analysis of the clusters, only selected aspects were taken into account. Finally, it should also be added that this qualitative analysis is based on publicly accessible data and therefore may not fully reflect internal company processes.

References

Arbeitgeberverband Chemie Rheinland e.V. (n.d.): Die Chemie Region, available at https://www.chemierheinland.de/die-chemie-region, accessed 13 October 2023.

Ausfelder, F., Seitz, A., & Von Roon, S. (2018): Flexibilitätsoptionen in der Grundstoffindustrie, pp. 160 f. AquaVentus (n.d.): AquaVentus-Vision, available at https:// aquaventus.org/, accessed 3 January 2024.

BAFA (Ed.) (2021): Amtliche Mineralöldaten für die Bundesrepublik Deutschland.

BioEconomy e.V. (n.d.): BioEconomy Start, available at https://www.bioeconomy.de/, accessed 20 November 2023.

Bundesnetzagentur (n.d.): Netzausbau—Karte. available at https://www.netzausbau.de/Vorhaben/uebersicht/karte/karte.html, accessed 20 November 2023.

CeChemNet (n.d.): Central European Chemical Network— Das Netzwerk, available at https://www.cechemnet.com/, accessed 20 October 2023.

Cefic (2013): European chemistry for growth—Unlocking a competitive, low carbon and energy efficient future, The European Chemical Industry Council, Brussels, p. 70.

Cefic (2021): iC2050 Project Report: Shining a light on the EU27 chemical sector’s journey toward climate neutrality, European Chemical Industry Council, Brussels, p. 59.

Cefic (2023): The European Chemical industry: Facts and Figures 2023 – A vital part of Europe’s Future, European Chemical Industry Council, Brussels, p. 7.

CHEManager (2011): Mitteldeutsche Chemieparks als „Knowledge Sites“ CHEManager, available at https://www.chemanager-online.com/news/mitteldeutschechemieparks-als-knowledge-sites, accessed 20 November 2023.

ChemCoast (n.d.): ChemCoast—Start (Chemie, Industrie, Standorte, Norddeutschland), available at https://www.chemcoast.de/, accessed 20 November 2023.

ChemCoast Park Brunsbüttel (n.d.): Standort | ChemCoast Park Brunsbüttel, available at https://www.chemcoastpark.de/de/standort/, accessed 20 November 2023.

ChemCologne (2021): Die leistungsstärkste Chemieregion im Herzen Europas. https://www.chemcologne.de/investitionen/die-chemie-region.

Covestro (2021): Closing the loop for polyurethane mattresses, available at https://www.covestro.com/press/de/den-zyklus-fuer-polyurethan-matratzen-schliessentrade/, accessed 20 November 2023.

CTC (n.d.): Center for the Transformation of Chemistry (CTC), available at https://transforming-chemistry.org/netzwerk/, accessed 23 November 2023.

Dehandschutter, H. (2006). Modeling Steam Cracking of Complex Hydrocarbons, Universiteit Gent, p. 5.

DOW (n.d.): Werk Stade, available at https://de.dow.com/content/dam/corp/documents/location/903-029-03-stadeplant-numbers-dates-and-facts.pdf, accessed 20 November 2023.

DOW (2013): Integriertes Energiekonzept im Werk Stade, available at http://storage.dow.com.edgesuite.net/dow. com/deutschland/unternehmen/19379_PSP_Energie_ V17b.pdf, accessed 20 November 2023.

Fraunhofer IMWS (2018): Aus Abfall wird Rohstoff— Fraunhofer IMWS, available at https://www.imws.fraunhofer.de/de/presse/pressemitteilungen/pilotanlage-carbontrans.html, accessed 20 November 2023.

FutureCamp & DECHEMA (2019): Roadmap Chemie 2050 auf dem Weg zu einer treibhausgasneutralen chemischen Industrie in Deutschland: Eine Studie von DECHEMA und FutureCamp für den VCI, FutureCamp Climate GmbH & DECHEMA Gesellschaft für Chemische Technik und Biotechnologie e.V., München & Frankfurt, p. 7.

future.hamburg (2021): Dow Stade: Chemie soll klimaneutral werden, available at https://future.hamburg/artikel/dowstade-chemie-soll-klimaneutral-werden#, accessed 20 November 2023.

Heitkamp, S. (2022): Sachsen wird Hotspot für PlastikRecycling, available at https://www.saechsische.de/sachsen/sachsen-groesste-anlage-fuer-chemischeskunststoff-recycling-in-boehlen-geplant-5756831.html, accessed 20 November 2023.

INEOS (2021): INEOS-Projekt für grünen Wasserstoff beschleunigt den Weg zur Netto-Null-Zukunft in Deutschland bis 2045, available at https://www.ineoskoeln.de/news/ineos-projekt-fur-grunen-wasserstoff-beschleunigt-denweg-zur-netto-null-zukunft-in-deutschland-bis-2045/, accessed 20 November 2023.

Janipour, Z., De Gooyert, V., Huijbregts, M., & De Coninck, H. (2022): Industrial clustering as a barrier and an enabler for deep emission reduction: A case study of a Dutch chemical cluster, Climate Policy, 22 (3), pp. 320–338.

KunststoffWeb (2022): Rittec: Kooperation bei PET-Recycling, available at https://www.kunststoffweb.de/branchen-news/rittec_kooperation_bei_pet-recycling_t250168, accessed 20 November 2023.

LEAG (2023): LEAG-GigawattFactory wächst mit weiterem 17-MWp-Solarpark, available at https://www.leag.de/de/news/details/leag-gigawattfactory-waechst-mit-weiterem17-mwp-solarpark-1/, accessed 03 January 2024.

Li, T., Shoinkhorova, T., Gascon, J., & Ruiz-Martínez, J. (2021): Aromatics Production via Methanol-Mediated Transformation Routes, ACS Catalysis, 11 (13), 7780–7819.

LyondellBasell (2021): LyondellBasell und Neste weiten Zusammenarbeit zur Herstellung von Polymeren und Chemieprodukten aus erneuerbaren Rohstoffen aus, available at https://www.lyondellbasell.com/de/wesselingsite/neuigkeiten/lyondellbasell-und-neste-vereinbarenlangfristige-zusammenarbeit/, accessed 20 November 2023.

LyondellBasell (2022): LyondellBasell Makes Decision to Progress Advanced Recycling Plant in Wesseling, Germany, available at https://www.lyondellbasell.com/en/news-events/products–technology-news/lyondellbasellmakes-decision-to-progress-advanced-recycling-plant-inwesseling-germany/, accessed 20 November 2023.

Meijering, J., & van Leeuwen, J. (2021): The dynamic development of organic chemistry in North-West Europe, Clingendael Clean Energy Program, The Hague, p. 16.

Merten, F., Lechtenböehmer, S., Krüger, C., Nebel, A., Scholz, A., & Taubitz, A. (2020): Policy Brief – Infrastructure needs of an EU industrial transformation towards deep decarbonisation, Wuppertal Institut für Klima, Umwelt, Energie, Wuppertal, p. 18.

Metropolregion Hamburg (n.d.): Chemische Industrie in der Metropolregion Hamburg, available at https://metropolregion.hamburg.de/chemie/, accessed 20 November 2023.

MVU Sachsen-Anhalt (2022): Energieministerium will 55 Millionen Euro für Wasserstoff-Infrastrukturen bereitstellen, available at https://mwu.sachsen-anhalt.de/artikel-detail/energieministerium-will-55-millionen-euro-fuer-wasserstoffinfrastrukturen-bereitstellen, accessed 20 November 2023.

NRW.Energy4Climate (n.d.-a): IN4climate.RR. NRW. Energy4Climate, available at https://www.energy4climate.nrw/industrie-produktion/in4climatenrw/in4climaterr, accessed 20 November 2023.

NRW.Energy4Climate (n.d.-b): Thinktank IN4climate. NRW. NRW.Energy4Climate, available at https://www.energy4climate.nrw/industrie-produktion/in4climatenrw, accessed 20 November 2023.

Raffinerie Heide (n.d.): Facts und Historie, available at https://www.heiderefinery.com/ueber-uns/facts-und-historie, accessed 20 November 2023.

Raffinerie Heide (2022): Entwicklung von grünem Wasserstoff in der Raffinerie Heide rückt einen Schritt näher, available at https://www.heiderefinery.com, accessed 20 November 2023.

Rattle, I., & Taylor, P. G. (2023): Factors driving the decarbonisation of industrial clusters: A rapid evidence assessment of international experience, Energy Research & Social Science, 105, 103265.

Rauterberg, C. (2023): Grüner Wasserstoff: Raffinerie Heide bricht Vorreiter-Projekt ab, available at https://www.ndr.de/nachrichten/schleswig-holstein/Gruener-WasserstoffRaffinerie-Heide-bricht-Vorreiter-Projekt-ab,wasserstoff480.html, accessed 20 November 2023.

Reich, H. (2022): Offshore-Windkraft – Wie die Nordsee zum Kraftwerk für die Energiewende wird. Manager Magazin, available at https://www.manager-magazin.de/politik/europa/offshore-wie-die-nutzung-von-windenergie-auf-dernordsee-ausgebaut-werden-soll-a-029f38af-d94a-40a5-95a5-09aa8bdc3482, accessed 3 January 2024.

RWE (2022): Import of green energy: RWE builds ammonia terminal in Brunsbüttel, available at https://www.rwe.com/en/press/rwe-ag/2022-03-18-import-of-green-enery-rwebuilds-ammonia-terminal-in-brunsbuettel/, accessed 20 November 2023.

Samadi, S., Fischer, A., & Lechtenböhmer, S. (2023): The renewables pull effect: How regional differences in renewable energy costs could influence where industrial production is located in the future, Energy Research & Social Science, 104, 103257.

Schneider, S. (2020): Innovation in Dormagen: Bei Ineos wird aus Müll neuer Kunststoff, available at https://rp-online.de/nrw/staedte/dormagen/dormagen-bei-ineos-wirdaus-abfall-neuer-kunststoff_aid-50237467, accessed 20 November 2023.

Scholz, A., Schneider, C., Saurat, M., & Theisen, S. (2023): Das petrochemische System in Deutschland und Westeuropa: Regionale Analyse der Polymer-Produktion in Deutschland, den Niederlanden und Belgien ; Ergebnisse aus dem Forschungsprojekt “Green Feedstock for a Sustainable Chemistry – Energiewende und Ressourceneffizienz im Kontext der dritten Feedstock-Transformation der chemischen Industrie”, Wuppertal Institut für Klima, Umwelt, Energie, Wuppertal.

Shell Deutschland (2023): Im Rheinland beginnt die Zukunft, available at https://www.shell.de/about-us/locations/shell-energy-and-chemicals-park-rheinland/media-and-downloads/_jcr_content/root/main/containersection-0/simple/list_1471045785/list_item_1756791981_1050193467.multi.stream/1684146100339/546c32a047cd706ad7a7f8ac46e5ff2e2db0a771/shell-energy-and-chemicals-parkrheinland-brochure.pdf, accessed 20 November 2023.

SPIN (2022): CO2 neutrale Energieversorgung im Chemiepark – SPIN, available at https://www.spin.ruhr/blog/spin-projekt-co2neichem-gestartet-co2-neutraleenergieversorgung-von-industriestandorten-am-beispieleines-chemieparks-in-nrw-das-spin-forschungsprojektco2neichem-entwickelt-konzepte-fuer-die-notwen/, accessed 03 January 2024.

SZ (2022): Der Stromschlucker in Stade und das unbeachtete LNG-Terminal, available at https://www.sueddeutsche.de/wirtschaft/energie-der-stromschluckerin-stade-und-das-unbeachtete-lng-terminal-dpa.urnnewsml-dpa-com-20090101-220520-99-361468, accessed 20 November 2023.

taz (2023): Energiesubventionen für Unternehmen: Licht aus oder Deckel drauf, available at https://taz.de/!5945481/, accessed 20 November 2023.

TotalEnergies (2022): TotalEnergies, Sunfire und Fraunhofer geben den Startschuss für grünes Methanol in Leuna, available at https://totalenergies.de/totalenergies-sunfireund-fraunhofer-geben-den-startschuss-fuer-gruenesmethanol-leuna, accessed 20 November 2023.

UPM Biochemicals (n.d.): Bioraffinerie Leuna, available at https://www.upmbiochemicals.com/de/uber-upmbiochemicals/bioraffinerie-leuna/, accessed 20 November 2023.

VCI (2023): Chemiewirtschaft in Zahlen 2023, Verband der Chemischen Industrie e.V., Frankfurt, pp. 32-37.

VCI NRW (n.d.): Trilateral Chemical Region, available at https://www.trilateral-chemical-region.eu/, accessed 20 November 2023.

Wasserstoffwirtschaft SH (n.d.): Yara—WTSH Wasserstoff, available at https://wasserstoffwirtschaft.sh/de/yara, accessed 20 November 2023

Wintershall Dea (n.d.): Erdölförderung Mittelplate— Wintershall Dea, available at https://wintershalldea.de/de/wo-wir-sind/mittelplate, accessed 20 November 2023.

* Alexander Scholz , Wuppertal Institute for Climate, Environment and Energy, alexander.scholz@wupperinst.org

** Svenja Theisen, Ylva Kloo, Wuppertal Institute for Climate, Environment and Energy

*** Clemens Schneider, University of Kassel

[1] Both German and European figures include scope 1 and scope 2 emissions.

[2] Part of the descriptive analyses presented in chapters 3.1 and 3.2 has already been published as a project report in a different format, with larger scope and in German language (cf. Scholz et al., 2023). In this follow-up paper, some of the most important results are presented in revised form and supplemented by extensive follow-up analyses for three selected regions.

[3] It should be noted that the extensive chlorine production in the cluster is accompanied by a substantial demand for electricity. Some of this is generated on site in the plant‘s own power stations, but a significant proportion is purchased externally and is not covered by this analysis. In an older brochure, DOW, by far the largest chlorine producer in the cluster, stated its own total electricity demand in Stade at 5 TWh, a figure confirmed by two recent newspaper articles (DOW, 2013; SZ, 2022; taz, 2023). Even taking these quantities into account, the energy requirements of other clusters remain higher.

[4] economic attractiveness of renewable-rich regions that might lead to industrial relocation of industrial activity.

[5] economic attractiveness of regions with low-ambition climate regimes that might lead to relocation of industrial activity.