The founding angels investment model-case studies from the field of nanotechnology

Abstract

The gap between academic research and the commercialization of research result can be overcome with the founding angels investment model where very early-stage investors found start-up companies together with appropriate research partners to conduct research and later, alone or together with industrial partners, commercialize the results. The engagement of founding angels is compensated not monetarily but through an equity share of the new company. This business model is already being implemented in the United States with some interesting examples in the area of nanotechnology. This article analyses approach and investment strategy as well as defines a best practice process of founding angels as early-stage technology investment model applying an exploratory multiple case analysis. The empirical data are based on literature research with a focus on document analysis and interviews with 35 nanotechnology experts.

Introduction

Nanotechnology is abroad term that refers to anything engineered down to the nanometer scale. It provides the ability to isolate and manipulate single atoms, which behave much differently than clustered atoms. This change in behaviour is due to an increased relative surface area, producing more chemical reactivity, and the dominance of quantum effects, altering the material’s optical, magnetic and electrical properties. The aim is to unlock capabilities in materials by manipulating them at the atomic level. Building at the nanometer scale allows scientists and engineers to design specific magnetic, thermal, and strength properties into products. Nanotechnology is expected to play a key role in the 21st century with large market potentials in numerous applications.

Companies such as 3M have been leading the change, citing nanotechnology as a primary driver for future revenue and technology growth. 3M has been working on nanomaterials since 1985 when it started using nanostructures in its film coatings. 3M is now expanding into developing biomedical sensors, new metal matrix composites, strong adhesives and advanced protective coatings. Chemical companies such as BASF, Bayer, DSM, DuPont, GE, Honeywell, Mitsubishi and Rohmand Haas have also begun to invest heavily in nanotechnology. These firms are developing, for example, scratch-resistant polymers, super-insulating wire coatings or batteries with longer shelflife. HP, IBM, Lucent and Motorola have turned to nanotechnology for the next breakthroughs in semiconductor manufacturing. These companies have also invested in developing super capacity data drives and nano emissive displays.

Governments worldwide are recognizing the importance and potential of nanotechnology (Roco, 2005) and the number of patents is continuously growing, led by the United States (US) and Europe (Chenetal., 2008).

But a gap can be identified between academic research and the commercialization of research results, which represents a serious barrier for innovation. This gap can be overcome with the founding angels investment model where very early-stage investors proactively found start-up companies together with appropriate research partners to conduct research and later, alone or together with industrial partners, commercialize the results.

This paper discusses early stage technology investments in the area of nanotechnology by founding angels.

In the first part we analyse a typical innovation process in nanotechnology and the role of start-up companies taking carbon nanotubes (CNTs) as an example. Then we show case examples of professionals using the founding angels investment model in the area of nanotechnology. Based on the investigation of the innovation process and the case examples we then analyse the founding angels investment model, define a best practice investment process and discuss the investment strategy.

Literature review

Importance of start-up companies

In many cases of innovation processes a technology transfer gap exists between academic research and the commercialization of the results to realise industrial applications. This gap can be closed through start-ups as they facilitate the transfer of research results into products. Therefore, they are important for innovation and an accelerator of economic growth, especially in high-tech areas like nanotechnology, targeting markets with high growth potentials (Roberts, 1991; Heirman and Clarysse, 2004; Stam et al., 2009). The importance of start-ups is also seen by universities (Shane, 2002). Generally, academic researchers neither have the knowledge nor the experience to commercialize their research results (Litan and Mitchell, 2007). To facilitate technology transfer from academic research to industrial applications many universities have implemented technology transfer offices (TTOs) (Goldfarb and Henrekson, 2003). Most TTOs recognise start-ups as an interesting method oftechnology transfer and thus help scientists in their entrepreneurial efforts (Feldman and Feller, 2002; Markman et al., 2005; Meyer, 2006).

Acquiring enough capital is a serious challenge for many start-ups, especially in early stages. Particularly for high-tech start-ups the necessary resources are relatively high in the first stages, due to the steep cost of research and product development. There are three financial sources which founders can rely on. The firstis the government, which can inject money into start-ups through governmental programs. The second financial source is private investors like business angels, who are normally referred to as informal investors. The third source is formal investors, for example venture capital companies (Fried and Hisrich, 1994; Kaplanand Strömberg, 2001). Venture capital companies normally invest only in companies that have at least proceeded beyond the product developmentstage (Branscomb and Auerswald, 2002) and they even prefer to invest when the technological potential is demonstrated by working together with first customers. Therefore, theinformal venturecapital marketisvital for earlystagehigh-techcompanies (Wetzel and Freear, 1996) and since the early nineties, politicians and researchers have increased their interest in understanding how the informal venture capital market works and how it can be optimised. For example, in the US and the United Kingdom (UK), the largest source of risk financing comes from business angels (Mason and Harrison, 1996). Globally speaking, the business angels investment in new technology-based firms is twice as large as formal venture capitalists’ investment(BygraveandQuill,2007).

Support by business angels

Due to their function of the “missing link”, business angels help bridge the financial gap in the high risk early stage phase (Mason, 2006; Maunula, 2006). Having been financed by business angels raises the credibility of the company in the eyes of potential partners and thus increases the chances of the company receiving further investment. Ideally, business angels complement venture capital companies, especially with regard to the size of the investment, the value added and the investment phases (Crawley, 2007) and provide a deal flow for venture capital funds (Madill et al., 2005). BAs in the U.S. account for double the amount of investments (in terms of deal size) in startups when compared to VCs (Riding 2008; Bygraveand Quill 2007). On the other hand, a recent Canadian study has shown that the 3F funding (from family, friends and fools) accounts for more than three times as much annual investment as BAs (Riding 2008).

Business angels choose to invest in specific sectors based on their previous experience and a strong network (Van Osnabrugge, 2000). Mason and Harrison (2002) have noticed that business angels are, in general, looking for more investment opportunities. This is mainly due to the fact that most of the proposals they receive do not coincide with their investment criteria. For example, in the industry or technology sector, the company stage or location may not fulfill their conditions. Also, many investors do not possess the necessary technical knowledge required for investing in high-tech areas. Finding a good opportunity takes much effort due to a lack of access to the academic researchers and the long selection process (Mason and Harrison, 1992).

Because of this time consuming procedure, more and more investors have neglected small investments in order to focus on bigger deals (Murray, 1999). This theory is confirmed by Mason and Harrison (1995) who attribute the equity gap to the high search cost of business angels seeking investment opportunities. According to Zhang (2009), this can also be overcome with the help of experienced people. They are faster than novices in acquiring resources due to an established network and working experience with people like venture capitalists and customers. They also know how to handle information asymmetry during the financing process, which is due to the fact that founders rarely paint a precise picture of the company (Binks et al., 1992).

Especially during the creation of a start-up, scientists as entrepreneurs face several challenges in order to develop the technology, strengthen the company and generate revenue as early as possible (Baron, 1998). The scientist is often absorbed by his daily duties and challenges in research and has quite often a biased view on how his research output could be used. Besides capital, new technology based companies very often lack business know-how, as the founders are usually highly research orientated scientists. This means, that besides enough capital, a start-up also heavily relies on operational assistance in order to be successful and additional knowledge provided by informal investors is often required and sometimes valued as a financial investment, in return for shares (Crawley 2007). Thus, the working relationship between founders and business angels is important and it should start as early possible (Landström, 1998). The earlier in the development process the relationship between founders and investors are established, the less likely conflicts regarding goals or tasks will occur, whereas these conflicts have been demonstrated to lead to investors’ or entrepreneurs’ exit (Collewaert 2011). Unfortunately, business angles normally do not have enough time to build a solid relationship with the founders (Ensley et al., 2002). Another important aspect is that because business angels normally only invest in existing companies, their work cannot help bridge the gap between academic research and industrial application if insufficient start-ups are founded.

Founding angels as new investment model

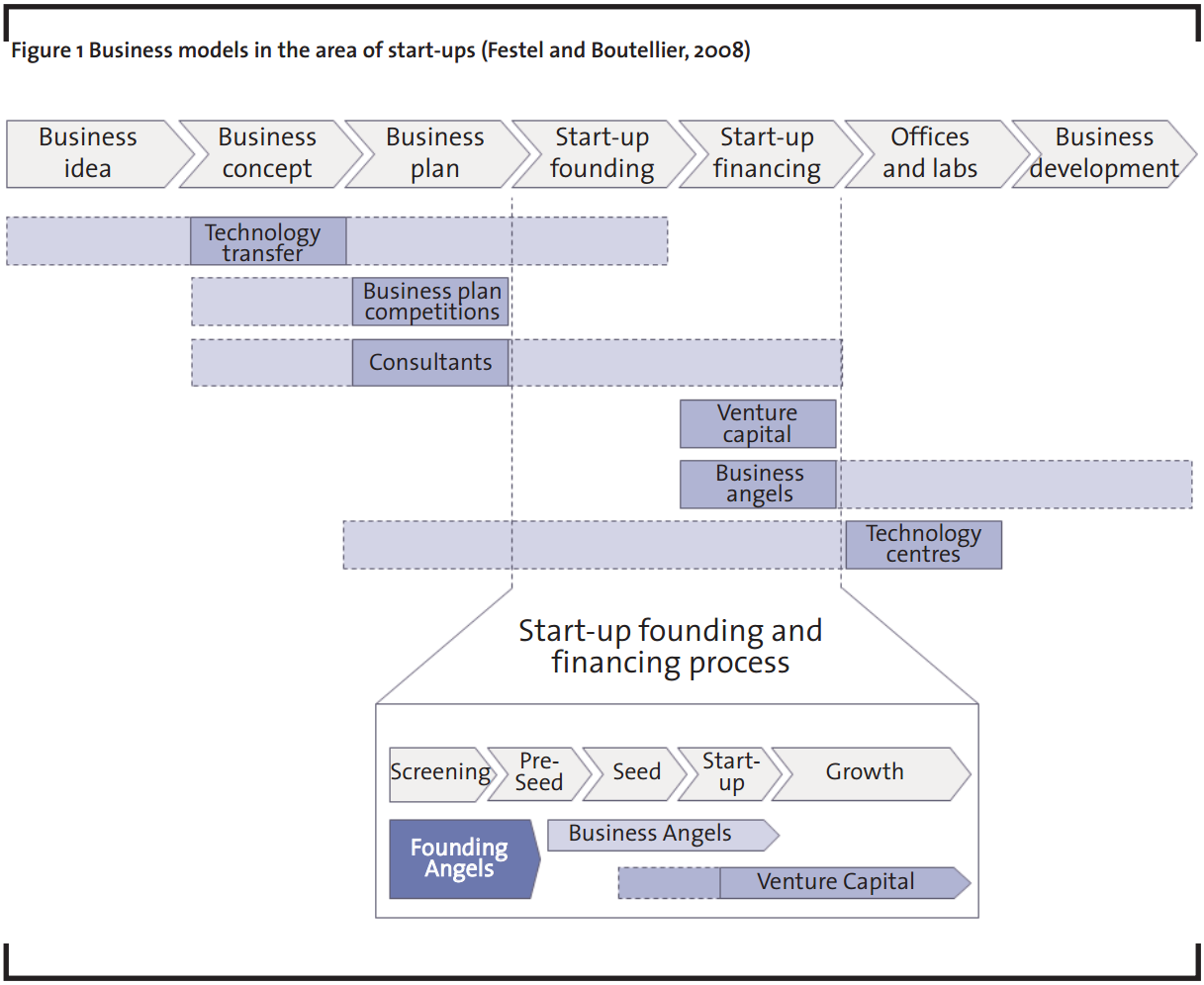

An analysis of established business models in the area of start-ups shows that known players, such as technology transfer offices at universities and research institutes and business plan competitions, are only active in parts of the value chain (Figure 1). Business angels and venture capital companies are normally focused on already founded companies. Especially venture capitalists do not play an important role in early stage technology investments. This gap in the pre-seed and seed phase before start-ups are founded can be closed by the founding angels business model (Festel and Boutellier, 2008).

Founding angels are engaged with the scientists before the start-up is founded and they are part of the founding team (Festel and Boutellier, 2008; Festel et al., 2010). They play an important operational role in the build-up phase of the start-up based on their specific industry or functional know-how e.g. in the field of financing, intellectual property (IP) management or licensing.

The founding angels investment model can be realised by both private persons and professional teams. By way of comparison to business angels, the private persons can be defined as founding angels. Like business angels they are generally not visible so it is very difficult to identify them – especially as they themselves are unaware of the fact that they are founding angels, as the term “founding angels” in this context is relatively new. For this reason, the research in this paper is focused on professional teams using the founding angels investment model. These are organised similar to venture capital teams with most of them coming from the venture capital area. In the field of nanotechnology there are some interesting examples of these very early stage technology investors, especially in the US.

The founding angels investment strategy offers clear advantages (Festel, 2011). Due to their engagement at an early stage in the new start-up company, there is little competition with other investors and a large opportunity to ensure attractive investment possibilities with a high value creation potential. Due to this fact and the relatively low initial investment volume needed for the pre-seed stage, a large number of investments or engagements can be achieved. This diversification will allow founding angels to expect higher returns due to a lower total risk.

Methodology

Research approach

The research is explorative in nature and therefore applies a case study research. The single case study focuses on unique, representative, extreme or not accessible cases which have been analysed over a longer period of time. It aims at falsifying theoretical insights or to provide new insights in unexplored phenomena (Yin, 2003; Yin, 2006; Borchardt and Göthlich, 2007). The multiple case study method compares cases and highlights resulting insights through similarities and dissimilarities between the cases (Borchardt and Göthlich, 2007). We selected to apply a multiple case study approach, as numerous authors consider results from multiple case studies as more convincing, trustworthy, and robust (Eisenhardt, 1989; Yin, 2003). Within this research design different sources of data, qualitative and quantitative data, can be included (Flick, 1995; Yin, 2006). The data collection methods for case studies are document and literature analysis, interviews, and observations. Our multiple case study includes desk research with a focus on document analysis and interviews with 35 nanotechnology experts.

Empirical data

Between 2006 and 2008, 35 nanotechnology experts from industry, government, academia and the finance sector were interviewed to learn more about the identification and analysis of the mechanisms to successfully commercialize nanotechnology as well as the hurdles and the solutions to overcome these hurdles. A reference set of questions was developed as a guideline for the interview, leaving enough room for spontaneous answers, which gave a semistructured nature to the interviews. Before each interview, the authors had gathered in-depth information on the company or institution through various public sources (e.g. databases, website, press releases), enabling an efficient conduct of the interviews.

Literature analysis was conducted in 2008 in order to be able to describe and understand the founding angels business model. This was the first time that the expression founding angels was used in the scientific literature to describe very early stage investors engaged in prefounding projects (Festel and Boutellier, 2008). A second phase of literature research took place from 2010 to 2011, during which the results of the first literature research were updated and, furthermore, additional founding angels identified in order to better analyse the business model. Based on the interviews and literature analysis, 12 founding angels case studies were created from which the five most interesting and fitting case studies are presented in this paper.

Analysis and research quality assurance

Particularly when conducting explorative research, applying a multiple case study approach and analysing qualitative data research quality assurance based on the criteria reliability, validity, and objectivity becomes very important (Albers et al., 2007; Lamnek, 2008; Bortz and Döring, 2005; Yin, 2003). As Yin (2006) stated, reliability of qualitative research can only be achieved by a structured way of proceeding and by exactly documenting the research process and its results. Therefore, all facets and steps of our qualitative research were discussed with other researchers and performed in a structured way. The analyses of the data were conducted systematically and in multiple iterations. First, all information gathered through our literature research was categorised, explored and analysed. Second, based on step one, a semi-structured interview guideline was developed and tested. Third, 35 interviews were conducted. Fourth, the interviews were transcribed and condensed over several iteration steps up to a point at which only the key insights of each case was remaining. During the analysis, each case was analysed by describing it and performing a short within case analysis. Afterward, all cases were compared to each other by executing a cross case analysis. And finally fifth, the resulting output from the interviews and literature research were combined and discussed with other researchers and practitioners.

Validity of the research was achieved by data and method triangulation, documentation of chains of evidence, or the discussion of preliminary case study results with the research participants (Yin, 2003). Objectivity was ensured by having the same person conducting the semistructured interviews, guaranteeing execution objectivity, and by recording the interviews with an audio device, ensuring evaluation objectivity (Yin, 2003).

Results and discussion

Innovation process and start-ups

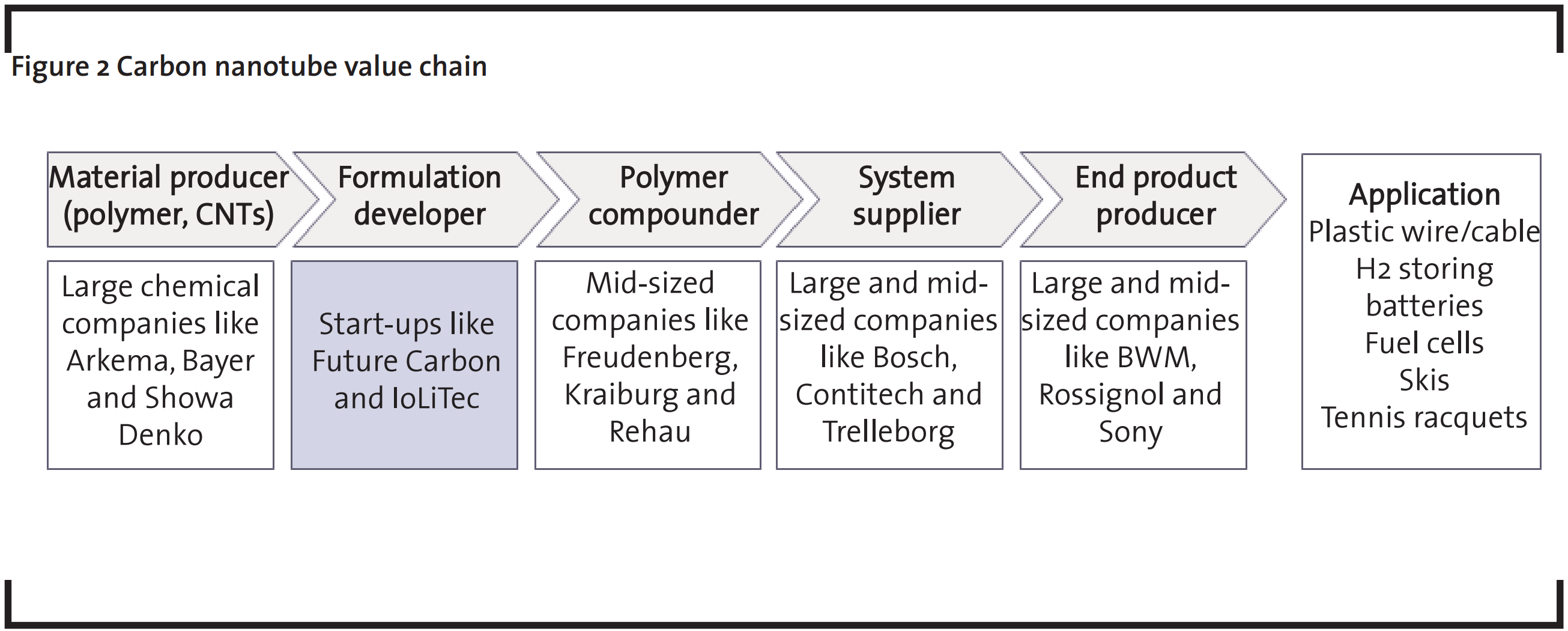

Nanotechnology know-how is mainly used in the early stages of the value chain, i.e. the stage of components and intermediate products or production and analysis technologies. The value added is normally reached through performance enhancement in the whole system or the end product, the commercialization of which is carried out by end product producers in different industrial sectors. A good example is CNTs, which was especially investigated through the expert interviews. This innovative nanomaterial enhances the mechanical properties of plastics and other materials. In sporting goods, for example, Wilson uses nanotech to produce tennis balls that do not deflate as quickly as traditional ones. Another application example is in the production of tennis racquets with improved properties. Due to the high price of CNTs and their high production costs, these racquets are significantly more expensive than traditional ones.

From an end product producer’s viewpoint, these materials can only establish in the market on a broader basis through lower prices. In order to realise lower prices, producers of CNTs, who are at the beginning of the value chain, need to invest in new production processes and facilities. This problem could be solved through cooperations between the material producers, polymer compounders, system suppliers and end product producers combining “technology push” and “market pull” effects. Practice shows, however, that with cooperations between established companies such developments take a long time. This lies mainly in the fact that such projects are neglected for daily business and, of course, the well-known problems of innovation processes in large organisations.

Start-ups can play an important role in the rapid transfer of research results into products as they are highly motivated, very focused and flexible. For example, start-ups in the area of CNTs, like Future Carbon, speed up the innovation processes along the value chain. They develop and provide the technology to produce special CNT formulations which are necessary for product development on the following value chain step (Figure 2). Polymer processing companies, like Freudenberg, have only low experience and resources to develop these formulations in-house. CNT producers, like Bayer on the other hand, are too large to focus on this kg business as their strategy is to produce thousands of tonnes.

Founding angels case studies

The aim of presenting the case studies is to show their approach to foster the creation of start-up companies.

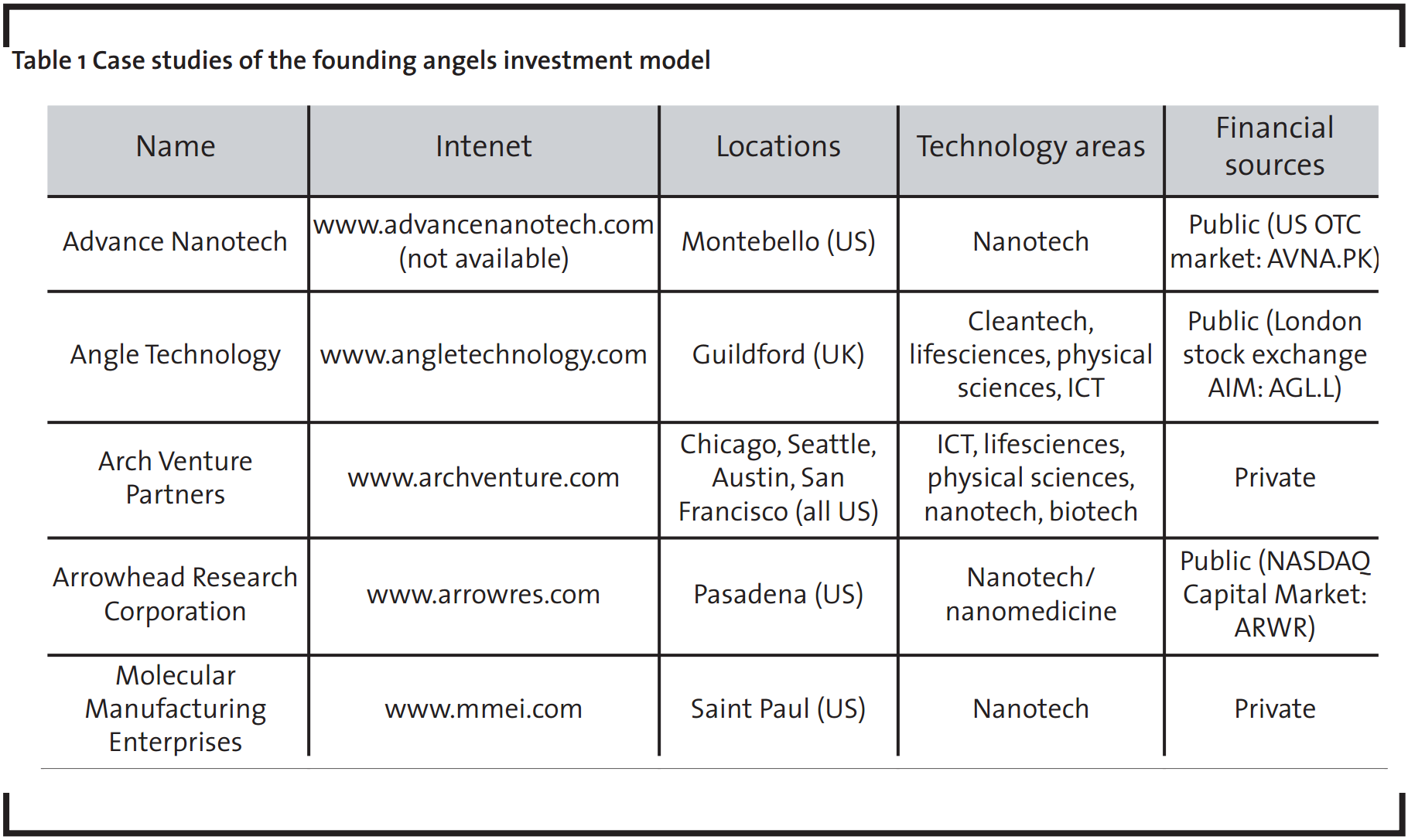

Some of the case studies are only active in the area of nanotechnology, like Advance Nanotech, Arrowhead Research Corporation or Molecular Manufacturing Enterprises, while others have a broader technological scope, like Angle Technology or Arch Venture Partners (Table1). Most of the activities are located in the US and one in the UK.

Advance Nanotech

Remark: The provided information is from 2008, as no current information could be found (e.g. the company website is no longer available). Founded in 2003, Advance Nanotech focused on nanotechnology for applications in electronics, biopharma and materials. They identified patented, patent-pending and proprietary technologies at leading universities and funded the additional development of such technologies in exchange for the exclusive rights to commerzialise any resulting products. In-house competence was used to accelerate the development of multiple early stage research programmes to proof-of-concept or demonstrate manufacturability within three years.

Advance Nanotech maintained a controlling interest in a broad portfolio of nanotechnology projects, each with a defined capital commitment. In order to ensure a high success rate for the portfolio, each project went throughan assessment process to ensure that each technology was still en route to successful commercialization. As the project progressed, preset milestones had to be accomplished for continued investment. These milestones were reviewed on a regular basis for continued funding, redirection of funds or withdrawal of investment. The projects were generated within partnerships with academic institutions like the Universities of Cambridge and Bristol as well as Imperial College London. By partnering with universities and leveraging the infrastructure and human resources of the university partners, individual project costs were low.

After prototypes were proven within the lab and a product roadmap and business plan had been developed, majority owned subsidiaries around the specific technology were formed. Additional money was sought through the sale or licensing of the technology, by securing additional financing from either the venture capital community, or by successfully executing the business plan and consolidating its income as the majority shareholder. Once a product was ready for market, in some cases, further funding was accessed from the capital markets by listing companies on the stock market.

Portfolio companies of Advance Nanotech were Advance Display Technologies, Advance Homeland Security, Bio-Nano Sensium, Nanofed, Nano Solutions and Owlstone Nanotech. From 2007, Advance Nanotech was publicly traded in the US on the over-the counter (OTC) market. Starting as “over-the counter bulletin board” share with the requirement to file current financial statements with the US Securities and Exchange Commission (SEC) or a banking or insurance regulator they became “pink sheet” shares (symbol AVNA.PK) with no need to meet minimum requirements or file with the SEC. Currently (end of May 2011), the share price is nearly zero.

Angle Technology

Angle was founded in 1994 and is headquartered in the UK with a technology commercialization subsidiary in the US. The company focuses on the commercialization of technologies and the development of technology-based start-ups. Besides its consulting business on a fee-for-service basis and the operation of science & technology parks, Angle has founded and developed a portfolio of start-ups in which it retains substantial equity stakes. Technologies sought are those at preseed/seed stages and were selected for their strong IP platform. The IP should have been granted or close to being granted and it has been demonstrated that the technology works. The Angle team consists of professionals with backgrounds that combine business, finance and entrepreneurial expertise, with scientific and technical knowledge. The management support for the start-ups includes the building of the senior management team, conducting market research, developing the business plan, and overseeing product development, as well as market entry strategies.

The portfolio spans from medical and life sciences, cleantech and physical sciences to IT and software. The current portfolio consists of the six companies Acolyte Biomedica, Geomerics, NeuroTargets, Novocellus, Parsortixand Synature. For example, Novocellus is a diagnostic company founded to commercialize technology from the University of York for non-invasive testing of the viability of in vitro fertilisation embryos. Additionally, Angle has performed two exits with Exago and Provexis. The projects are sourced from world class research establishments, such as UK Defence Science & Technology Laboratory, the universities of Bristol, Cambridge and York and the Rowett Institute, and in the US, from the universities of Southern California and New York.

Angle seeks to retain a substantial shareholding in these companies with a view to ongoing returns from dividend, milestone, royalty and capital returns. The average age of the portfolio companies is six years and they have been developed to the stage where the portfolio, as a whole, is substantially cash independent of Angle, thereby presenting Angle shareholders with the potential for substantial upside returns without a corresponding downside risk of further investment. Over the last two years, Angle has deployed a deliberate strategy to focus its efforts and resources on the winners within the portfolio recognising that, with early stage technology investment, successful returns are likely to be concentrated in a relatively small number of investments, which may be big winners.

Angle is quoted on the London Stock Exchange at the AIM market (symbol AGL.L). AIM is the London Stock Exchange’s international market for smaller growing companies. A wide range of businesses including early stage, venture capital backed as well as more established companies join AIM seeking access to growth capital. Starting in June 2006, with a share price of 86 GBP and the minimum in December 2008 with 7.5 GBP, the share price is currently (end of May 2011) at 25 GBP.

Arch Venture Partners

Arch Venture Partners was spun off from an initiative by the University of Chicago in 1986 as a not-for-profit affiliate corporation. Although the company separated from the university in 1992, the university still remained a special limited partner and investor. Arch Venture Partners is one of the largest providers of seed capital in the US with over USD 1.5 billion under management. Its first fund was launched in 1989 and the sixth in 2003. A partnership led bypartners joined by a team of investment managers and advisors. It has offices in San Francisco, Seattle, Austin, Chicago, and Boston.

Arch Venture Partners has cofounded with scientists and entrepreneurs or led the seed round for more than 130 start-ups using scientific discoveries from over 40 major research universities. Arch Venture Partners focuses on IT, life sciences, and physical sciences, with 95% of its investments at the seed and start-up stage. Special competence is in the building of startups from research originating in academic and research laboratory settings. Their business model is to invest conservatively in a seed roundand then to lead and colead additional rounds to liquidity. They also play an active role in assisting portfolio company management.

Arrowhead Research Corporation

Arrowhead Research Corporation sponsors research at university level in exchange for rights to commercialize the IP that results. The company works closely with universities to source early stage deals. By funding the launch of companies, rather than investing in them at a later stage, Arrowhead obtains rights to the IP without having to pay for all of the overhead costs associated with R&D. When the technologies are ready to leave the lab, startups are formed and additional financing and support services are provided and, if necessary, a broader investor syndicate for a follow-on round is organised. Arrowhead maintains a majority interest in its subsidiaries and provides financial, administrative, corporate and strategic resources. As a public company, there is access to the public markets for the purpose of raising capital and provide meaningful incentives in the form of stock options to attract the most talented managers and scientists. By offering financial, administrative, corporate and strategic resources to their subsidiary companies, each individual management team can maintain focus on specific technologies and specific markets, increasing the likelihood of successful technological development and commerzialisation.

Currently, Arrowhead has the four majority owned subsidiaries Ablaris, Calando, Leonardo Biosystems and Nanotope commerzialising nanotech products and applications, including anticancer drugs, RNAi therapeutics, fullerene antioxidants, carbon-based electronics and compound semiconductor materials. Since 2004, Arrowhead is quoted on the NASDAQ Capital Market (symbol ARWR). The NASDAQ Capital Market, previously called NASDAQ Small CapMarket, was renamed in 2005. Starting with 7 USD in January 2004, the highest stock price was 7.50 USD in June 2004 and 7.60 USD in April 2007. The current price (end of May 2011) with 0.56 USD is near the all time low of 0.39 USD in January 2009.

Molecular Manufacturing Enterprises

Molecular Manufacturing Enterprises Incorporated (MMEI) is a seed capital firm helping individuals or small groups to develop a laboratory-bench model into a working prototype that might then, in turn, interest a venture capital firm. MMEI has a good working relationship with the Foresight Institute (FI) and with the Institute for Molecular Manufacturing (IMM). FI is dedicated to educating the public and policy makers about the advantages and consequences of molecular nanotechnology. IMM focuses on providing research funding, with an emphasis on pure research.

MMEI has the resources to provide modest amounts of financial assistance to several highrisk/highleverage efforts to advance the state of the art of molecular nanotechnology. In addition, MMEI can provide technical and nontechnical advice and can also serve as a contact point for people working towards advancing the field of molecular nanotechnology. MMEI was founded by three people with strong scientific and financial backgrounds. In addition, MMEI uses several advisors from a variety of areas, both technical and nontechnical. The advisors include a broad range of business, legal, and financial experts.

Model of founding angels

The model of founding angels is the combination of management and capital. They build a bridge between the early stage research and development (R&D) phase and a marketable product by funding additional development at universities and providing access to further funding once a product is ready for the market.After analysing the case studies, it has been found that the following process with five different phases provides a best practice framework for founding angels investments.

Phase 1: Screening/sourcing of projects

Project opportunities are sourced and evaluated to identify those which have the highest potential and the best fit. If necessary, founding angels finance early stage research at universities or research institutions in exchange for IP rights. The founding angels work together with industry and technology experts to identify and pursue these new opportunities in targeted industries. These experts work closely together with the scientists from the universities or research institutions to develop a business plan.

Phase 2: Foundation of start-ups

When the technology is ready (e.g. proof-ofconcept in the laboratory) a start-up company is established together with the scientists after developing a business plan. The founding angels provide seed capital for the development of the start-ups as well as financial, administrative, and strategic support. An agreement with the universities or research institutions is signed based normally on the exclusive rights regarding all relevant IP. In exchange, the technology partner receives a preagreed payment and/or equity stake of the start-up.

Phase 3: Building-up of the start-ups

The new company utilises the founding angel’s seed funding and management support to build and operate the company, typically focusing on R&D activities. The research focus is on applied research up to the development of a working prototype. The founding angels also help start-ups to obtain access to additional academic research laboratories and manufacturing facilities should this be required. Intensive technical and nontechnical advice from the founding angels is provided to the startups. This includes conducting market research, supporting product development and establishing market entry strategies. A new management team will take over responsibility from the interim management organised by the founding angels. Preset milestones are used to assess the progress of the research projects with regard to continued investment, redirection of funds or withdrawal of investment.

Phase 4: Development of the business

The focus is on building up a sustainable business for the start-up by acquiring cooperation partners and customers. Revenues are generated through the sale or licensing of the technology, by securing additional financing from either the venture capital community or the capital markets, or by successfully executing the business plan and using own cash flow. If necessary, a broader investor syndicate for a follow-on financing is organized by the founding angels.

Phase 5: Execution of an exit

The exit will enable founders, founding angels and other investors to get payed off. Universities or research institutions will also profit if they have an equity stake in the company. In most cases a trade sale to existing industrial cooperation partners of the start-up company is realised.

Comparison with established models

Comparing founding angels, business angels und venture capitalists shows that these investment models fit perfectly together. Founding angels are engaged in very early stage projects (pre-seed and seed stage), business angels in early stage projects (mostly seed and start-up stage) and venture capitalists more in later stage projects (mostly growth stage and only a few specialised companies in the start-up stage). There are also case examples, like Arch Venture Partners, combining the established venture capital and the emerging founding angels investment model as they primarily invest in companies co-founded with scientists and entrepreneurs. Because founding angels fund preseed ventures, their average exit horizon is much longer than their average venture capital fund manager counterpart’s. Due to this long exit horizon, both the entrepreneur and the founding angel have enough time to increase the value of the start-up, which results in higher valuations when additional funding is sought from large venture capital funds. Increased value also translates into a smaller dilution of stock ownership in future rounds, an important consideration for entrepreneurs and founding angels.

Advance Nanotech, Angle Technology and Arrowhead Research are listed on public stock markets. All of them had lost value continuously during the last years. The negative developmentof the stock price may lead to the conclusion that the business model is flawed. We argue that the business model in general is not flawed, but that the concept of founding angel investment is in strong contrast to the concept of investing in public stock markets. Public investors focus often on fast returns, but technology start-ups need patient money with an investment horizon of at least five to seven years. Investors in public stock markets need transparency and the information asymmetry between investors and management is generally overcome through financial statements, income and cash flow statements, and balance sheets. But technology start-ups generally have no positive cash flows to analyse and the balance sheet consists mainly of intangible assets, such as patents and knowledge, which are hard to value due to technological novelty and complexity.

Conclusion

After analysing founding angels as early stage technology investors, they can be defined as a relatively new investment model with the potential to increase start-up activities, especially at universities and research institutions. They are active in high-tech sectors and invest at an earlier stage of the start-up development than other investors. Founding angels provide business expertise and operational advice to identify the mechanisms and actions needed to found a new firm. With their innovative model, founding angels are valuable for founders because they i) invest time to support the founders in the daily business, ii) have a vast amount of knowledge, skills and experience, iii) provide access to their networks.

Because of their profound market know-how, founding angels help to broaden the view on potential applications and they also keep an eye out for new scientific breakthroughs which have the potential of being commercialized. Unrecognised commerzial potential can be identified, and otherwise undiscovered technologies or ideas make it to the market. Thus, founding angels engagements have a “pull” function in the venture business and they significantly help to close the technology transfer gap between academic research and commerzial application. Because they work very closely with the founders, the founding angels will acquire a deep knowledge of the financial situation or the technological potential of the company. When facing important decisions such as whether a large investment should be made, a founding angel will decide differently than a business angel or a venture capitalist, due to his deeper and more complete information of the company, which gives him an advantage.

An important limitation of our study relates to the data gathering methodology. focus on nanotechnology, which is (probably) a distorted sample of the real population, might have influenced our findings. In order to fully understand the dynamics of FA activities, it might be necessary to investigate engagements with a broader technological scope. Given the exploratory nature of this study, this problem should be overcome in follow-up studies on the subject.

References

Albers, S., Klapper, D., Konradt, U., Walter, A., Wolf, J. (2007): Methodik der empirischen Forschung, 2nd edition, Gabler, Wiesbaden.

Baron, R.A. (1998): Cognitive mechanisms in entrepreneurship: Why and when entrepreneurs think differently than other people, Journal of Business Venturing, 13(4), p. 275-294.

Binks, M.R., Ennew, C.T., Reed, C.V. (1992): Information asymmetries and the provision of finance to small firms, International Small Business Journal, 11(1), p. 35-46.

Borchardt, A., Göthlich, S. (2007): Erkenntnisgewinnung durch Fallstudien, in: Albers, S., Klapper, D., Konradt, U., Walter, A., Wolf, J. (eds.), Methodik der empirischen Forschung, 2nd edition, Gabler, Wiesbaden, p. 37-54.

Bortz, J., Döring, N. (2005): Forschungsmethoden und Evaluation, 3rd edition, Springer, Heidelberg.

Branscomb, L.H., Auerswald, P.E. (2002): Between Invention and Innovation – An Analysis of Funding for Early Stage Technology Development, Economic Assessment Office, National Institute of Standards and Technology, Gaithersburg.

Bygrave, W., Quill, M. (2007): Global entrepreneurship monitor: 2006 financing report, London Business School and Babson College, London.

Chen, H., Roco, M.C., Xin, L., Yiling, L. (2008): Trends in nanotechnology patents, Nature Nanotechnology, 3, p. 123-125.

Collewaert, V. (2011): Angel investors’ and entrepreneurs’ intention to exit their ventures: A conflict perspective, Entrepreneurship Theory & Practice (Early view on 23 May 2011).

Crawley, T. (2007): Commercialisation of Nanotechnology – Key Challenges, Report on the workshop organised by Nanoforum, Helsinki.

Eisenhardt, K.M. (1989): Building theories from case study research, The Academy of Management Review, 14, p. 532-550.

Ensley, M.D., Pearson, A.W., Amason, A.C. (2002): Understanding the dynamics of new venture top management teams: Cohesion, conflict and new venture performance, Journal of Business Venturing, 17(4), p. 365-386.

Feldman, M., Feller, I. (2002): Equity and the technology transfer strategies of american research universities, University Entrepreneurship and Technology Transfer, 48(1), p. 105-121.

Festel, G., Boutellier, R. (2008): Founding angels as a driving force for the creation of new high-tech startup companies, The R&D Management Conference, Ottawa.

Festel G., Schicker A. and Boutellier R. (2010): Importance and best practice of early stage nanotechnology investments. Nanotechnology Law & Business, 7(1), p. 50.

Festel, G. (2011): Founding angels as early stage investment model to foster biotechnology start-ups, Journal of Commercial Biotechnology, 17(2), p. 165–17.

Flick, U. (1995): Triangulation, in: Flick, U. (ed.) Handbuch Qualitative Sozialforschung, Frankfurt, p. 432-434.

Fried, V., Hisrich, R. (1994): Toward a model of venture capital investment decision making. Financial Management, 23(3), p. 28-37.

Goldfarb, B., Henrekson, M. (2003): Bottom-up versus top-down policies towards the commercialization of university intellectual property, Research Policy, 32(4), p. 639-658.

Harrison, R., Mason C. (1993): Finance for the growing business: the role of informal investment, National Westminster Bank Quarterly Review, London.

Heirman, A., Clarysse, B. (2004): How and why do research-based start-ups differ at founding? A resource-based configurational perspective, Journal of Technology Transfer, 29(3-4), p. 247-268.

Kaplan, S., Strömberg, P. (2001): Venture capitalists as principals: Contracting, screening, and monitoring, American Economic Review Papers and Proceedings, 91(2), p. 426-430.

Lamnek, S. (2008): Qualitative Sozialforschung, 4th edition, Beltz, Weinheim.

Landström, H. (1998): Informal Investors As Entrepreneurs, Technovation, 18(5), p. 321-333.

Litan, R.E., Mitchell, L., Reedy, E.J. (2007): The university as innovator: Bumps in the road. Issues in Science and Technology, p. 57-66.

Madill, J.J., Haines, G.H., Riding, A.L. (2005): The role of angels in technology SMEs: A link to venture capital, Venture Capital: An International Journal of Entrepreneurial Finance, 7(2), p. 107-129.

Markman, G., Phan, P., Balkin, D., Giannodis, P. (2005): Entrepreneurship and university-based technology transfer, Journal of Business Venturing, 20(2), p. 241-263.

Mason, C., Harrison, R. (1992): The supply of equity finance in the UK: A strategy for closing the equity gap, Entrepreneurship and Regional Development, 4(4), p. 357-380.

Mason, C., Harrison, R. (1995): Closing the regional equity capital gap: The role of informal venture capital, Small Business Economics, 7(2), p. 153-172.

Mason, C., Harrison, R. (1996): Informal venture capital: A study of the investment process, The post investment experience and investment performance, Entrepreneurship and Regional Development, 8(2), p. 105-125.

Mason, C., Harrison, R. (2002): Barriers to investment in the informal venture capital sector, Entrepreneurship and Regional Development, 14(3), p. 271-287.

Mason, C. (2006): Informal Sources of Venture Finance, in: Parker, S. (ed.), The Life Cycle of Entrepreneurial Ventures, International Handbook on Entrepreneurship, Springer, New York, p. 259-299.

Maunula, M. (2006): The perceived value-added of venture capital investors – Evidence from Finnish biotechnology industry. in: Discussion Paper 1030 of the research project, The Development of Biotechnology Industry in Finland, The Research Institute of the Finnish Economy, Helsinki.

Meyer, M. (2006): Academic inventiveness and entrepreneurship: On the importance of start-up companies in commercializing academic patents, Journal of Technology Transfer, 31(4), p. 501-510.

Murray, G. (1999): Early-stage venture capital funds, scale economies and public support, Venture Capital, 1(4), p. 351-384.

Riding, A.L. (2008): Business angels and love money investors: Segments of the informal market for risk capital, Venture Capital, 10(4), p. 355-369.

Roberts, E.B. (1991): Entrepreneurs in high technology Lessons from MIT and beyond, Oxford University Press, Oxford.

Roco, M.C. (2005): International perspective on government nanotechnology funding in 2005, Journal of Nanoparticle Research, 7, p. 707-712.

Shane, S. (2002): Selling university technology: Patterns from MIT, Management Science, 48(1), p. 122-138.

Stam, E., Suddle, K., Hessels, J., Stel, A. (2009): High-growth entrepreneurs, public policies and economic growth, International Studies in Entrepreneurship, 22(1), p. 91-110.

Van Osnabrugge, M. (2000): A comparison of businessangel and venture capitalist investment procedures: An agency theory-based analysis, Venture Capital, 2(2), p. 91-109.

Wetzel, W.E., Freear, J. (1996): Promoting informal venture capital in the United States: Reflections on the history of the venture capital network. in: Harrison, R., Mason, C.M. (eds.), Informal venture capital: Information, networks and public policy, Woodhead-Faulkner, Hemel-Hempstead, p. 61-74.

Yin, R.K. (2003): Case study research – Design and methods, 3rd edition, Sage Publications, Thousand Oaks.

Yin, R.K. (2006): Mixed methods research: Are the methods genuinely integrated or merely parallel? Research in the Schools, 13(1), p. 41-47.

Zhang, J. 2009. The advantage of experienced start-up founders in venture capital acquisition: Evidence from serial entrepreneurs, Small Business Economics, 36(2), p. 187-208.